A Look at Celestica’s (TSX:CLS) Valuation Following a Strong Multi-Month Rally

Reviewed by Simply Wall St

Celestica (TSX:CLS) has been attracting attention as investors digest the latest movements in its stock price and performance. Conversations around its valuation and long-term potential in the tech sector continue to pique curiosity.

See our latest analysis for Celestica.

Celestica’s share price has surged an impressive 21.6% over the past week and soared nearly 80% in the last three months, reflecting renewed optimism in tech manufacturing and strong demand tailwinds. The momentum is also notable over a longer term, with a year-to-date share price return of 257.6% and a total shareholder return of almost 300% over the past year, indicating investor confidence in Celestica’s growth trajectory.

If Celestica’s run has you thinking bigger, consider your next opportunity by exploring the tech and AI space with our See the full list for free.

With such rapid gains and sustained momentum, investors may wonder whether Celestica's current share price truly reflects its long-term potential, or if the market is already pricing in all future growth. Could there still be a buying opportunity here?

Most Popular Narrative: 15.8% Undervalued

The latest narrative places Celestica’s fair value at CA$569.94, well above the last close of CA$480.11. Investors are clearly weighing recent gains against powerful future growth assumptions, and what comes next may surprise many.

Accelerated demand for advanced networking and AI infrastructure by hyperscaler customers is driving rapid growth in Celestica's CCS segment, with multiple new 800G and upcoming 1.6T program ramps, supporting robust revenue expansion and greater operating leverage over the next 12 to 24 months.

Want to know which core assumptions drive this bold valuation jump? The narrative counts on future expansion, high-margin moves, and a financial leap that could rewrite expectations. Dive in to see exactly what numbers and transitions the market’s most followed narrative is betting on.

Result: Fair Value of $569.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few hyperscaler customers and potential delays in tech transitions could challenge Celestica’s strong growth assumptions in the future.

Find out about the key risks to this Celestica narrative.

Another View: Is the Market Getting Ahead of Itself?

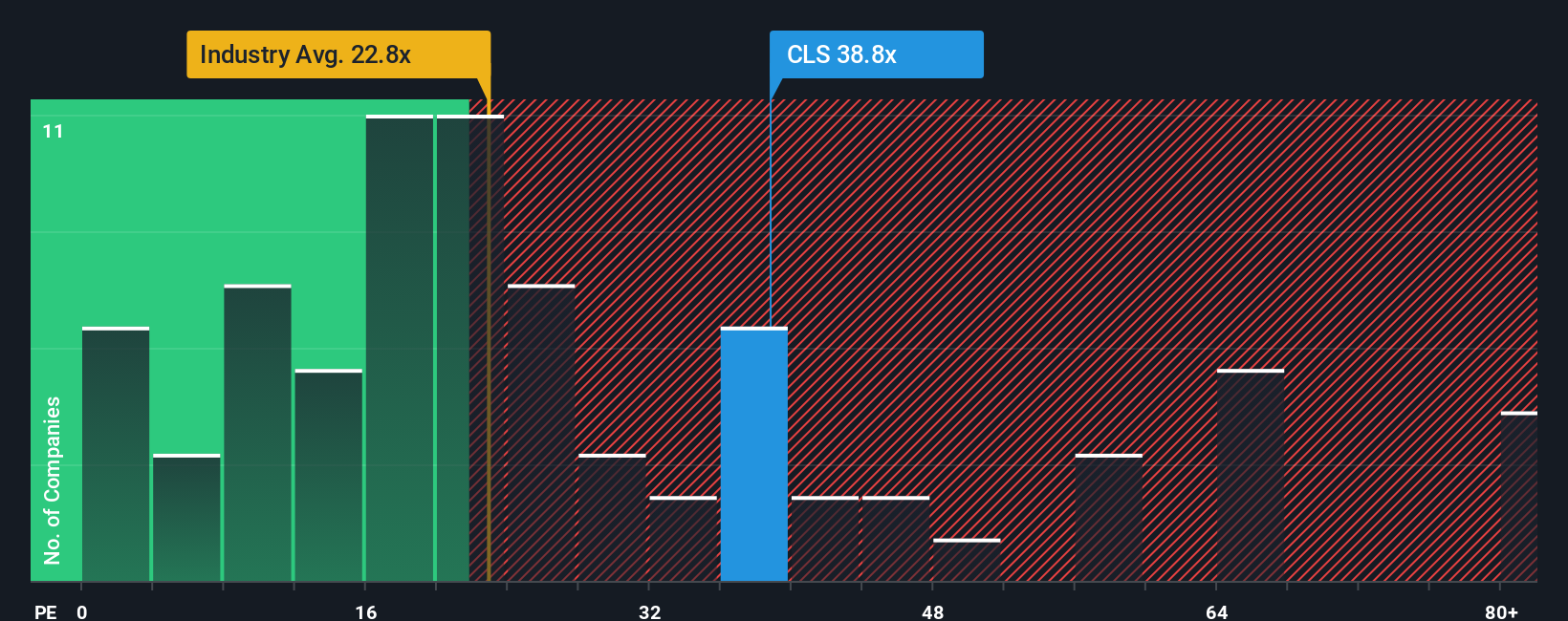

Despite bullish narratives, Celestica's price-to-earnings ratio stands at 55.2x. This figure is significantly higher than both its industry peers at 23.9x and its own fair ratio of 52.9x. Such a wide gap raises the risk that future returns could lag if growth expectations cool off. Is this optimism warranted, or could the stock retrace?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Celestica Narrative

If you see the story differently, or want to uncover your own insights, you can put together a personal view in just minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Celestica.

Looking for More Investment Ideas?

If you want to stay ahead of the crowd, now’s the time to check out timely opportunities beyond Celestica. The market is always evolving, so don’t miss out on what’s next.

- Unlock the potential for high returns with these 3570 penny stocks with strong financials, which are building real momentum and disrupting established industries.

- Tap into the explosive growth of artificial intelligence by screening for promising innovators using these 25 AI penny stocks, as they are poised to shape tomorrow’s technology landscape.

- Secure your income stream by targeting market leaders with attractive yields through these 15 dividend stocks with yields > 3% before the best opportunities are gone.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.