- Switzerland

- /

- Capital Markets

- /

- SWX:CFT

Compagnie Financière Tradition And 2 Other Top Dividend Stocks On SIX Swiss Exchange

Reviewed by Simply Wall St

The Switzerland market started off on a firm note Thursday morning, but pared gains and very nearly slipped into the red by early afternoon, before recovering well to end the day's session moderately higher. Investors digested the Swiss National Bank's interest rate move and awaited some key economic data from the U.S. In this fluctuating environment, dividend stocks can offer a measure of stability and income potential for investors. Here are three top dividend stocks on the SIX Swiss Exchange: Compagnie Financière Tradition, along with two other noteworthy picks.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.03% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.70% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.52% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.87% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.73% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.40% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.13% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 3.99% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.72% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.38% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as a global interdealer broker of financial and non-financial products, with a market cap of CHF1.21 billion.

Operations: Compagnie Financière Tradition SA generates revenue from three primary regions: Americas (CHF352.67 million), Asia-Pacific (CHF273.16 million), and Europe, Middle East, and Africa (CHF452.85 million).

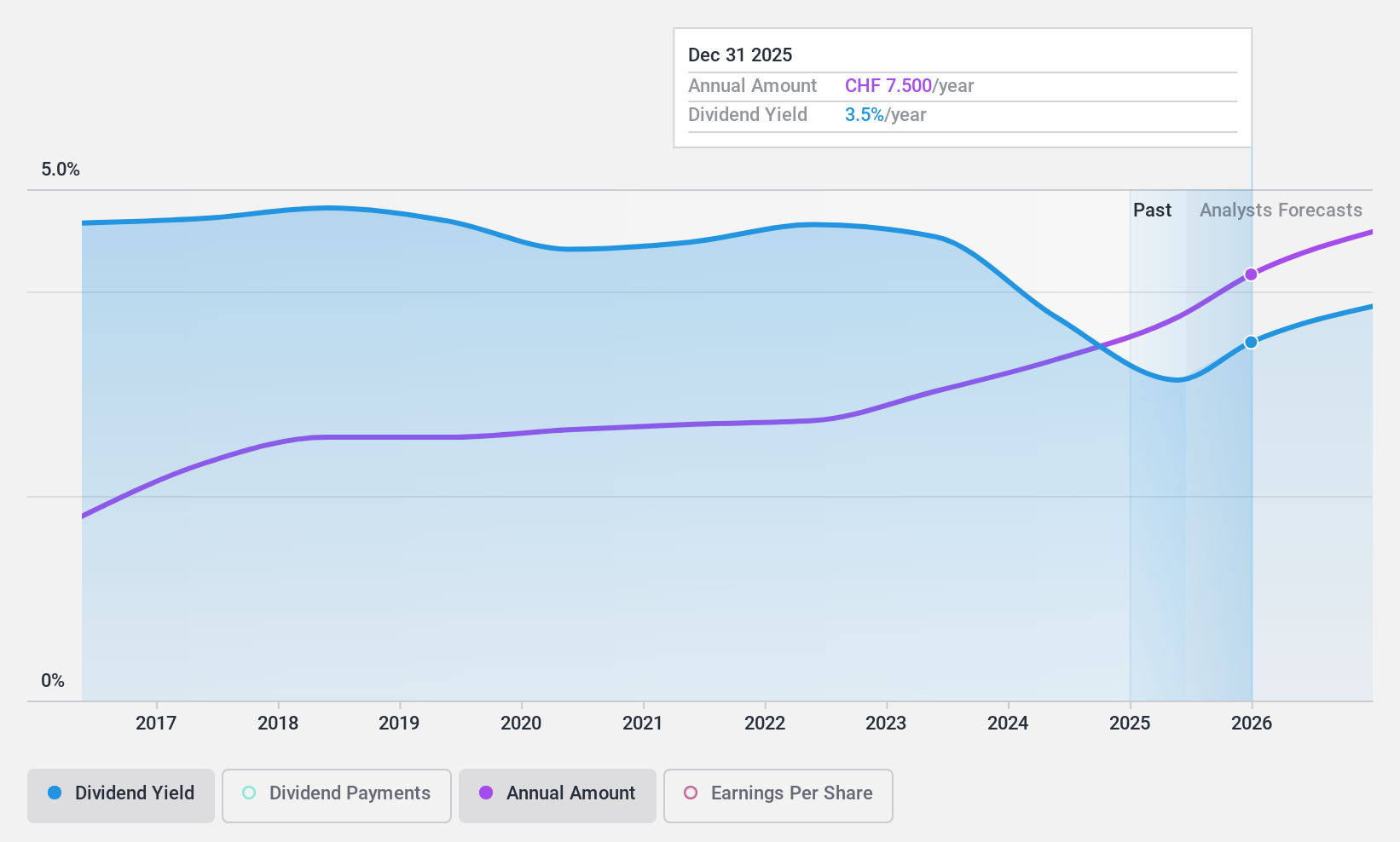

Dividend Yield: 3.8%

Compagnie Financière Tradition offers stable and growing dividends, with payments increasing over the past decade. Despite recent shareholder dilution, its dividend yield of 3.85% is covered by both earnings (43.3% payout ratio) and cash flows (60.7% cash payout ratio). The company trades at a discount to its estimated fair value and has shown strong earnings growth, reporting CHF 59.99 million in net income for H1 2024 compared to CHF 51.02 million a year ago.

- Dive into the specifics of Compagnie Financière Tradition here with our thorough dividend report.

- The valuation report we've compiled suggests that Compagnie Financière Tradition's current price could be quite moderate.

Meier Tobler Group (SWX:MTG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meier Tobler Group AG operates as a trading and services company specializing in heat generation and air conditioning systems, with a market cap of CHF302.52 million.

Operations: Meier Tobler Group AG generates revenue through two main segments: Service (CHF104.01 million) and Distribution (CHF404.27 million).

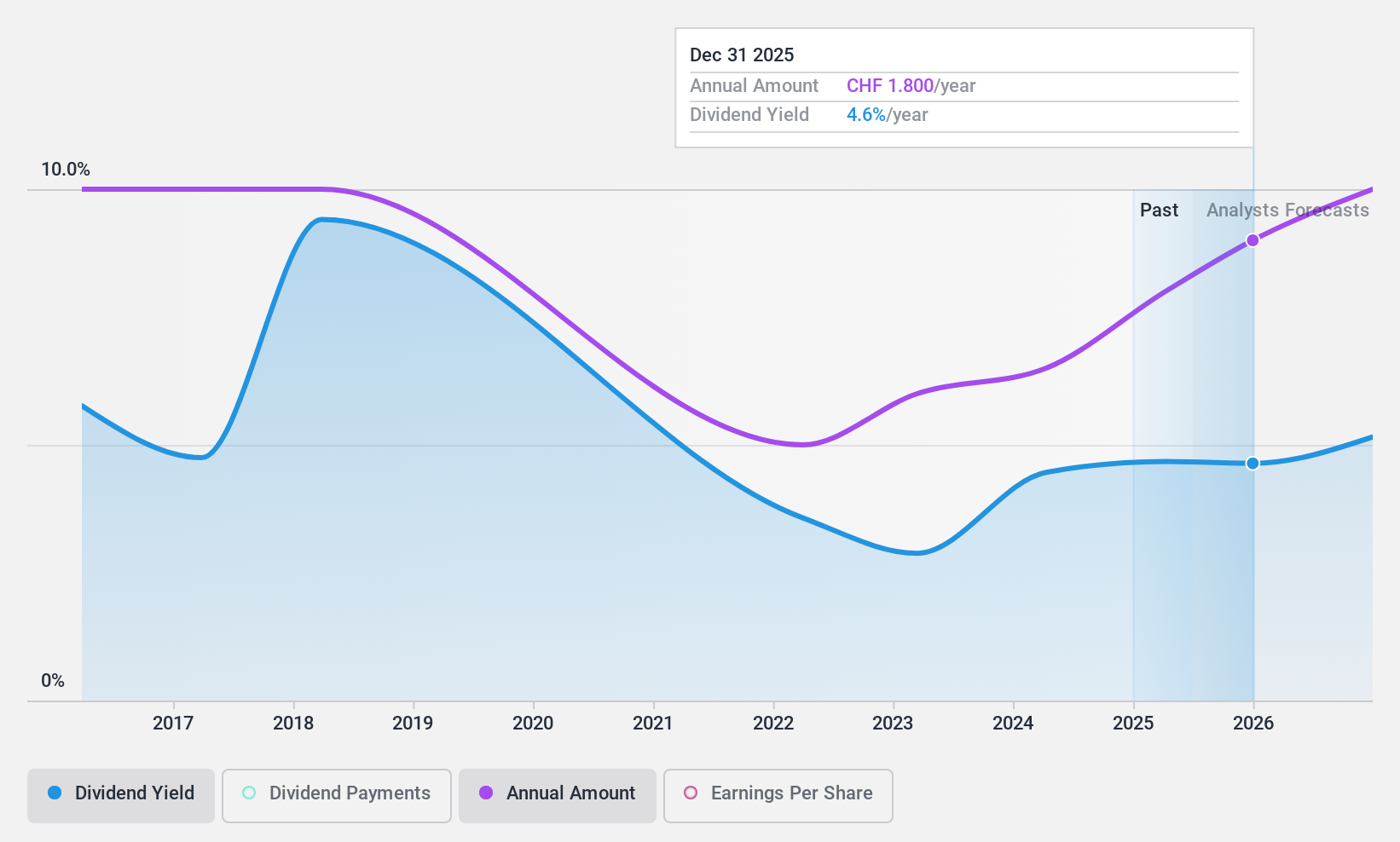

Dividend Yield: 4.9%

Meier Tobler Group's dividend yield of 4.85% is among the top in the Swiss market but is not well covered by free cash flows, with a high cash payout ratio of 179.3%. The company's earnings have declined, with net income falling to CHF 8 million for H1 2024 from CHF 15.97 million a year ago. Additionally, its dividend history has been volatile and unreliable over the past decade despite some growth in payments.

- Take a closer look at Meier Tobler Group's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Meier Tobler Group shares in the market.

Phoenix Mecano (SWX:PMN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Phoenix Mecano AG, with a market cap of CHF441.23 million, manufactures and sells components for industrial customers worldwide through its subsidiaries.

Operations: Phoenix Mecano AG generates revenue from three primary segments: Enclosure Systems (€218.16 million), Industrial Components (€197.28 million), and Dewertokin Technology Group (€348 million).

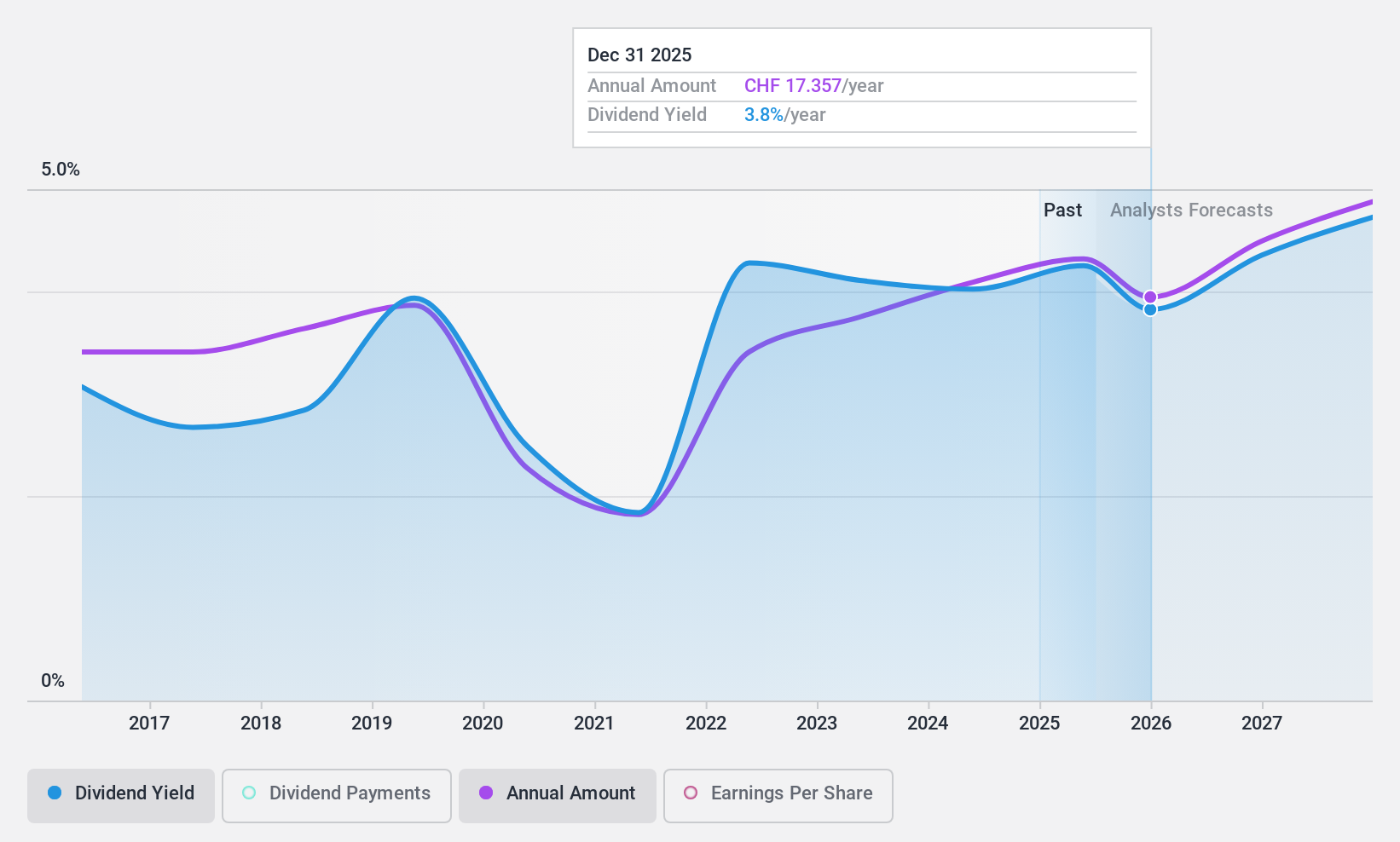

Dividend Yield: 6.2%

Phoenix Mecano's dividend yield of 6.18% is among the top 25% in Switzerland but is not well covered by free cash flows, with a cash payout ratio of 118.5%. The company's dividend payments have been volatile and unreliable over the past decade, despite some growth. Recent earnings for H1 2024 show a decline, with net income at €17.2 million compared to €19.9 million last year, indicating potential sustainability concerns for future dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Phoenix Mecano.

- Our valuation report unveils the possibility Phoenix Mecano's shares may be trading at a discount.

Seize The Opportunity

- Unlock our comprehensive list of 26 Top SIX Swiss Exchange Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CFT

Compagnie Financière Tradition

Operates as an interdealer broker of financial and non-financial products worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.