- Switzerland

- /

- Banks

- /

- SWX:LUKN

Berner Kantonalbank And 2 Top Dividend Stocks To Explore

Reviewed by Simply Wall St

Swiss stocks recently showcased a robust performance, buoyed by positive earnings updates and the anticipation of further monetary easing by the Swiss National Bank. The benchmark SMI's upward movement reflects a resilient market environment that could be conducive for exploring investment opportunities, particularly in dividend-paying stocks which might offer investors both stability and potential income in such optimistic market conditions.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.56% | ★★★★★★ |

| Vontobel Holding (SWX:VONN) | 5.38% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.15% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.49% | ★★★★★☆ |

| Roche Holding (SWX:ROG) | 4.05% | ★★★★★☆ |

| EFG International (SWX:EFGN) | 4.74% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.12% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.77% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.59% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Berner Kantonalbank (SWX:BEKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Berner Kantonalbank AG provides banking products and services to private individuals and corporate customers in Switzerland, with a market capitalization of approximately CHF 2.33 billion.

Operations: Berner Kantonalbank AG generates CHF 532.28 million in revenue primarily through its banking segment.

Dividend Yield: 4%

Berner Kantonalbank AG has demonstrated a consistent ability to grow and sustain its dividends over the past decade, underpinned by a stable dividend per share and a reasonable payout ratio of 52.8%. Although its dividend yield of 3.97% is slightly below the top quartile for Swiss dividend stocks, it trades at a significant discount to estimated fair value, offering potential value. Recent earnings show growth with net interest income rising to CHF 388.2 million and net income increasing to CHF 174.89 million in 2023.

- Delve into the full analysis dividend report here for a deeper understanding of Berner Kantonalbank.

- Our expertly prepared valuation report Berner Kantonalbank implies its share price may be lower than expected.

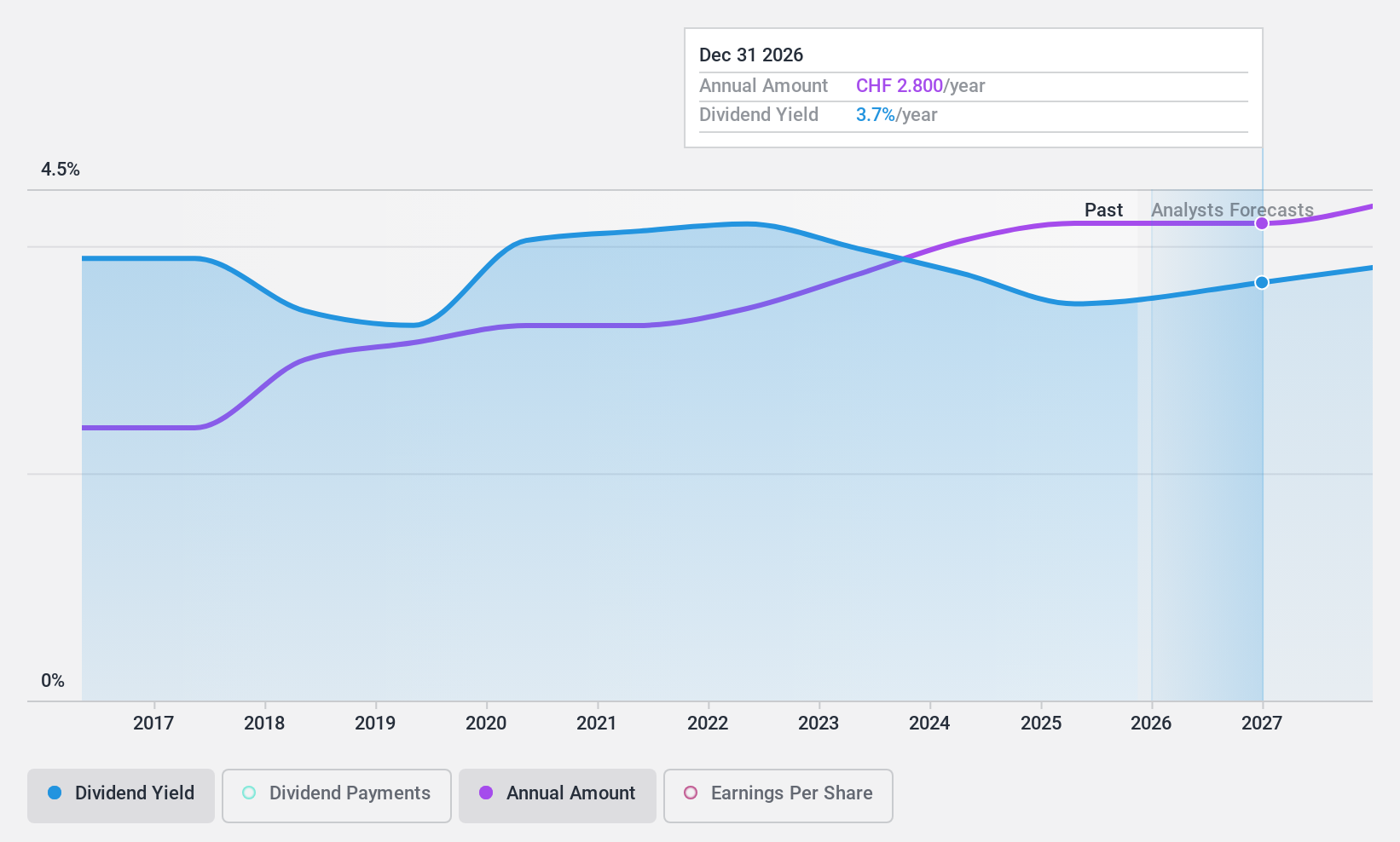

Liechtensteinische Landesbank (SWX:LLBN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liechtensteinische Landesbank Aktiengesellschaft operates as a bank offering a range of financial products and services across Liechtenstein, Switzerland, Germany, Austria, and other international markets, with a market capitalization of approximately CHF 2.17 billion.

Operations: Liechtensteinische Landesbank Aktiengesellschaft generates revenue primarily through its Retail & Corporate Banking segment with CHF 273.32 million, followed by International Wealth Management at CHF 241.19 million.

Dividend Yield: 3.8%

Liechtensteinische Landesbank's dividends are reasonably covered by earnings, with a current payout ratio of 50.3% and a forecasted coverage in three years at 45.7%. However, its dividend yield of 3.8% is below the top quartile for Swiss stocks, and its history shows volatility in dividend payments over the last decade. Despite trading at a 24.9% discount to its fair value and demonstrating earnings growth of 12.7% annually over five years, concerns about dividend reliability persist due to past inconsistencies and a low allowance for bad loans at 44%.

- Take a closer look at Liechtensteinische Landesbank's potential here in our dividend report.

- The analysis detailed in our Liechtensteinische Landesbank valuation report hints at an deflated share price compared to its estimated value.

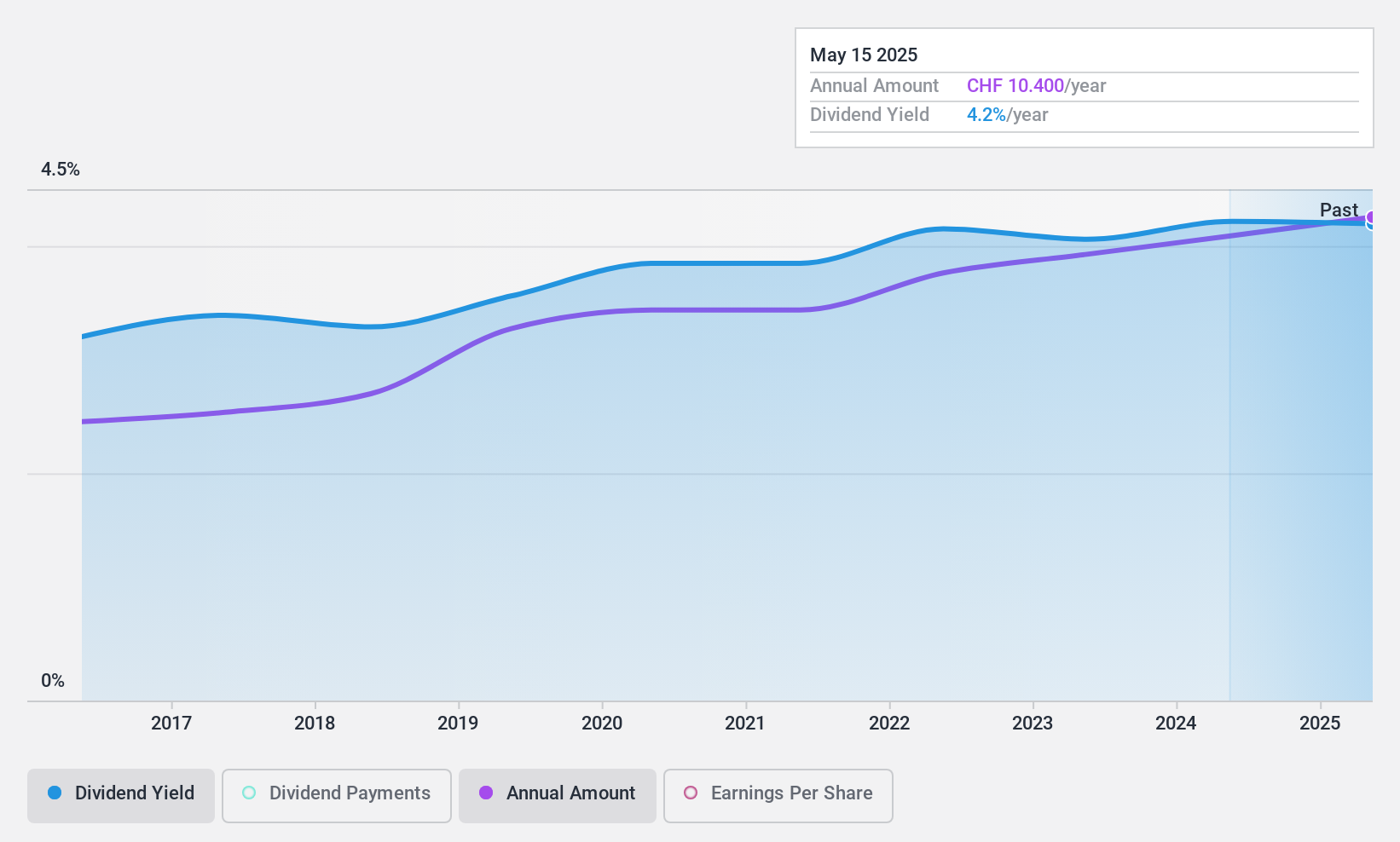

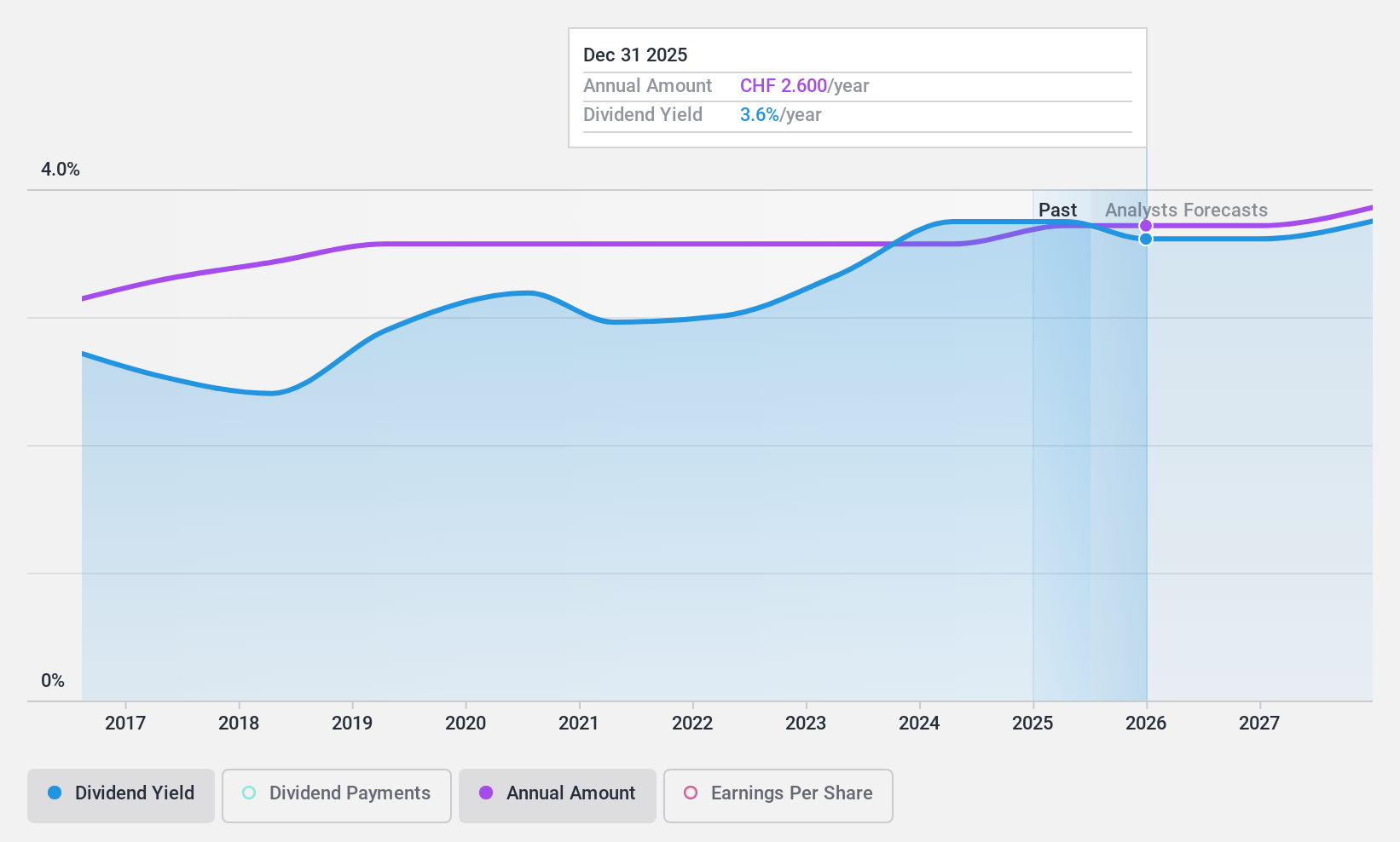

Luzerner Kantonalbank (SWX:LUKN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Luzerner Kantonalbank AG operates as a comprehensive banking institution offering a range of financial products and services in Switzerland, with a market capitalization of approximately CHF 3.41 billion.

Operations: Luzerner Kantonalbank AG offers a diverse array of financial products and services across Switzerland.

Dividend Yield: 3.6%

Luzerner Kantonalbank has demonstrated a consistent increase in dividends over the past decade, with stable annual payments that reflect reliability. The recent earnings report from April 12, 2024, shows a robust financial performance with net interest income and net income rising to CHF 106.56 million and CHF 74.81 million respectively. Despite a low dividend yield of 3.61% compared to the top Swiss dividend payers, its payout ratio of 46.5% suggests dividends are well covered by earnings, projecting sustainability into the next three years at a forecasted ratio of 40.8%.

- Unlock comprehensive insights into our analysis of Luzerner Kantonalbank stock in this dividend report.

- In light of our recent valuation report, it seems possible that Luzerner Kantonalbank is trading behind its estimated value.

Taking Advantage

- Dive into all 27 of the Top Dividend Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LUKN

Luzerner Kantonalbank

Provides various banking products and services in Switzerland.

Solid track record with excellent balance sheet and pays a dividend.