- Switzerland

- /

- Medical Equipment

- /

- SWX:YPSN

3 Undervalued Stocks On The SIX Swiss Exchange With Discounts Up To 32.9%

Reviewed by Simply Wall St

The Switzerland market started off on a firm note Thursday morning, but pared gains and very nearly slipped into the red by early afternoon, before recovering well to end the day's session moderately higher. Investors digested the Swiss National Bank's interest rate move and awaited some key economic data from the U.S. In this fluctuating environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential market inefficiencies. Here are three stocks on the SIX Swiss Exchange that currently appear undervalued with discounts up to 32.9%.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LEM Holding (SWX:LEHN) | CHF1338.00 | CHF1827.73 | 26.8% |

| Swissquote Group Holding (SWX:SQN) | CHF312.00 | CHF569.19 | 45.2% |

| ALSO Holding (SWX:ALSN) | CHF270.50 | CHF367.06 | 26.3% |

| Georg Fischer (SWX:GF) | CHF65.20 | CHF113.17 | 42.4% |

| lastminute.com (SWX:LMN) | CHF18.70 | CHF29.53 | 36.7% |

| Barry Callebaut (SWX:BARN) | CHF1539.00 | CHF2287.69 | 32.7% |

| Clariant (SWX:CLN) | CHF12.47 | CHF21.49 | 42% |

| Comet Holding (SWX:COTN) | CHF331.50 | CHF529.45 | 37.4% |

| SGS (SWX:SGSN) | CHF97.60 | CHF145.42 | 32.9% |

| Dätwyler Holding (SWX:DAE) | CHF171.60 | CHF242.13 | 29.1% |

Here we highlight a subset of our preferred stocks from the screener.

SGS (SWX:SGSN)

Overview: SGS SA offers inspection, testing, and verification services across Europe, Africa, the Middle East, the Americas, and the Asia Pacific with a market cap of CHF18.19 billion.

Operations: The revenue segments for SGS SA include Business Assurance at CHF755 million and Segment Adjustment at CHF5.92 billion.

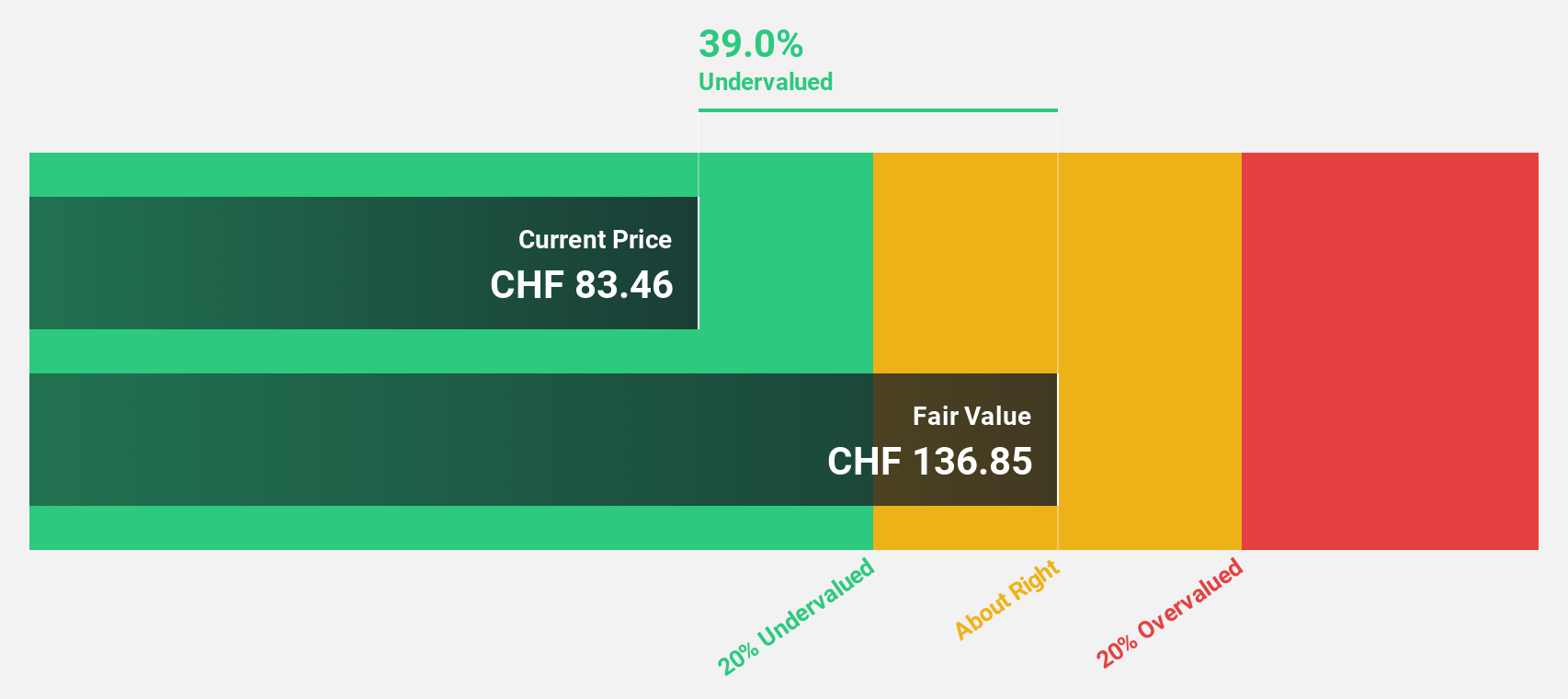

Estimated Discount To Fair Value: 32.9%

SGS SA's recent earnings report showed stable performance with sales of CHF 3.34 billion and net income of CHF 267 million for H1 2024, slightly down from the previous year. The stock is trading at CHF 97.6, significantly below its estimated fair value of CHF 145.42, indicating it may be undervalued based on cash flows. Despite a high level of debt and a dividend not well covered by earnings, SGS's revenue and profit growth forecasts outpace the Swiss market averages.

- Our growth report here indicates SGS may be poised for an improving outlook.

- Click here to discover the nuances of SGS with our detailed financial health report.

VAT Group (SWX:VACN)

Overview: VAT Group AG develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows worldwide with a market cap of CHF12.90 billion.

Operations: Revenue segments for VAT Group AG include Valves at CHF783.51 million and Global Service at CHF163.83 million.

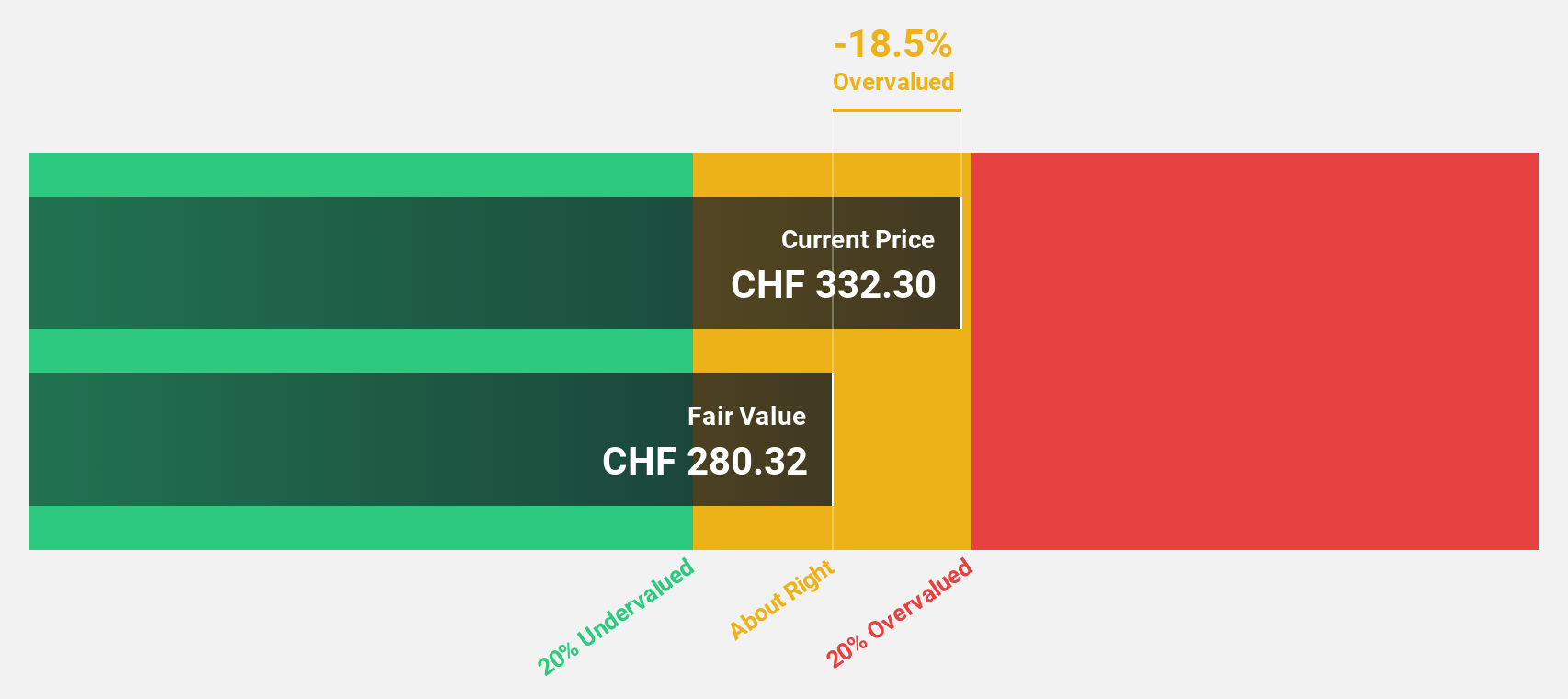

Estimated Discount To Fair Value: 22.9%

VAT Group AG's recent earnings report for H1 2024 revealed sales of CHF 449.61 million and net income of CHF 94 million, showing growth in profitability despite a slight dip in sales. The stock is trading at CHF 430.3, approximately 23% below its estimated fair value of CHF 557.76, suggesting it is undervalued based on cash flows. Forecasts indicate strong revenue and profit growth significantly above Swiss market averages, although the share price has been highly volatile recently.

- The analysis detailed in our VAT Group growth report hints at robust future financial performance.

- Get an in-depth perspective on VAT Group's balance sheet by reading our health report here.

Ypsomed Holding (SWX:YPSN)

Overview: Ypsomed Holding AG, with a market cap of CHF 5.96 billion, develops, manufactures, and sells injection and infusion systems for pharmaceutical and biotechnology companies through its subsidiaries.

Operations: Ypsomed's revenue segments include Ypsomed Diabetes Care at CHF 151.05 million and Ypsomed Delivery Systems at CHF 385.15 million.

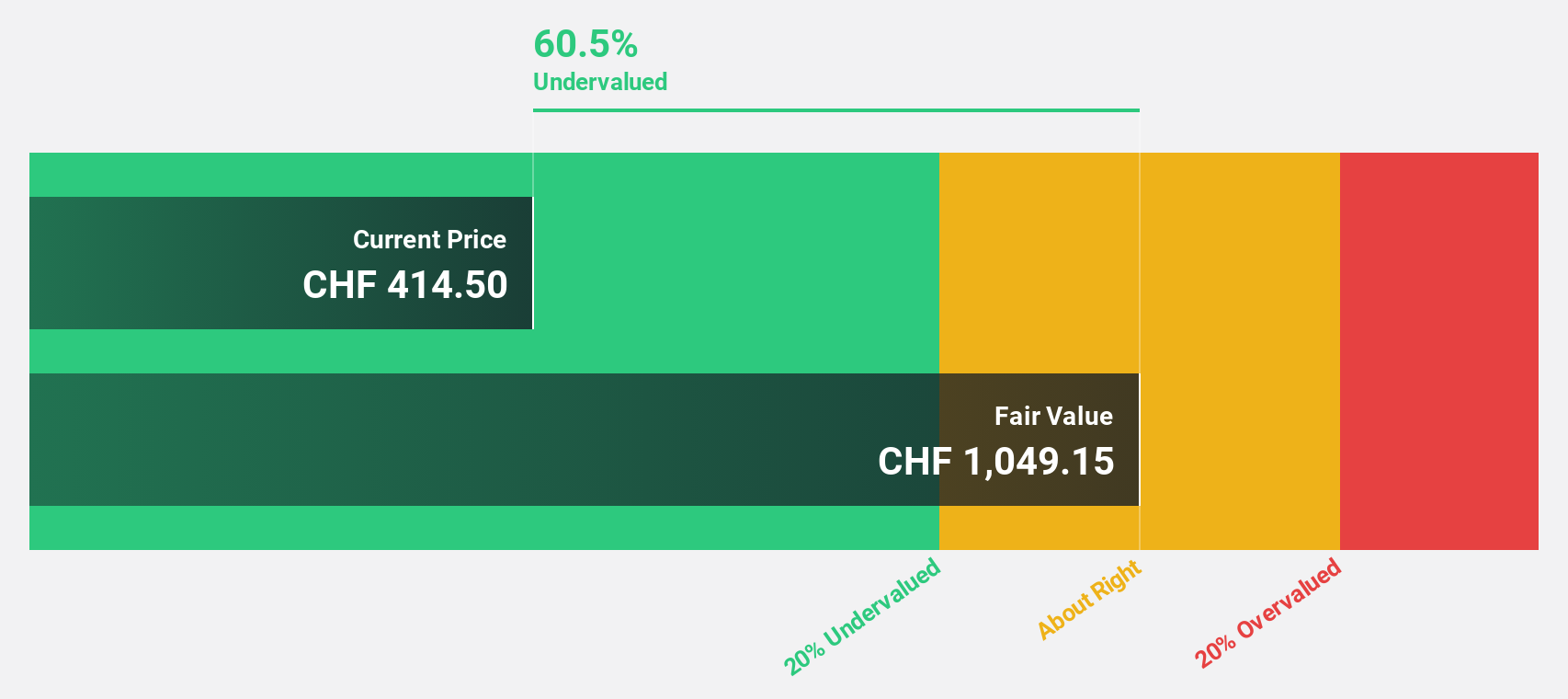

Estimated Discount To Fair Value: 18.4%

Ypsomed Holding is trading at CHF 437, about 18.4% below its estimated fair value of CHF 535.43. The company's earnings grew by 52.8% last year and are expected to grow significantly over the next three years at an annual rate of 33.3%, outpacing the Swiss market's forecasted growth of 11.6%. Recent partnerships, such as with Astria Therapeutics for the STAR-0215 autoinjector, highlight Ypsomed's innovative product pipeline and potential future revenue streams.

- The growth report we've compiled suggests that Ypsomed Holding's future prospects could be on the up.

- Dive into the specifics of Ypsomed Holding here with our thorough financial health report.

Seize The Opportunity

- Investigate our full lineup of 14 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:YPSN

Ypsomed Holding

Develops, manufactures, and sells injection and infusion systems for pharmaceutical and biotechnology companies.

Solid track record with reasonable growth potential.