- Canada

- /

- Renewable Energy

- /

- TSX:MXG

Maxim Power And 2 Other Prominent Penny Stocks On The TSX

Reviewed by Simply Wall St

Throughout the year, the Canadian market has navigated policy shifts, global uncertainty, and valuation concerns, yet there are reasons to be thankful as it approaches one of its strongest calendar-year returns since 2009. Amid these conditions, investors often look for stocks that combine strong fundamentals with growth potential. Penny stocks may be an outdated term but remain relevant as they often represent smaller or newer companies offering unique opportunities; when backed by solid financials, they can provide a promising avenue for those seeking hidden gems in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.08 | CA$52.58M | ✅ 3 ⚠️ 3 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.08 | CA$233.05M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.44 | CA$145.14M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.34 | CA$51.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.29 | CA$858.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.14 | CA$22.59M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.78 | CA$141.1M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.17 | CA$205.34M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.78 | CA$10.64M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 392 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Maxim Power (TSX:MXG)

Simply Wall St Financial Health Rating: ★★★★★★

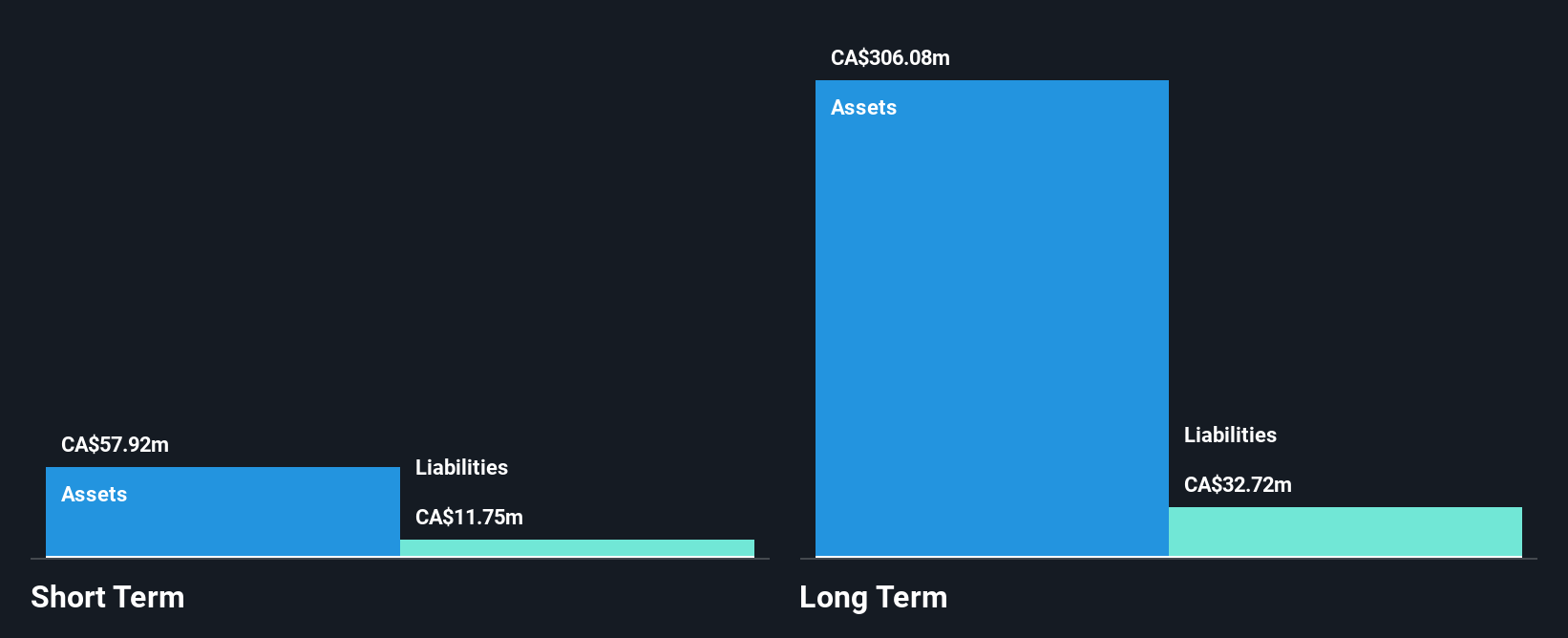

Overview: Maxim Power Corp. is an independent power producer that develops, owns, and operates power and related projects in Canada, with a market cap of CA$284.98 million.

Operations: Maxim Power generates CA$92.96 million in revenue from its power generation facilities segment.

Market Cap: CA$284.98M

Maxim Power Corp. operates without debt, providing financial stability and flexibility. Despite a seasoned board and management team, the company faces challenges with declining profit margins—15% compared to 35.9% last year—and negative earnings growth of -66.6%. Recent earnings reports show a decrease in revenue from CA$34.11 million to CA$27.58 million year-over-year for Q3 2025, though net income remains stable at around CA$10 million. The company has initiated a share repurchase program, potentially enhancing shareholder value by reducing outstanding shares by up to 5%.

- Click here to discover the nuances of Maxim Power with our detailed analytical financial health report.

- Evaluate Maxim Power's historical performance by accessing our past performance report.

Colonial Coal International (TSXV:CAD)

Simply Wall St Financial Health Rating: ★★★★★★

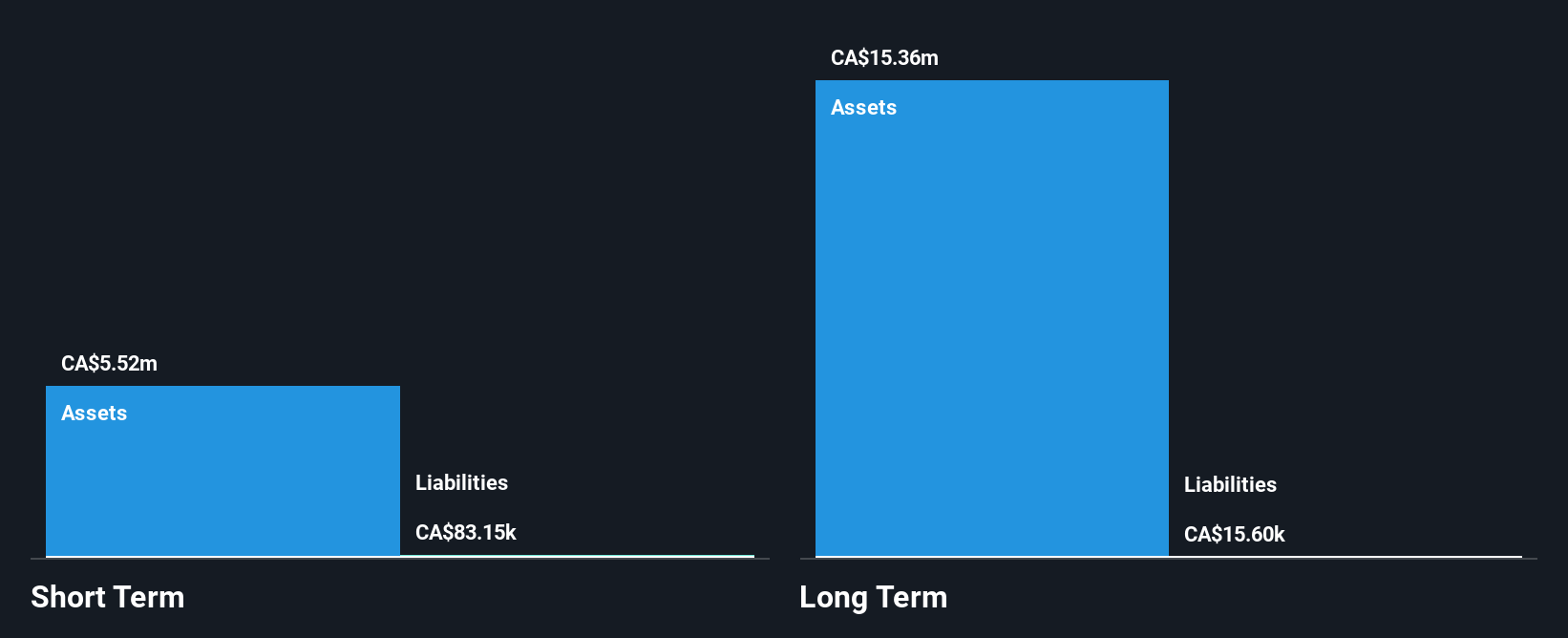

Overview: Colonial Coal International Corp. focuses on the acquisition, exploration, and development of coal properties in Canada with a market cap of CA$373.53 million.

Operations: Colonial Coal International Corp. has not reported any revenue segments.

Market Cap: CA$373.53M

Colonial Coal International Corp., with a market cap of CA$373.53 million, remains pre-revenue and unprofitable, facing increasing losses over the past five years at a rate of 15.1% annually. Despite this, it operates debt-free and has sufficient cash runway for more than a year based on current free cash flow trends. The management and board are seasoned with significant tenure, contributing to stability in leadership. Recent financial results show a reduced net loss of CA$0.45 million for Q1 2025 compared to CA$5.5 million the previous year, indicating some improvement in managing expenses despite ongoing challenges in profitability growth.

- Dive into the specifics of Colonial Coal International here with our thorough balance sheet health report.

- Examine Colonial Coal International's past performance report to understand how it has performed in prior years.

Santacruz Silver Mining (TSXV:SCZ)

Simply Wall St Financial Health Rating: ★★★★★★

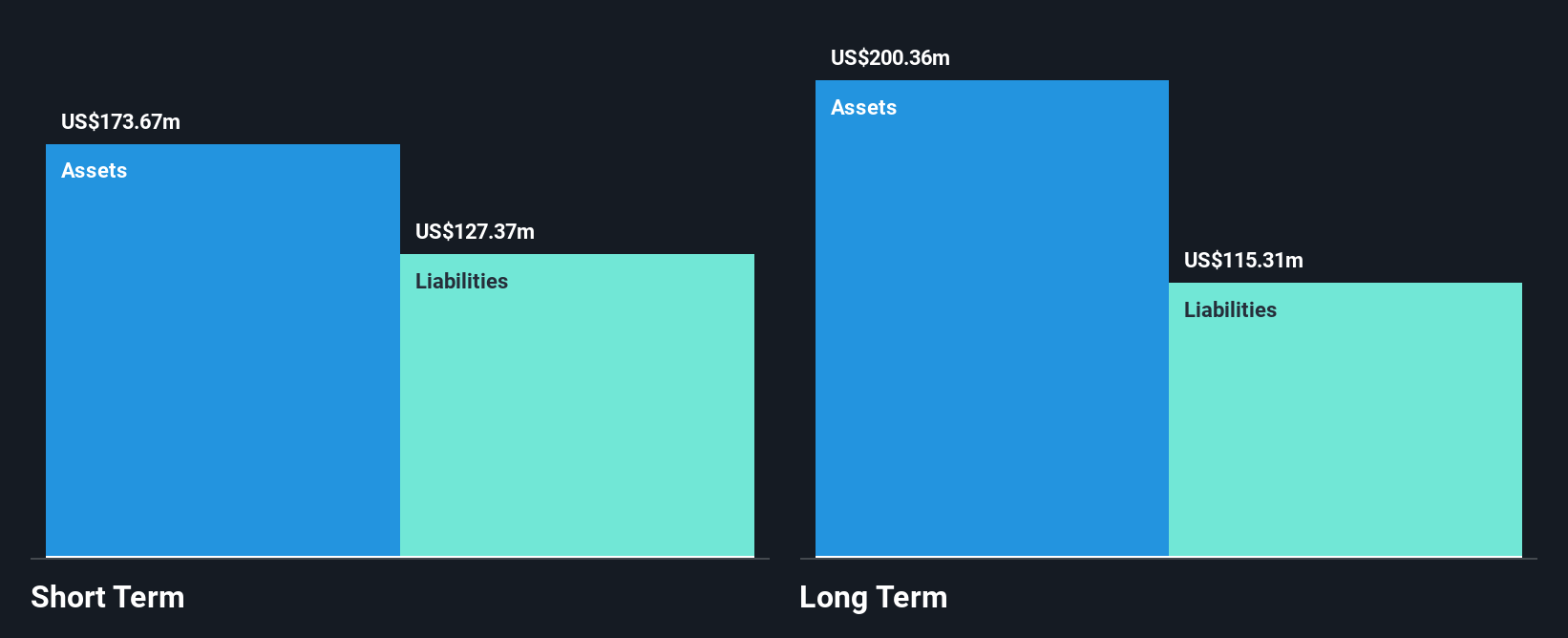

Overview: Santacruz Silver Mining Ltd. is involved in the acquisition, exploration, development, production, and operation of mineral properties in Latin America with a market cap of CA$1.07 billion.

Operations: The company's revenue is derived from its operations at Porco ($38.02 million), Bolivar ($73.25 million), Zimapan ($93.41 million), SAN Lucas ($89.89 million), and the Caballo Blanco Group ($75.48 million).

Market Cap: CA$1.07B

Santacruz Silver Mining Ltd., with a market cap of CA$1.07 billion, has shown stable revenue growth, reporting US$79.99 million in Q3 2025 sales and maintaining solid net income despite a decrease from the previous year. The company’s financial health is robust, with short-term assets exceeding liabilities and strong debt coverage by operating cash flow. However, recent insider selling and lower profit margins compared to last year suggest caution. The appointment of Bruce Wolfson to the board brings extensive expertise in emerging markets, potentially enhancing strategic direction as Santacruz advances its Soracaya Project toward production readiness in Bolivia.

- Navigate through the intricacies of Santacruz Silver Mining with our comprehensive balance sheet health report here.

- Understand Santacruz Silver Mining's earnings outlook by examining our growth report.

Seize The Opportunity

- Jump into our full catalog of 392 TSX Penny Stocks here.

- Interested In Other Possibilities? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MXG

Maxim Power

An independent power producer, develops, owns, and operates power and power related projects in Canada.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026