- Canada

- /

- Transportation

- /

- TSX:CNR

Did CIBC’s Upgrade After the Toronto Conference Just Shift Canadian National Railway's (TSX:CNR) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Canadian National Railway presented at the Desjardins Toronto Conference, with its Executive VP & CFO sharing insights on the company’s outlook and direction.

- This was followed by a CIBC analyst upgrade to ‘outperform,’ highlighting Canadian National Railway’s operational strengths and its positioning for potential improvements in the freight cycle.

- To understand the impact of CIBC’s optimism around operational improvements, we’ll examine how this upgrade influences Canadian National Railway’s overall investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Canadian National Railway Investment Narrative Recap

To be a Canadian National Railway shareholder, you need confidence in its ability to convert a high-quality, coast-to-coast freight network into stable volume growth and efficient operations, even with current macroeconomic and supply chain uncertainties. CIBC’s analyst upgrade, reflecting optimism in operational execution and a freight cycle rebound, supports sentiment but may not fully address the key short-term catalyst, meaningful volume recovery, or ease concerns around resilience to flat demand and margin pressures if economic headwinds persist.

Among recent company developments, Canadian National Railway’s Q3 2025 earnings release stands out for its relevance to the current investment thesis. The modest rise in revenues and net income, combined with consistent dividend payouts and buybacks, underscores the company's commitment to shareholder returns yet highlights that underlying volume growth and margin expansion remain critical catalysts for future upside, as flagged by both analysts and the market.

By contrast, investors should also be aware that persistent macroeconomic uncertainty, including ongoing tariffs and volatile industrial demand, could still limit Canadian National Railway’s progress if...

Read the full narrative on Canadian National Railway (it's free!)

Canadian National Railway's outlook anticipates CA$19.6 billion in revenue and CA$5.6 billion in earnings by 2028. This projection is based on expected annual revenue growth of 4.6% and a CA$1.0 billion increase in earnings from the current CA$4.6 billion.

Uncover how Canadian National Railway's forecasts yield a CA$150.57 fair value, a 13% upside to its current price.

Exploring Other Perspectives

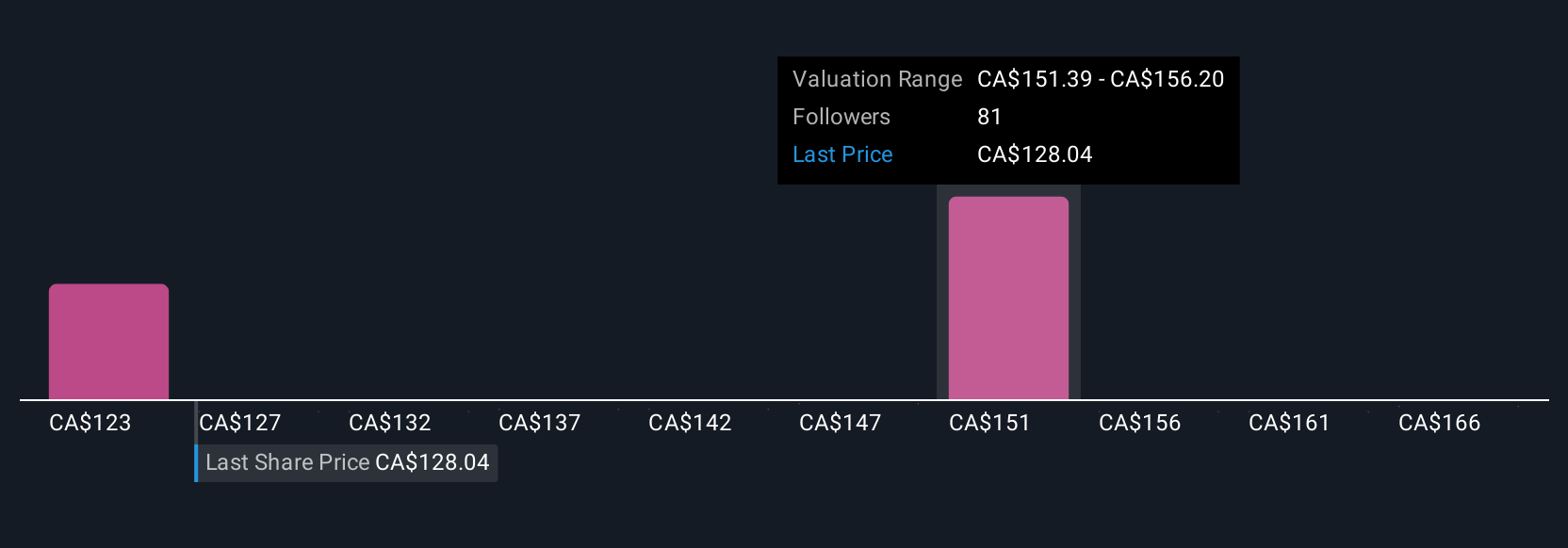

Fourteen Simply Wall St Community members see Canadian National Railway’s fair value anywhere from CA$116.67 to CA$156.78. With the company's operational strengths in focus after the CIBC upgrade, opinions show that market participants weigh diverse catalysts and risks leading to a wide set of expectations for future performance.

Explore 14 other fair value estimates on Canadian National Railway - why the stock might be worth as much as 17% more than the current price!

Build Your Own Canadian National Railway Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian National Railway research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Canadian National Railway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian National Railway's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026