- Canada

- /

- Transportation

- /

- TSX:CP

How Investors Are Reacting To Canadian Pacific Kansas City (TSX:CP) Steady Q3, Buybacks And Rising Leverage

Reviewed by Sasha Jovanovic

- Canadian Pacific Kansas City reported a steady Q3 2025 with revenue growth, improved operating efficiency despite a one-time derailment cost, and reaffirmed its 2025 earnings guidance while continuing significant share buybacks that have modestly increased leverage.

- Alongside these financial updates, the CPKC Holiday Train’s multi-state tour underscores the railway’s long-running community role, having raised more than US$26 million and collected about 5.40 million pounds of food for local food banks since 1999.

- Against this backdrop of reaffirmed earnings guidance and ongoing efficiency gains, we’ll examine how the latest developments shape Canadian Pacific Kansas City’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Canadian Pacific Kansas City's Investment Narrative?

To own Canadian Pacific Kansas City, you need to believe in the long-term value of its tri-national freight network, consistent profitability and disciplined, if sometimes aggressive, capital allocation. The latest Q3 report largely reinforces that story: modest revenue growth, better efficiency and reaffirmed 2025 EPS guidance suggest the core rail franchise is intact, even with Q4 volumes tracking a few points lower. The more material shift is in the balance between shareholder returns and financial flexibility. CPKC has already retired over 3% of its share count under the current buyback, and management is leaning into repurchases even as leverage ticks up and the company carries a high debt load. The Holiday Train news does not change near-term catalysts, but it does highlight a strong brand and community presence that can matter at the margin in a regulated industry.

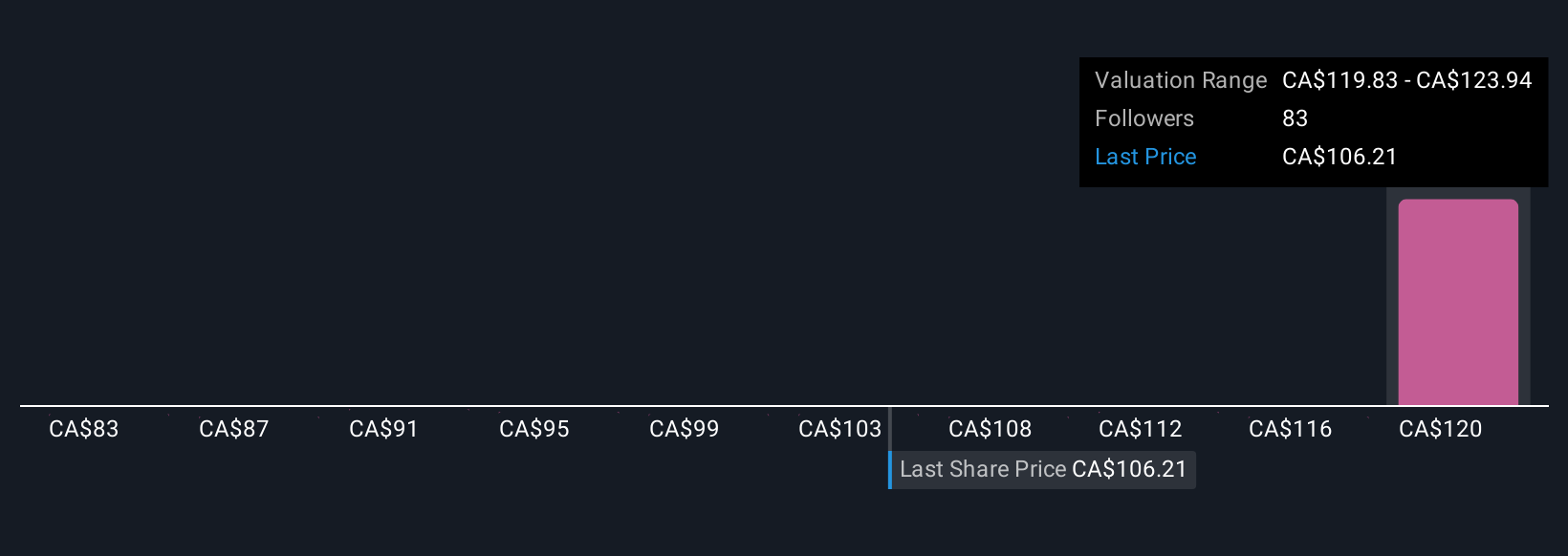

However, the combination of rising leverage and softer near-term volumes is something investors should watch closely. Canadian Pacific Kansas City's shares have been on the rise but are still potentially undervalued by 18%. Find out what it's worth.Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly CA$93 to CA$124 per share, reflecting a wide band of opinion. Set against CPKC’s reaffirmed earnings guidance and higher leverage from buybacks, that spread underlines why many investors are weighing short-term volume softness against the appeal of a rare North American rail network. This is a space where it can pay to compare several viewpoints before forming a view.

Explore 6 other fair value estimates on Canadian Pacific Kansas City - why the stock might be worth 9% less than the current price!

Build Your Own Canadian Pacific Kansas City Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Pacific Kansas City research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Pacific Kansas City research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Pacific Kansas City's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CP

Canadian Pacific Kansas City

Owns and operates a transcontinental freight railway in Canada, the United States, and Mexico.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026