Celestica (TSX:CLS) Is Up 21.5% After Launching Ultra-Dense SD6300 Storage Platform – What's Changed

Reviewed by Sasha Jovanovic

- In November 2025, Celestica Inc. announced the introduction of its SD6300 ultra-dense storage platform, offering the industry’s highest density and most compact JBOD system to meet AI and enterprise data growth needs.

- This launch highlights Celestica's push into advanced storage solutions designed to maximize data center efficiency for AI, hyperscaler, and enterprise clients.

- We'll now look at how the SD6300’s compact, high-density design could impact Celestica's broader investment outlook and market positioning.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Celestica Investment Narrative Recap

To be a Celestica shareholder, you need to believe in sustained demand for advanced AI and hyperscaler infrastructure, with successful execution and product development as major near-term catalysts. The SD6300 launch highlights Celestica’s efforts to meet the AI-driven storage needs of new and existing customers, but does not materially reduce the business’s key risk: revenue concentration with a handful of hyperscaler clients, which continues to create the most significant volatility for the company.

Of recent announcements, the Q3 2025 earnings report stands out, showcasing robust sales and net income growth. This momentum could encourage optimism about product launches like the SD6300 contributing to short-term revenue strength, although it does not address the concentration risk that still looms over Celestica’s business model.

In contrast, investors should be aware of how exposure to a small group of customers can quickly...

Read the full narrative on Celestica (it's free!)

Celestica's narrative projects $17.4 billion revenue and $992.0 million earnings by 2028. This requires 17.9% yearly revenue growth and a $453.6 million earnings increase from $538.4 million today.

Uncover how Celestica's forecasts yield a CA$569.94 fair value, a 19% upside to its current price.

Exploring Other Perspectives

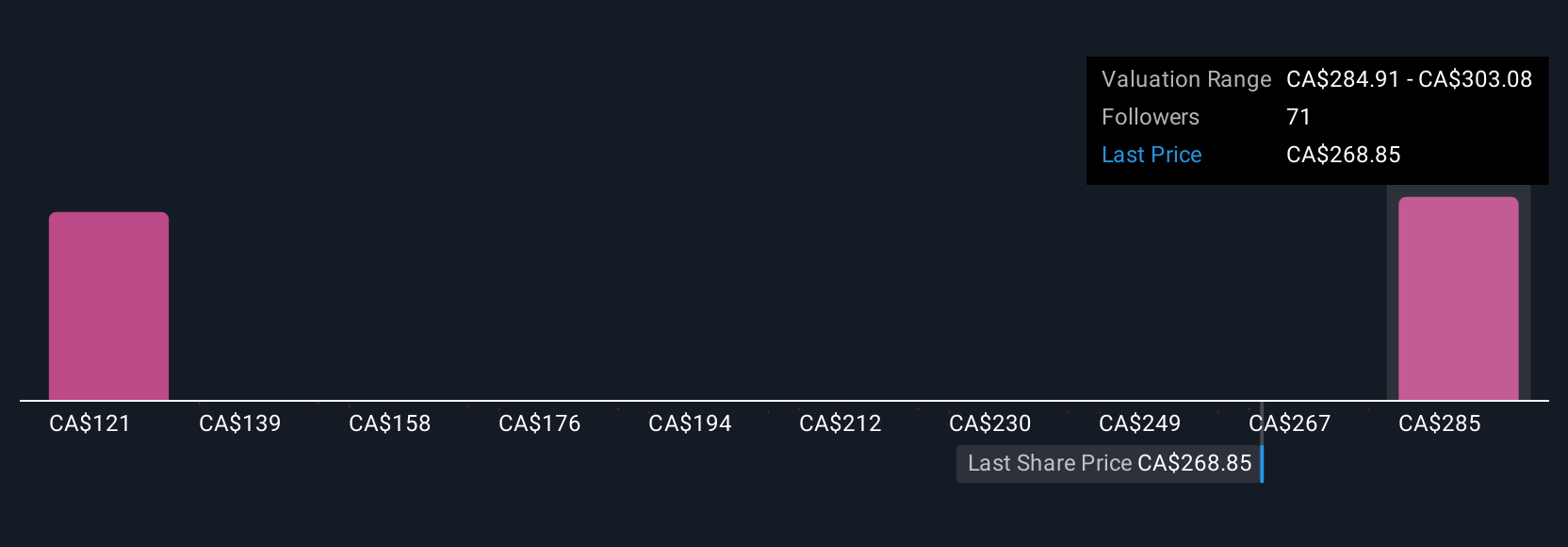

Twenty members of the Simply Wall St Community valued Celestica between CA$145.84 and CA$569.94. The business still faces the risk that a sudden pullback in hyperscaler spending could impact operating results and expectations.

Explore 20 other fair value estimates on Celestica - why the stock might be worth less than half the current price!

Build Your Own Celestica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celestica research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Celestica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celestica's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026