Celestica (TSX:CLS) Valuation Check After Earnings Beat, Guidance Hike and AI Data Center Momentum

Reviewed by Simply Wall St

Celestica (TSX:CLS) just delivered earnings that cleared the bar by a wide margin, raised its full year outlook, and doubled down on AI data center demand with new hardware and a fresh buyback.

See our latest analysis for Celestica.

The latest results land after a huge run, with Celestica delivering a 234.84% year to date share price return and a staggering 2,906.82% three year total shareholder return, suggesting momentum is still firmly on its side despite recent volatility.

If Celestica’s AI driven surge has caught your attention, this is a good moment to see what else is setting up for growth via high growth tech and AI stocks.

After such a parabolic run, a blowout quarter, and a richer AI narrative, investors are left with a simple question: is Celestica still trading below its true potential, or is the market already pricing in tomorrow’s growth?

Most Popular Narrative Narrative: 21.1% Undervalued

With Celestica last closing at CA$449.52 against a narrative fair value near CA$569.94, the story reflects room for further upside if assumptions hold.

Shifting mix toward high margin end markets (A&D, industrial, healthtech) and value added services (full rack integration, after market, design, and services) is expected to drive net margin expansion and enhance earnings quality, particularly from 2026 onward.

Want to see what powers that margin story? The narrative focuses on rapid top line expansion, rising profitability, and a future earnings multiple usually reserved for elite tech names.

Result: Fair Value of $569.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated hyperscaler exposure and execution risk on next generation AI hardware ramps could quickly unwind that optimism if spending or deployments disappoint.

Find out about the key risks to this Celestica narrative.

Another View: Rich On Earnings

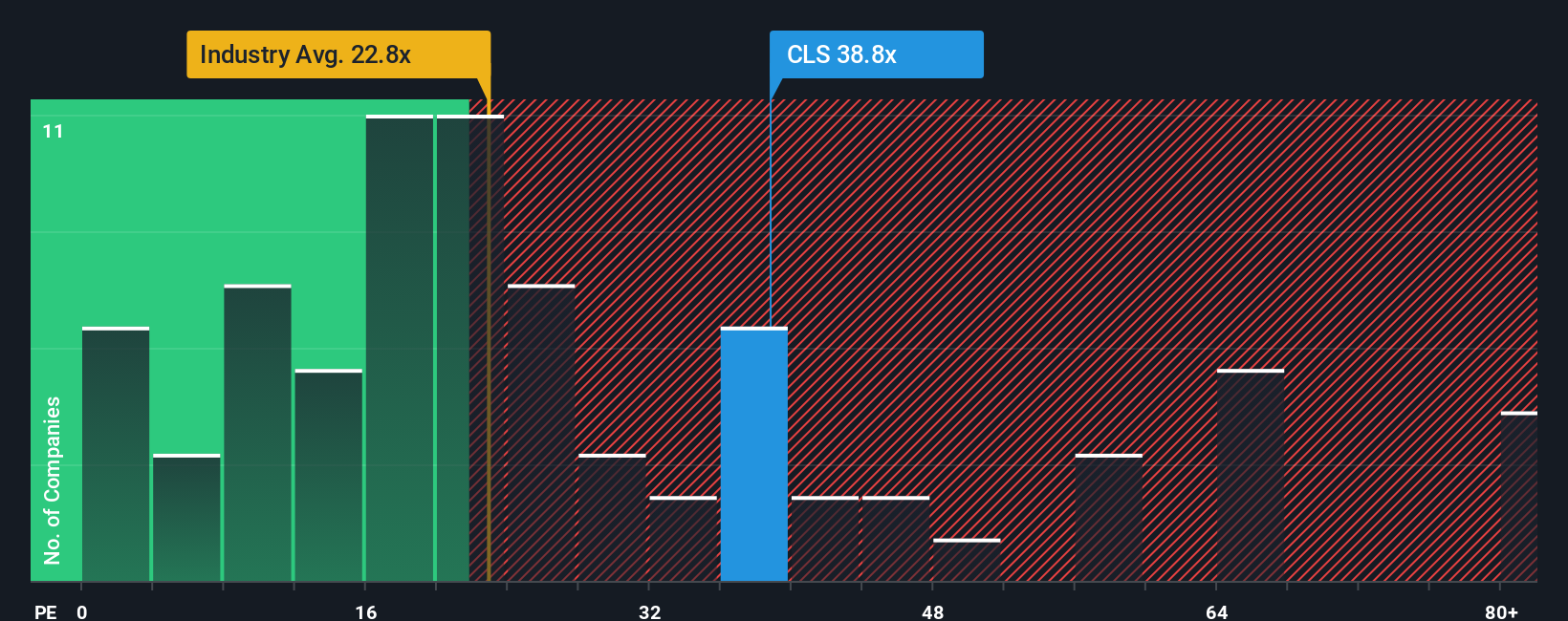

There is a catch to the bullish narrative. On earnings based valuation, Celestica trades at about 52.2 times profits, versus 24.6 times for the North American Electronic industry and 33.2 times for peers, while our fair ratio sits lower at 48.1 times.

This gap suggests investors are already paying up for flawless execution and sustained AI demand, leaving less room for error if growth or margins wobble. The key question is how much valuation risk you are really comfortable holding at these levels.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Celestica Narrative

If this perspective does not fully align with your own, or you prefer hands on research, you can build a personalized view in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Celestica.

Looking for more investment ideas?

Do not stop with just one compelling story. Use the Simply Wall St Screener to explore additional opportunities.

- Identify potential multi baggers early by scanning these 3574 penny stocks with strong financials that combine small market caps with relatively solid financial foundations.

- Focus on long term structural themes by exploring these 26 AI penny stocks that may benefit from ongoing demand for automation, data processing and intelligent software.

- Find potential value opportunities with these 907 undervalued stocks based on cash flows that appear mispriced relative to their cash flow profile and earning power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026