- Switzerland

- /

- Banks

- /

- SWX:LLBN

Liechtensteinische Landesbank (SWX:LLBN): Assessing Valuation Following CEO Succession Announcement

Reviewed by Kshitija Bhandaru

Liechtensteinische Landesbank (SWX:LLBN) has named Christoph Reich as its new Group Chief Executive Officer and Chairman of the Group Executive Board, effective September 29, 2025. The appointment follows the recent departure of the previous CEO and places a familiar leader at the helm.

See our latest analysis for Liechtensteinische Landesbank.

The CEO transition follows a healthy year for Liechtensteinische Landesbank, with steady total shareholder return of 11.5% over the past twelve months and an impressive 60.7% over three years. Despite some recent profit taking, momentum remains positive. This suggests investors view the leadership change as a stable hand for long-term growth.

If news of this executive shakeup has you thinking bigger, it could be the perfect moment to broaden your investing lens and uncover fast growing stocks with high insider ownership

With the stock trading at a modest discount to analyst targets but following years of strong returns, the key question now is whether Liechtensteinische Landesbank still offers a buying opportunity, or if future growth is already priced in.

Price-to-Earnings of 14x: Is it justified?

With Liechtensteinische Landesbank trading at a price-to-earnings ratio of 14x compared to the last close price of CHF77.2, investors are paying a premium relative to the European Banks sector.

The price-to-earnings (PE) ratio measures how much investors are willing to pay today for a Swiss franc of earnings. This is a key metric for bank valuations. This higher-than-industry-average multiple suggests confidence in future profitability or perceived stability of the bank’s earnings. It can also indicate the market expects above-average growth or quality.

However, with the European Banks industry trading at a PE of 9.9x, Liechtensteinische Landesbank’s valuation stands out as more expensive than its peers. Even when compared to the peer group average of 15.3x, the company is priced only slightly below, suggesting the market treats it as a higher-quality or more defensive bank, but not as a clear bargain.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 14x (OVERVALUED)

However, weaker near-term price momentum and the potential for profit taking could challenge the view that Liechtensteinische Landesbank remains undervalued in the current environment.

Find out about the key risks to this Liechtensteinische Landesbank narrative.

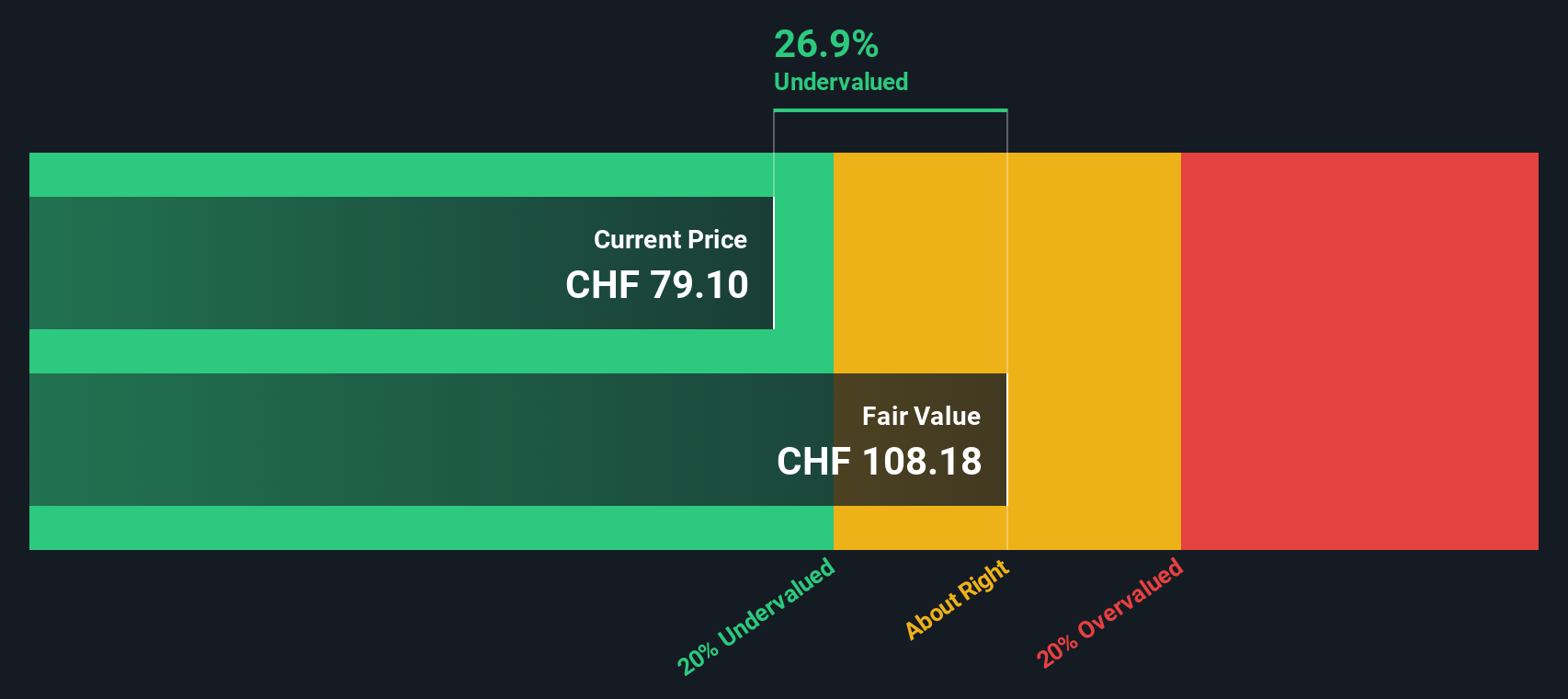

Another View: SWS DCF Model Says Undervalued

While the market currently prices Liechtensteinische Landesbank at a premium to industry peers, our DCF model offers a different perspective. According to the SWS DCF model, the shares are trading about 28.9% below their estimated fair value of CHF108.62, suggesting potential upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Liechtensteinische Landesbank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Liechtensteinische Landesbank Narrative

If you see the numbers differently, or want to dive into the details yourself, you can craft a custom analysis in just a few minutes. Do it your way

A great starting point for your Liechtensteinische Landesbank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Uncover your next great opportunity by exploring sectors with significant potential. Take action now, or you may miss trends that informed investors are already observing.

- Begin your search for stable income streams by exploring these 18 dividend stocks with yields > 3% offering yields above 3%, which can help enhance your portfolio’s cash flow.

- Consider opportunities in the next technological revolution by targeting these 25 AI penny stocks supporting innovation in artificial intelligence.

- Look for overlooked value plays by reviewing these 888 undervalued stocks based on cash flows trading below intrinsic value and positioned for possible appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LLBN

Liechtensteinische Landesbank

Provides banking products and services in Liechtenstein, Switzerland, Germany, and Austria.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives