- Canada

- /

- Other Utilities

- /

- TSX:CU

Should Canadian Utilities' (TSX:CU) New Preferred Share Offering Change Investors’ View on Its Capital Structure?

Reviewed by Sasha Jovanovic

- On November 17, 2025, Canadian Utilities Limited completed a CAD 175 million fixed-income offering by issuing 7,000,000 callable, cumulative 5.60% preferred shares at CAD 25 each, with a CAD 0.75 discount per share.

- This capital raise introduces new dividend and redemption obligations for the company, which may have implications for its financial flexibility and funding plans.

- We'll explore how this preferred share issuance could impact Canadian Utilities' investment case, including its future capital structure and earnings outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Canadian Utilities Investment Narrative Recap

To own shares in Canadian Utilities, an investor needs to believe in the reliability of regulated utility assets in Alberta and the company's ability to deliver steady earnings and dividends despite regulatory and economic challenges. The recent CAD 175 million preferred share offering introduces new fixed dividend obligations, but does not materially affect the most pressing short-term catalyst, regulatory outcomes on major capital projects, or the core risk from Alberta policy shifts.

Of recent developments, the Alberta Utilities Commission’s approval of the Yellowhead Pipeline Project stands out, as this project aims to increase natural gas transmission capacity and could directly influence Canadian Utilities’ rate base growth. While the preferred share issuance boosts financial flexibility for such growth initiatives, success will still depend heavily on ongoing regulatory support and stable returns from Alberta operations.

By contrast, investors should be aware of the potential for heightened regulatory risk involving performance-based frameworks and mandated customer refunds, especially if...

Read the full narrative on Canadian Utilities (it's free!)

Canadian Utilities' narrative projects CA$4.6 billion in revenue and CA$808.3 million in earnings by 2028. This requires 7.4% yearly revenue growth and a CA$362.3 million earnings increase from the current CA$446.0 million.

Uncover how Canadian Utilities' forecasts yield a CA$41.43 fair value, in line with its current price.

Exploring Other Perspectives

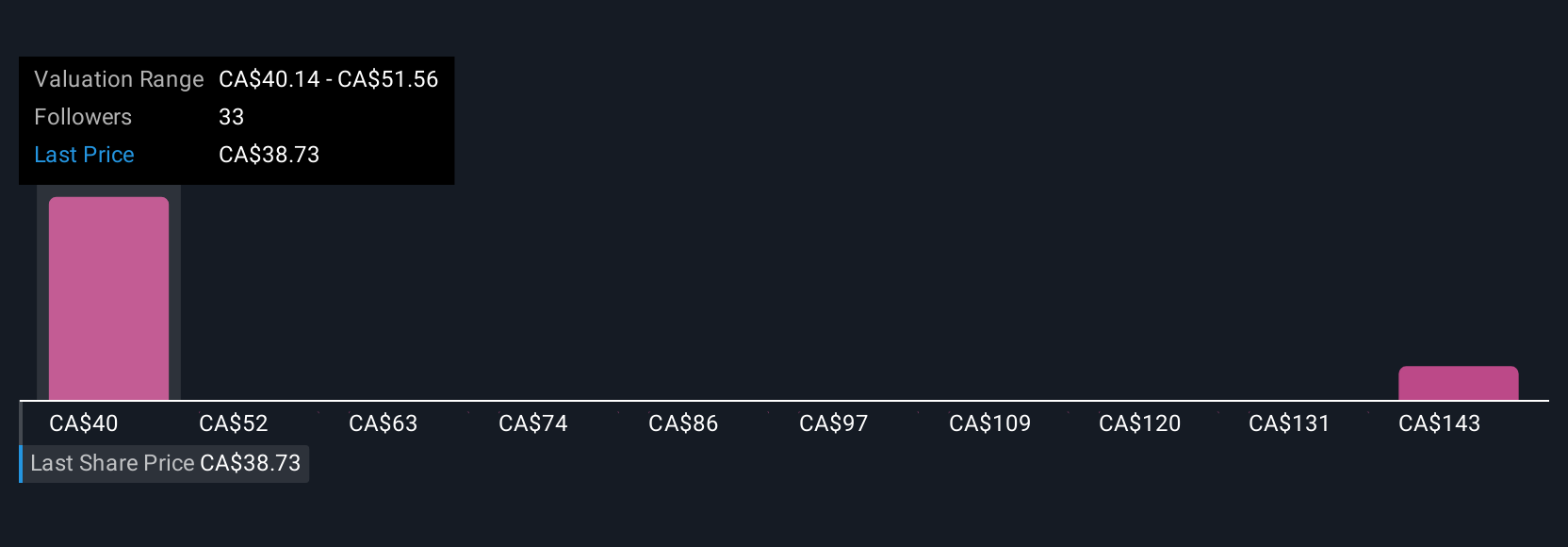

Fair value estimates from two Simply Wall St Community members span a wide range from C$41.43 to C$152.72 per share. While community perspectives vary, regulatory risk in Alberta continues to be a critical factor shaping Canadian Utilities’ future performance, inviting readers to consider several alternative viewpoints.

Explore 2 other fair value estimates on Canadian Utilities - why the stock might be worth over 3x more than the current price!

Build Your Own Canadian Utilities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Utilities research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Utilities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Utilities' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CU

Canadian Utilities

Engages in the electricity, natural gas, renewables, pipelines, and liquids businesses in Canada, Australia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026