Is Air Canada’s New Toronto–Rio Route a Strategic Test of Long-Haul Expansion Ambitions (TSX:AC)?

Reviewed by Sasha Jovanovic

- Air Canada recently launched its first seasonal Toronto–Rio de Janeiro route, operating three times weekly on a Boeing 787-9 Dreamliner with multiple cabin classes and premium ground services, and running through March 2026.

- This new link into Brazil strengthens Air Canada’s international footprint while also deepening the value of its Aeroplan ecosystem through onboard connectivity perks.

- We’ll now examine how this added Toronto–Rio long-haul capacity fits into Air Canada’s existing narrative of international network expansion.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Air Canada Investment Narrative Recap

To own Air Canada, you need to believe that international long haul growth and a stronger Aeroplan ecosystem will eventually outweigh current margin pressure and volatility in earnings. The new Toronto to Rio route modestly reinforces the long haul expansion catalyst, but does not materially change the near term picture where rising labor costs and capital spending remain the key risks to watch.

The Summer 2026 European expansion announcement is the most relevant comparator here, since it shows Air Canada layering new long haul routes across several continents at once. Together with Toronto to Rio, these additions highlight how much of the company’s near term thesis hinges on successfully filling new international capacity at acceptable yields while managing cost inflation.

Yet even as international routes grow, investors should be aware that rising labor expenses and capital needs could...

Read the full narrative on Air Canada (it's free!)

Air Canada's narrative projects CA$26.3 billion revenue and CA$869.3 million earnings by 2028. This requires 5.6% yearly revenue growth and an earnings decrease of about CA$630.7 million from CA$1.5 billion today.

Uncover how Air Canada's forecasts yield a CA$24.24 fair value, a 28% upside to its current price.

Exploring Other Perspectives

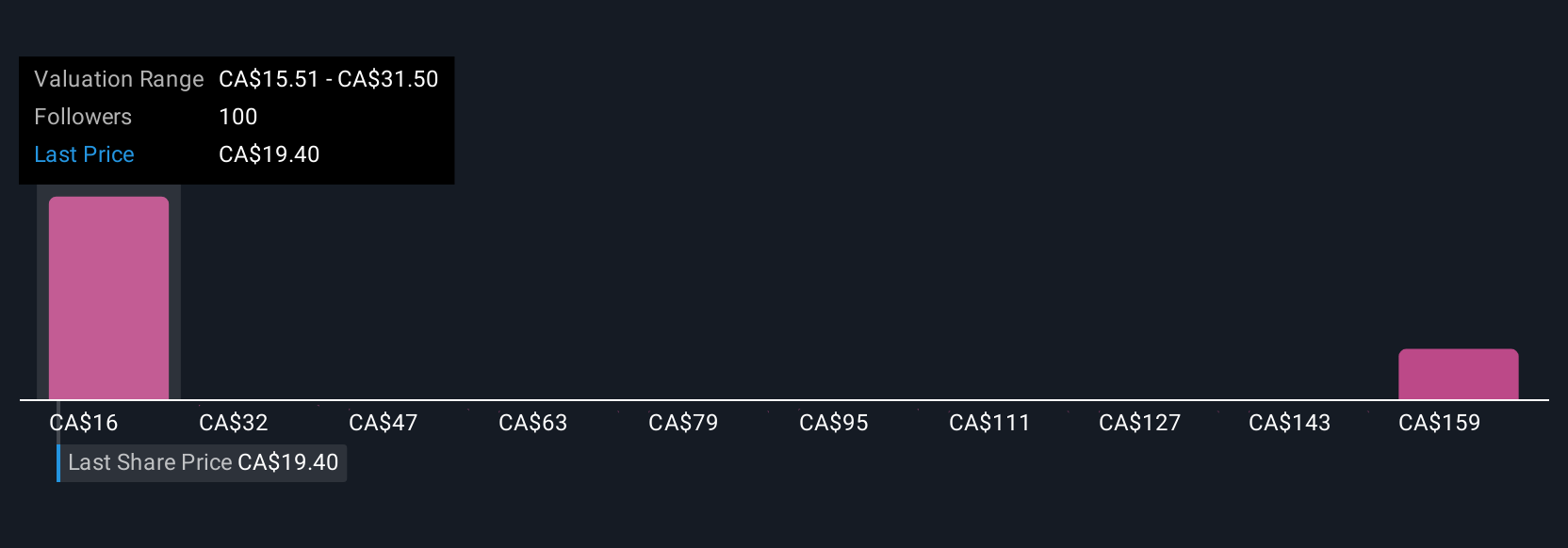

Eight members of the Simply Wall St Community currently place Air Canada’s fair value between CA$19.00 and CA$85.08, showing very different expectations about upside. When you set those views against the company’s heavy spend on new aircraft and cabins, it underlines how important execution on cost control and long haul demand will be for future performance.

Explore 8 other fair value estimates on Air Canada - why the stock might be worth over 4x more than the current price!

Build Your Own Air Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Canada research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Air Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Canada's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AC

Air Canada

Provides domestic, U.S. transborder, and international airline services.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026