Is TELUS (TSX:T) Undervalued? A Fresh Look at Its Current Valuation and Growth Prospects

Reviewed by Simply Wall St

TELUS (TSX:T) shares have seen some movement over the past month, with the stock down about 6%. Over the past year, TELUS has delivered a total return close to flat. The stock has held steady in a fairly active telecom sector.

See our latest analysis for TELUS.

Recent share price dips from TELUS reflect a period of fading momentum, even as the company’s one-year total shareholder return stays just positive. While the stock started the year with a modest uptick, recent moves suggest investors are reassessing both future growth and risk.

If you’re exploring fresh opportunities beyond the telecom sector, now might be the perfect time to discover fast growing stocks with high insider ownership.

With TELUS currently trading at a notable discount to analyst price targets and still showing solid long-term revenue growth, is there genuine value for investors here, or is the market already factoring in the company’s future prospects?

Most Popular Narrative: 12.3% Undervalued

With TELUS closing at CA$20.51 while the narrative consensus points to a fair value of CA$23.38, analysts are currently pricing in meaningful upside potential. The foundation of this view rests on expectations that key diversification efforts and investment in new segments could transform its long-term earnings profile.

TELUS Health and related digital health and virtual care businesses are demonstrating rapid revenue and EBITDA growth (16% and 29% YoY, respectively), underpinned by ongoing product innovation, global expansion, and synergies from recent acquisitions. This strategic push into high-margin, non-commoditized digital wellness segments aligns with Canada's demographic trends and will diversify and increase TELUS's long-term earnings and margin profile.

Want to know what really drives expectations above today’s price? The narrative hinges on ambitious expansion outside traditional telecom, with future growth projections that might surprise you. Unlock the details behind the math. The key numbers are waiting for your analysis.

Result: Fair Value of $23.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued competitive pressures and high capital requirements could limit TELUS's ability to achieve its expected earnings growth and margin expansion.

Find out about the key risks to this TELUS narrative.

Another View: What Do Market Multiples Say?

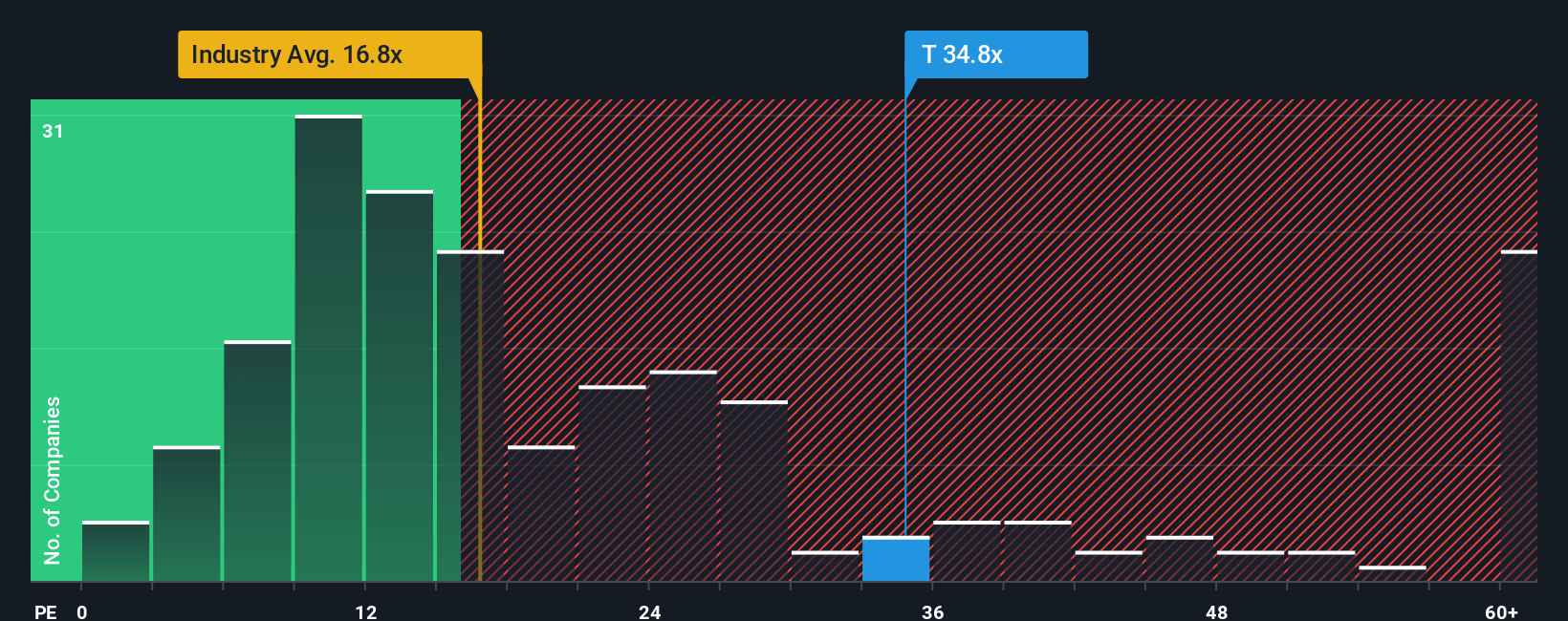

Taking a different angle, market pricing based on earnings suggests a more cautious outlook for TELUS. Its current price-to-earnings ratio of 32.6x is substantially higher than both the global telecom industry average (16.3x) and what our fair ratio analysis suggests it should be (17.3x). This means TELUS is priced well above its peers and what the market may ultimately accept, potentially signaling a valuation risk if growth fails to materialize. Is the optimism already priced in, or will the market pull back?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TELUS Narrative

If you’re curious to see the numbers for yourself or have a different perspective, crafting your own story with the available data takes just a few minutes. Why not give it a try and Do it your way?

A great starting point for your TELUS research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Your next big opportunity could be waiting beyond TELUS. Don't limit yourself; challenge your thinking and strengthen your portfolio by targeting highly relevant, potentially overlooked sectors. Check out some of the most exciting strategies below and start making smart moves today.

- Boost your passive income by targeting high yields among top contenders found in these 22 dividend stocks with yields > 3%.

- Get ahead of market trends with exposure to disruptive companies through these 26 AI penny stocks pushing innovation in artificial intelligence.

- Unlock value now by seeking out strong earners trading below their intrinsic worth inside these 840 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives