- Switzerland

- /

- Trade Distributors

- /

- SWX:DKSH

3 Top Dividend Stocks On SIX Swiss Exchange Yielding Up To 4.4%

Reviewed by Simply Wall St

After opening slightly down Monday morning, the Switzerland market recovered and kept edging higher as the day progressed, eventually ending on a firm note with several stocks posting solid gains in the final hour. Last week's data showing a sharp surge in Swiss industrial output and rising optimism about an interest rate cut by the Federal Reserve in September helped underpin sentiment. In such a dynamic market environment, dividend stocks can offer stability and consistent returns for investors. Here are three top dividend stocks on the SIX Swiss Exchange yielding up to 4.4%.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.17% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.50% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.49% | ★★★★★☆ |

| Compagnie Financière Tradition (SWX:CFT) | 4.10% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.15% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 4.76% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.52% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.68% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.34% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

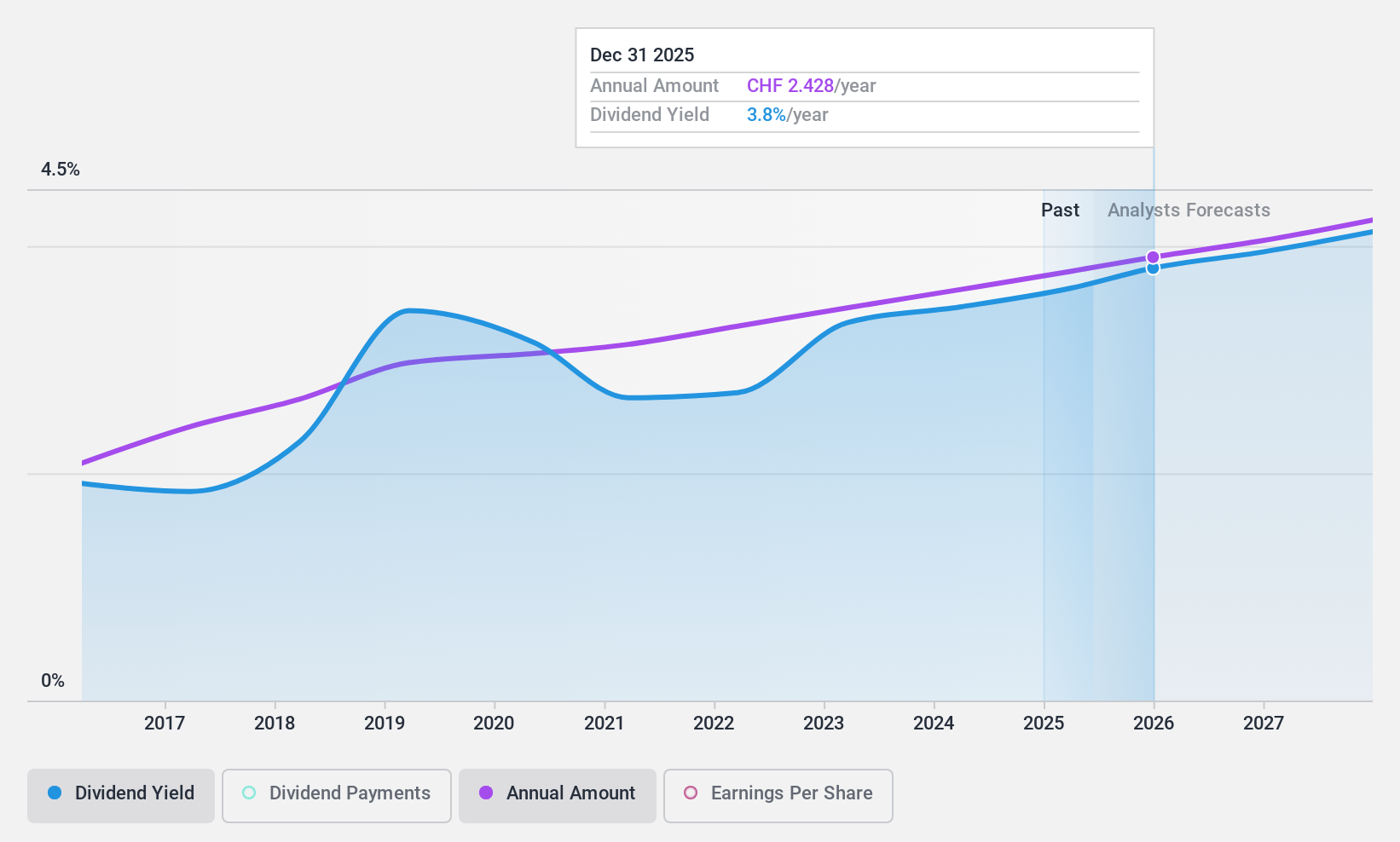

DKSH Holding (SWX:DKSH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DKSH Holding AG offers market expansion services across Thailand, Greater China, Malaysia, Singapore, and other regions in the Asia Pacific with a market cap of CHF4.38 billion.

Operations: DKSH Holding AG's revenue segments include Healthcare (CHF5.55 billion), Consumer Goods (CHF3.43 billion), Performance Materials (CHF1.38 billion), and Technology (CHF526.50 million).

Dividend Yield: 3.3%

DKSH Holding AG reported H1 2024 earnings with sales of CHF 5.44 billion and net income of CHF 111.2 million, showing growth in net income despite a slight dip in sales. The dividend yield stands at a modest 3.34%, lower than the top quartile in Switzerland, but the dividends are well-covered by both earnings and cash flows, with payout ratios of 77% and 45.8%, respectively. Dividends have been stable and growing over the past decade, reflecting reliability for investors seeking steady income streams.

- Navigate through the intricacies of DKSH Holding with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, DKSH Holding's share price might be too pessimistic.

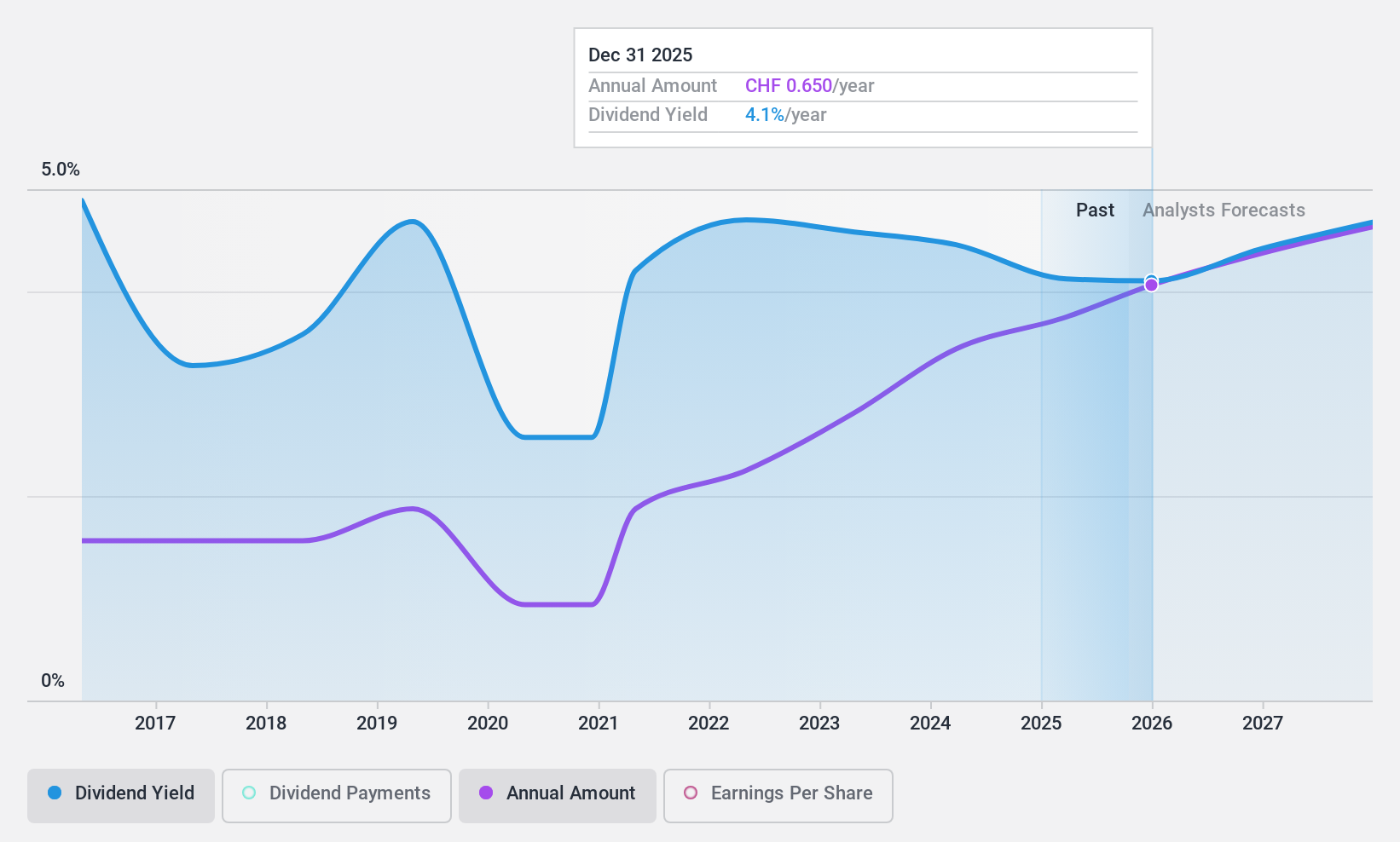

EFG International (SWX:EFGN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EFG International AG, with a market cap of CHF3.70 billion, offers private banking, wealth management, and asset management services through its subsidiaries.

Operations: EFG International AG's revenue segments include Americas (CHF128.80 million), Asia Pacific (CHF176.70 million), United Kingdom (CHF193.30 million), Corporate Center (CHF60.50 million), Switzerland & Italy (CHF449.70 million), Global Markets & Treasury (CHF55.30 million), Investment and Wealth Solutions (CHF122.90 million), and Continental Europe & Middle East (CHF257.30 million).

Dividend Yield: 4.5%

EFG International's earnings grew by 31% over the past year, and its dividend yield of 4.49% ranks it in the top 25% of Swiss dividend payers. The company maintains a reasonable payout ratio of 55.2%, ensuring dividends are covered by earnings, with future coverage forecasted at 57.4%. Despite this, EFGN's dividends have been volatile over the past decade and are currently supported by a low allowance for bad loans (5%).

- Click here and access our complete dividend analysis report to understand the dynamics of EFG International.

- Insights from our recent valuation report point to the potential undervaluation of EFG International shares in the market.

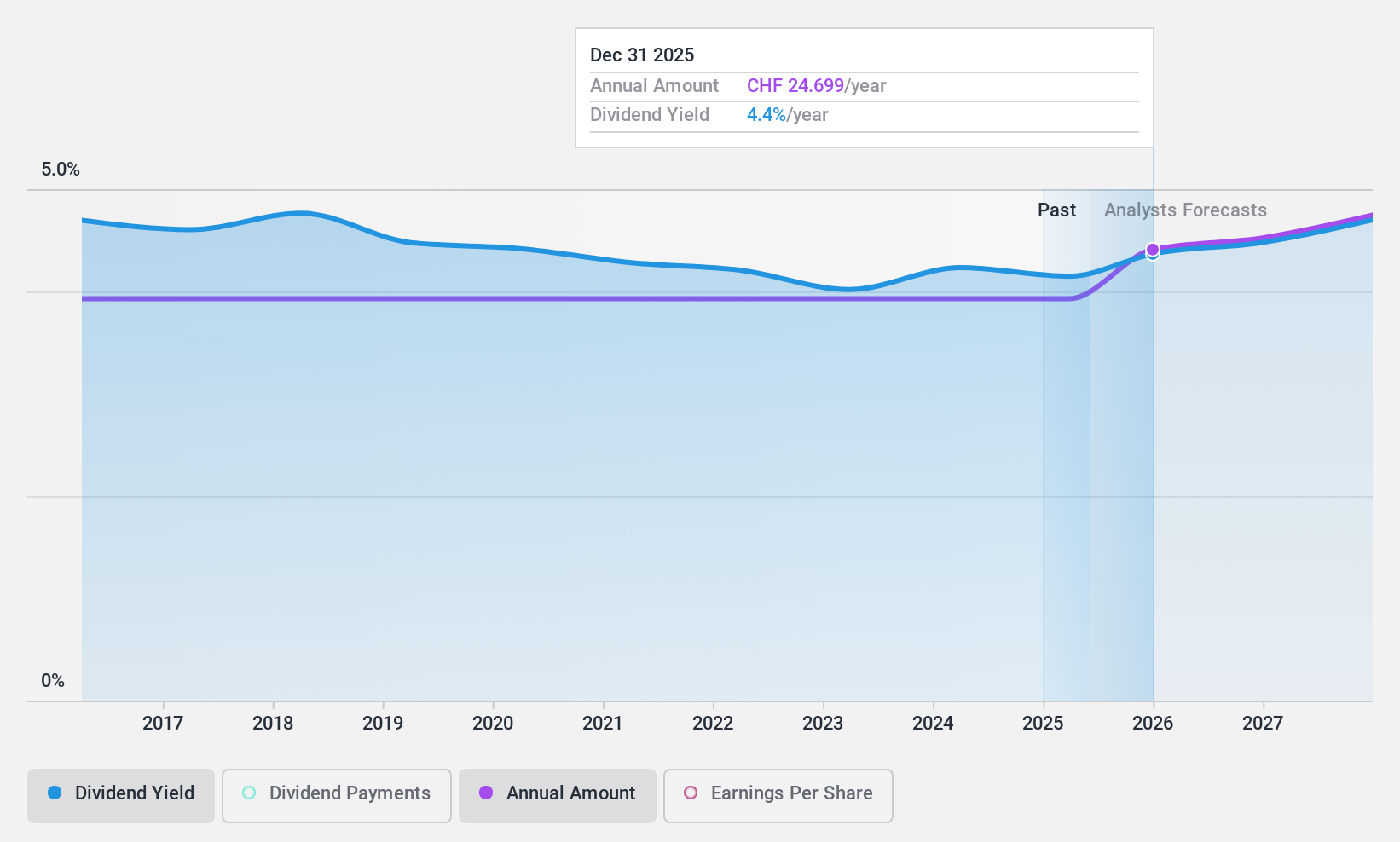

Swisscom (SWX:SCMN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swisscom AG provides telecommunication services primarily in Switzerland, Italy, and internationally, with a market cap of CHF27.56 billion.

Operations: Swisscom AG's revenue segments include Fastweb (CHF2.61 billion), Swisscom Switzerland - Wholesale (CHF535 million), Swisscom Switzerland - Business Customers (CHF3.13 billion), Swisscom Switzerland - Residential Customers (CHF4.42 billion), and Swisscom Switzerland - Infrastructure & Support Functions (CHF73 million).

Dividend Yield: 4.1%

Swisscom's dividend yield of 4.14% is slightly below the top 25% of Swiss dividend payers but remains reliable, with dividends covered by earnings (67.1%) and cash flows (69.5%). Despite stable payouts over the past decade, there has been no growth in dividends during this period. Recent earnings showed a slight decline in net income to CHF 381 million for Q2 2024 from CHF 406 million a year ago, reflecting modest financial performance challenges.

- Unlock comprehensive insights into our analysis of Swisscom stock in this dividend report.

- Our expertly prepared valuation report Swisscom implies its share price may be lower than expected.

Next Steps

- Unlock our comprehensive list of 26 Top SIX Swiss Exchange Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:DKSH

DKSH Holding

Provides various market expansion services in Thailand, Greater China, Malaysia, Singapore, rest of the Asia Pacific, and internationally.

Excellent balance sheet established dividend payer.