Exchange Income (TSX:EIF) Valuation After Debenture Conversion Reshapes Balance Sheet and Share Count

Reviewed by Simply Wall St

Exchange Income (TSX:EIF) just wrapped up the redemption of its 5.25% convertible debentures, with most holders choosing to convert into shares. This move meaningfully shifts both leverage and the share count.

See our latest analysis for Exchange Income.

That balance sheet cleanup comes after a strong run, with the share price at CA$80.27 and a hefty year to date share price return alongside a near doubling three year total shareholder return. This suggests momentum is still very much on Exchange Income's side.

If this kind of re rating has you thinking about what else might be gaining traction, it could be worth exploring fast growing stocks with high insider ownership as a source of new ideas.

With leverage easing, earnings growing and the share price sitting below analyst targets yet up sharply in recent years, is Exchange Income still a buying opportunity, or is the market already pricing in its future growth?

Most Popular Narrative: 11% Undervalued

With Exchange Income last closing at CA$80.27 versus a narrative fair value of about CA$90.23, the story implies more upside if execution holds.

The recent acquisition of Canadian North, combined with a long term exclusive contract with the Government of Nunavut, uniquely positions the company as the primary provider of essential air services to remote Arctic regions. This leverages multi decade demand for connectivity and government infrastructure investment in the North creating a stable, recurring revenue base and supporting future revenue and EBITDA growth.

Curious how long dated Arctic contracts, rising margins and ambitious earnings targets combine into that valuation gap, and what growth runway those assumptions quietly build in?

Result: Fair Value of $90.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering cost inflation and persistent labor shortages could squeeze margins and delay the earnings ramp that this upbeat valuation case depends on.

Find out about the key risks to this Exchange Income narrative.

Another Angle on Valuation

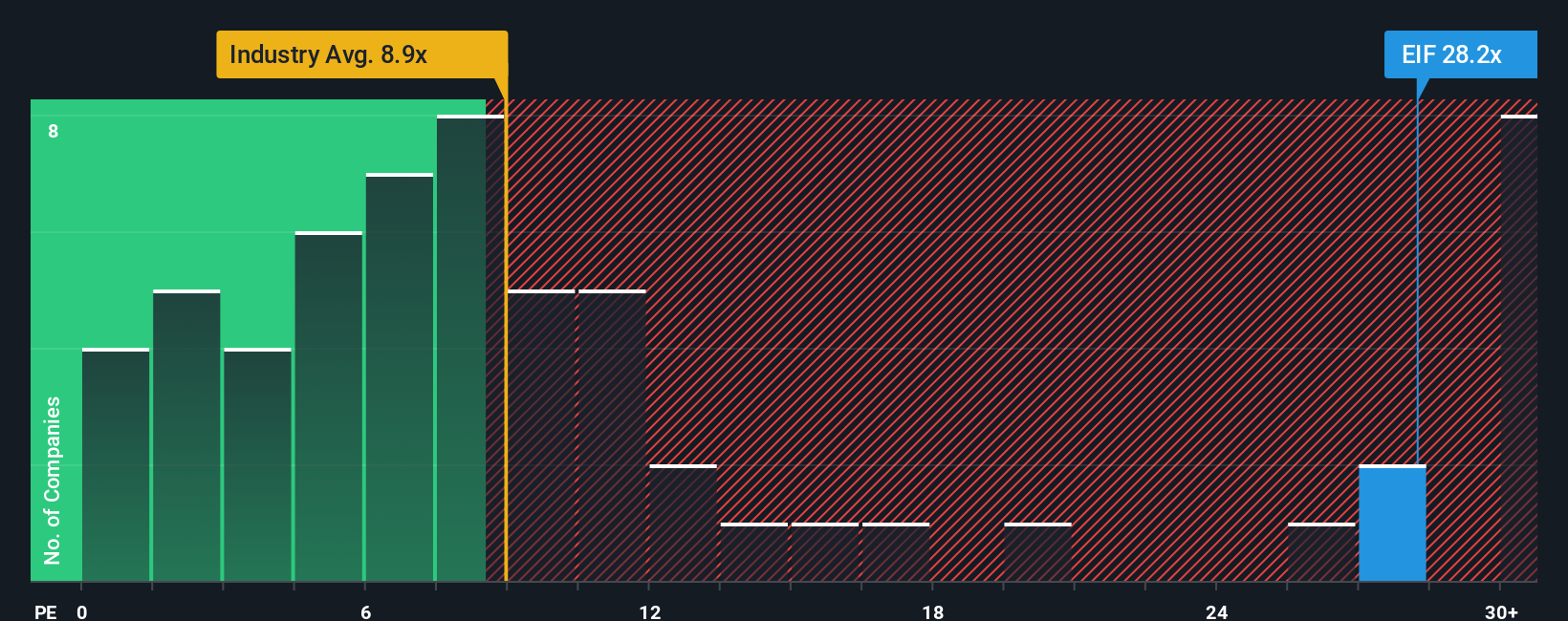

On earnings, the picture looks very different. Exchange Income trades at about 30.3 times earnings, versus roughly 9.1 times for the global airlines industry and 14.7 times for peers, while our fair ratio sits nearer 20.7 times. That leaves today’s multiple looking stretched and raises the question of whether growth can keep justifying this premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Exchange Income Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fresh narrative in just a few minutes: Do it your way.

A great starting point for your Exchange Income research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before the next wave of opportunities races past, put the Simply Wall Street Screener to work and line up a watchlist packed with high potential candidates.

- Capture early stage upside by targeting under the radar businesses trading at compelling prices through these 3575 penny stocks with strong financials.

- Ride structural growth in machine learning, automation and data analytics by focusing on innovators highlighted in these 26 AI penny stocks.

- Strengthen your core portfolio with companies priced below their estimated cash flow value using these 908 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exchange Income might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EIF

Exchange Income

Engages in aerospace and aviation services and equipment, and manufacturing businesses worldwide.

Reasonable growth potential with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026