- Canada

- /

- Renewable Energy

- /

- TSX:BLX

Did Boralex’s (TSX:BLX) New European Leader Quietly Redefine Its Core Investment Narrative?

Reviewed by Sasha Jovanovic

- On December 4, 2025, Boralex Inc. appointed Jean-Christophe Dall’Ava as Executive Vice President and General Manager, Europe, replacing Nicolas Wolff and entrusting him with its European renewable operations.

- Dall’Ava’s track record in shaping Boralex’s European power purchase agreement strategy and leading development teams signals management continuity in a core market where regulatory and contract structures are central to the business model.

- We’ll now examine how Dall’Ava’s European leadership, particularly his PPA expertise, could influence Boralex’s existing investment narrative and future outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Boralex Investment Narrative Recap

To own Boralex, you have to believe in long term demand for contracted renewable power and the company’s ability to turn its 7.3 GW pipeline into more stable cash flows despite recent losses. The biggest near term catalyst remains securing higher quality PPAs as legacy, richer French contracts roll off, while the key risk is continued revenue and margin volatility from weaker short term contract prices. Dall’Ava’s appointment supports execution in Europe, but does not materially alter these near term drivers.

Among recent announcements, the June 2025 unveiling of Boralex’s 2030 Strategic Plan, which targets a doubling of installed capacity, feels most relevant here. That growth ambition depends heavily on disciplined capital allocation and winning PPAs across Europe and North America, areas where Dall’Ava’s commercialization and French PPA background could be particularly important as the company balances contract quality against rising debt and earnings volatility.

Yet beneath the promise of long term growth, investors should be aware of how exposed Boralex remains to declining short term contract prices in France...

Read the full narrative on Boralex (it's free!)

Boralex's narrative projects CA$1.1 billion revenue and CA$162.7 million earnings by 2028.

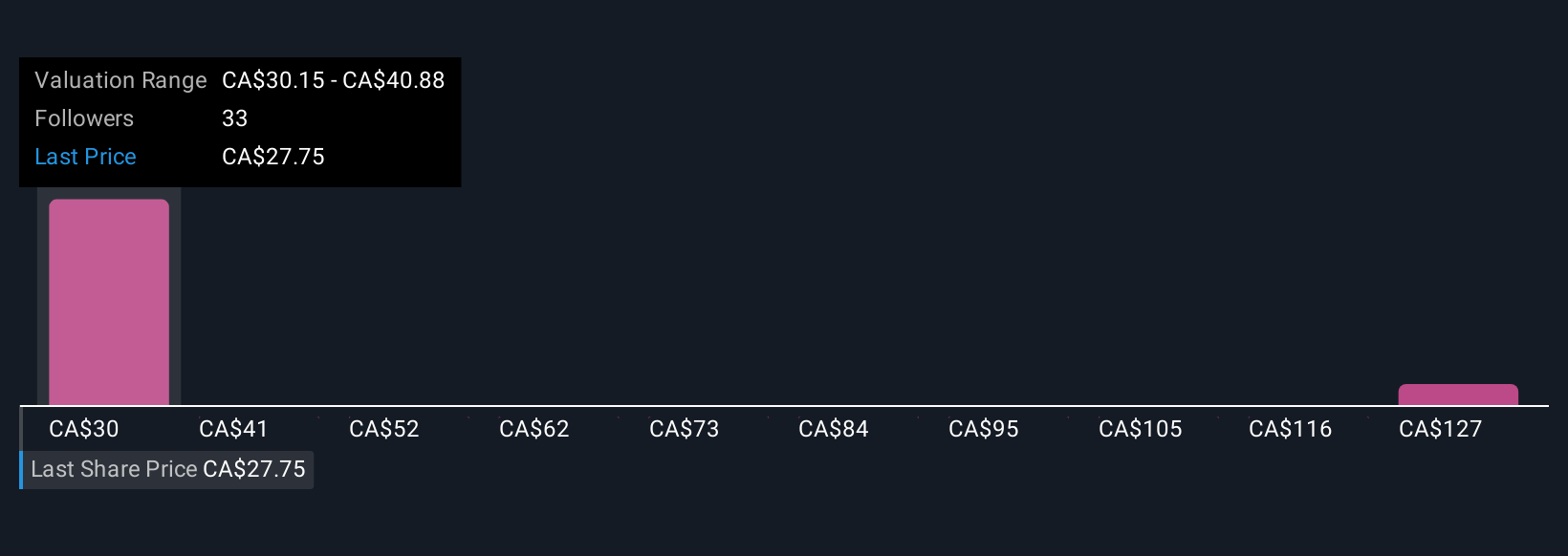

Uncover how Boralex's forecasts yield a CA$36.90 fair value, a 51% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for Boralex span from CA$36.90 to CA$125.01, underlining how widely opinions on upside potential can vary. Against this spread, the reliance on European PPAs and exposure to French power prices remains a central issue that could shape how those different views on future earnings ultimately play out.

Explore 2 other fair value estimates on Boralex - why the stock might be worth over 5x more than the current price!

Build Your Own Boralex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boralex research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Boralex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boralex's overall financial health at a glance.

No Opportunity In Boralex?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boralex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BLX

Boralex

Engages in the developing, building, and operating power generating and storage facilities in Canada, France, and the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026