- Canada

- /

- Gas Utilities

- /

- TSX:SPB

A Look at Superior Plus (TSX:SPB) Valuation Following New Share Buyback Plan

Reviewed by Simply Wall St

Superior Plus (TSX:SPB) just announced a new share repurchase program, allowing it to buy back nearly 10% of its current shares over the next year. This move often signals management’s confidence in future performance.

See our latest analysis for Superior Plus.

Superior Plus’s buyback news comes after a year where momentum has generally tilted positive, with an 18.31% share price return year-to-date and a 15.14% total shareholder return over the past twelve months. While the stock showed a dip in the past month, recent gains and management’s share repurchase plan could indicate renewed confidence in its growth prospects beyond recent volatility.

If you’re looking to broaden your search beyond energy and utilities, now is a great time to discover fast growing stocks with high insider ownership

But with shares still below analyst price targets, annual net income increasing significantly, and a new buyback being considered, is Superior Plus currently trading at an attractive discount, or is the market already accounting for its future growth?

Most Popular Narrative: 22.8% Undervalued

At CA$7.43, Superior Plus trades noticeably below the most widely followed narrative's fair value estimate of CA$9.62. This raises expectations for stronger future returns if the narrative’s projections materialize.

Expansion into renewable propane, RNG, hydrogen, and industrial distributed energy segments aligns with policy and customer priorities for lower-carbon solutions. This broadens Superior Plus's addressable market and diversifies future revenue streams, especially as commercial adoption of clean transitional fuels accelerates.

Curious why analysts think this business could tap new potential? The narrative centers on several key numbers: one future profit increase, one margin shift, and a possible valuation change that challenges past assumptions. Find out the exact drivers behind this high-conviction price target.

Result: Fair Value of $9.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as decarbonization trends and increased competition in clean fuels could challenge Superior Plus’s optimistic outlook if market conditions shift unexpectedly.

Find out about the key risks to this Superior Plus narrative.

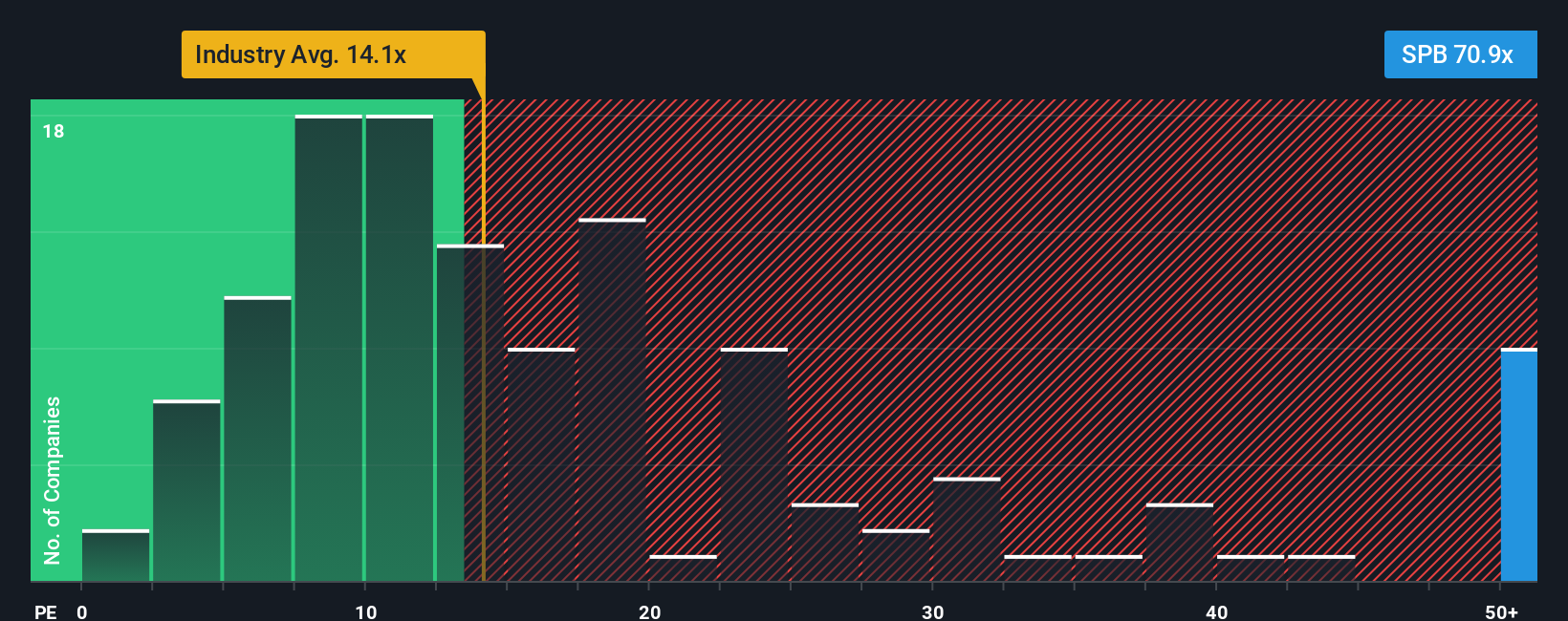

Another View: Price Ratios Flash a Warning

While the analyst consensus sees Superior Plus as undervalued, its price-to-earnings ratio paints a different picture. The company trades at 74.6 times earnings, which is much higher than its industry peers at 11.7x and also above its fair ratio of 31.4x. This gap suggests valuation risk if the market shifts toward more typical levels. Which viewpoint will prove right as market sentiment evolves?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Superior Plus Narrative

If you want to tap into your own insights or see how the story stacks up against your research, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your Superior Plus research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why stop at a single stock? Boost your portfolio by finding fresh opportunities in other sectors where growth, innovation, or solid income potential may be hiding.

- Tap into companies shaping tomorrow’s world by checking out these 25 AI penny stocks that are building smart solutions and driving major trends today.

- Unlock powerful streams of potential income as you scan these 15 dividend stocks with yields > 3%, offering yields above 3% and dependable track records.

- Seize overlooked chances with these 914 undervalued stocks based on cash flows, where fundamental value creates exciting entry points that many investors miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SPB

Superior Plus

Distributes propane, compressed natural gas, and renewable energy and related products and services in the United States and Canada.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026