- Canada

- /

- Other Utilities

- /

- TSX:CU

A Look at Canadian Utilities (TSX:CU) Valuation Following Major Preferred Shares Offering for Infrastructure Growth

Reviewed by Simply Wall St

Canadian Utilities (TSX:CU) just wrapped up a major preferred shares offering and raised $201 million. The proceeds are set to boost its financial strength, supporting capital expenditures and ongoing infrastructure projects.

See our latest analysis for Canadian Utilities.

Momentum has clearly picked up for Canadian Utilities, with a 21.4% share price return since the start of the year and a one-year total shareholder return of 23.2% supporting improving sentiment. Investors seem to be responding to both the capital raise and ongoing infrastructure investment, steadily building optimism around the company’s long-term growth potential.

If Canadian Utilities’ steady run has you considering other opportunities, broaden your search and discover fast growing stocks with high insider ownership.

Yet with the stock rallying this year, investors may wonder if Canadian Utilities remains undervalued at current prices, or if the market has already factored in its ambitious growth plans and capital raise. Investors may be considering whether there is still an opportunity, or if all the optimism is already reflected in the current price.

Most Popular Narrative: Fairly Valued

Canadian Utilities’ last close of CA$42.23 sits just above the narrative fair value estimate of CA$41.43, suggesting minimal upside according to the most widely followed view on the stock. The market appears to be in close agreement with the consensus of analysts, who see the current price anchored by stable sector expectations.

Substantial investment in grid modernization and expansion, including major projects like the Central East Transfer-Out and 90%-contracted Yellowhead pipeline, positions Canadian Utilities to capitalize on rising power and gas demand from electrification and industrial growth. This supports future increases in rate base and long-term revenue growth.

Want to know what’s really powering that valuation? There is a bold set of growth assumptions and margin improvements woven into this forecast. The full narrative reveals the kind of financial leap usually reserved for companies at the forefront of industry change. Find out what makes this fair value stand out from the crowd.

Result: Fair Value of $41.43 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory disputes and Alberta's shifting economic landscape could quickly alter the outlook for Canadian Utilities. These factors may challenge the case for steady growth.

Find out about the key risks to this Canadian Utilities narrative.

Another View: What Do Earnings Ratios Say?

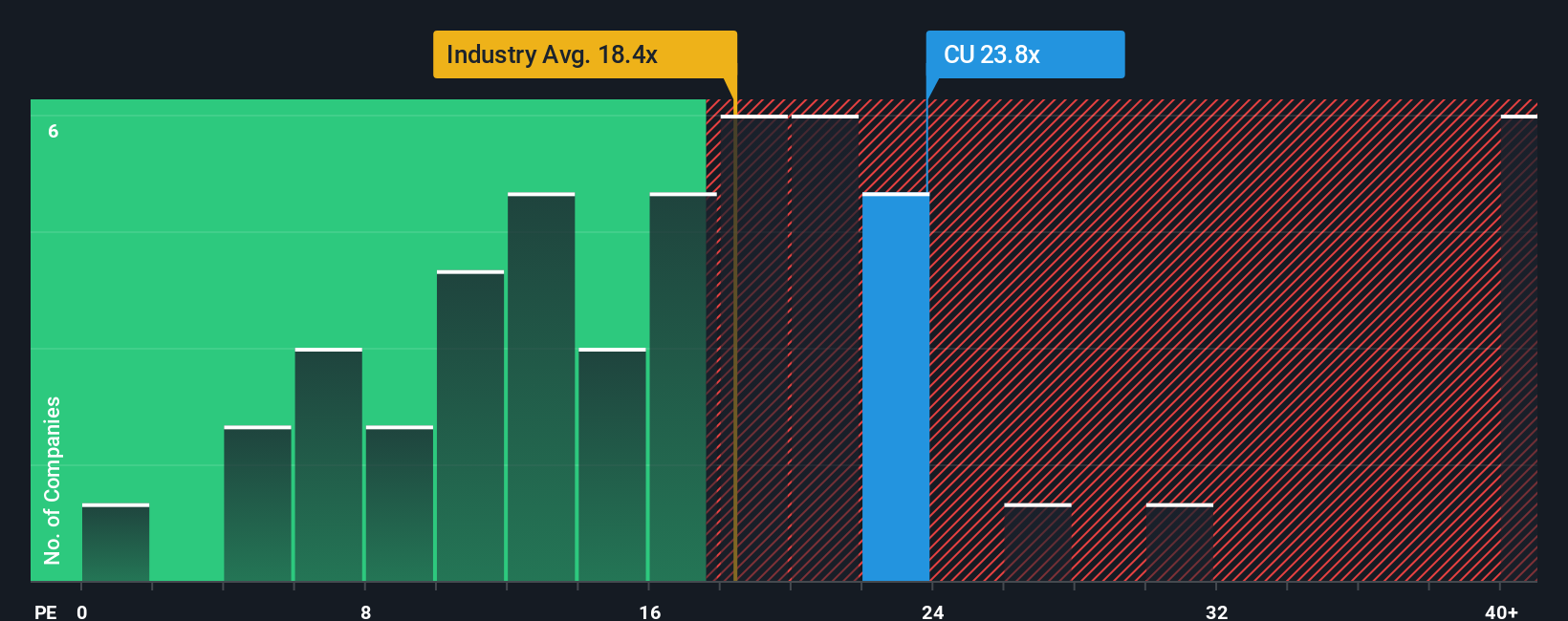

Looking through the lens of the commonly used price-to-earnings ratio, Canadian Utilities trades at 21.5x, which is quite a premium to the global industry average of 18.4x and even higher than the fair ratio of 19.6x. This suggests that current optimism already adds valuation risk, raising the question: is the premium justified or does it leave less room for upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Canadian Utilities Narrative

If the fair value story doesn’t match your outlook, you can dive into the numbers yourself and shape your own in just a few minutes. Do it your way.

A great starting point for your Canadian Utilities research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that opportunities do not wait. Step ahead of the crowd with powerful tools that spotlight unique trends and investment edge before others catch on.

- Spot companies riding the artificial intelligence surge and get instant access to those shaping tomorrow’s breakthroughs with these 25 AI penny stocks.

- Tap into reliable income potential by checking out these 15 dividend stocks with yields > 3% for robust yields and long-term cash flow strength.

- Catch undervalued gems early and find stocks the market may be overlooking right now through these 915 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CU

Canadian Utilities

Engages in the electricity, natural gas, renewables, pipelines, and liquids businesses in Canada, Australia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026