- Canada

- /

- Metals and Mining

- /

- TSX:EDV

3 TSX Stocks Trading At Estimated Discounts Up To 43.7%

Reviewed by Simply Wall St

As the Canadian market navigates through policy shifts and global uncertainties, the TSX is on track for its strongest calendar-year return since 2009, providing investors with much to be thankful for despite earlier volatility. In this context of robust equity gains, identifying undervalued stocks can offer potential opportunities for growth as these stocks may be trading at significant discounts relative to their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topicus.com (TSXV:TOI) | CA$128.50 | CA$228.13 | 43.7% |

| Savaria (TSX:SIS) | CA$20.90 | CA$34.99 | 40.3% |

| Neo Performance Materials (TSX:NEO) | CA$17.33 | CA$31.80 | 45.5% |

| Montage Gold (TSX:MAU) | CA$8.80 | CA$15.18 | 42% |

| Kinaxis (TSX:KXS) | CA$173.12 | CA$291.34 | 40.6% |

| Haivision Systems (TSX:HAI) | CA$5.15 | CA$8.66 | 40.5% |

| GURU Organic Energy (TSX:GURU) | CA$4.70 | CA$8.91 | 47.3% |

| Dexterra Group (TSX:DXT) | CA$11.93 | CA$22.83 | 47.7% |

| Decisive Dividend (TSXV:DE) | CA$7.20 | CA$14.20 | 49.3% |

| Constellation Software (TSX:CSU) | CA$3319.39 | CA$5943.64 | 44.2% |

Let's explore several standout options from the results in the screener.

Aecon Group (TSX:ARE)

Overview: Aecon Group Inc. is a construction and infrastructure development company serving private and public sector clients in Canada, the United States, and internationally, with a market cap of approximately CA$1.79 billion.

Operations: The company's revenue is primarily derived from its Construction segment, which accounts for CA$5.14 billion, and its Concessions segment, contributing CA$9.99 million.

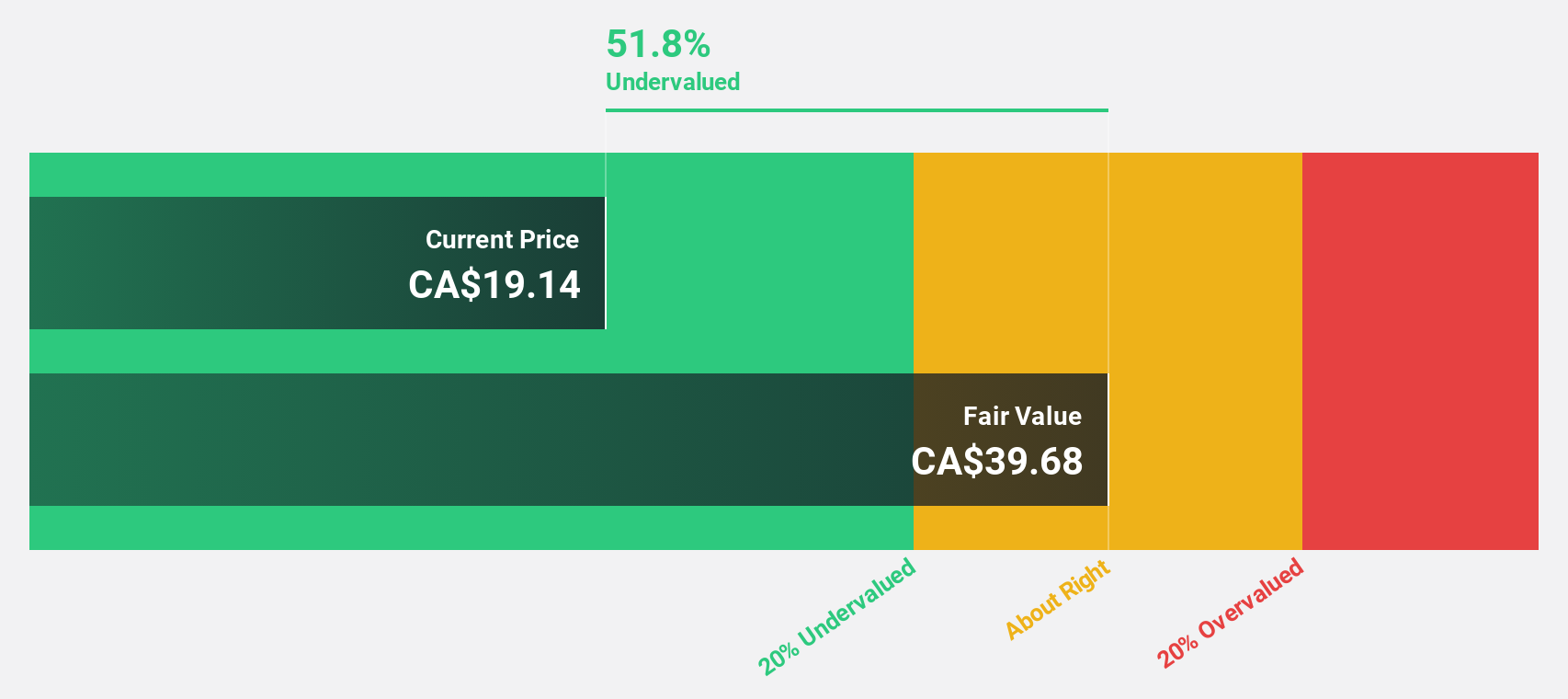

Estimated Discount To Fair Value: 23.8%

Aecon Group is trading at CA$28.24, significantly below its estimated fair value of CA$37.07, suggesting it may be undervalued based on cash flows. Despite a recent decline in quarterly net income to CA$40 million from CA$56.46 million the previous year, Aecon's earnings are forecasted to grow substantially over the next three years. The company has a robust backlog of $10.8 billion and strategic projects like the Contrecoeur Terminal and Cascade Nuclear Partners joint venture underpin future revenue growth potential.

- According our earnings growth report, there's an indication that Aecon Group might be ready to expand.

- Unlock comprehensive insights into our analysis of Aecon Group stock in this financial health report.

Endeavour Mining (TSX:EDV)

Overview: Endeavour Mining plc, along with its subsidiaries, operates as a multi-asset gold producer in West Africa with a market cap of CA$15.78 billion.

Operations: The company's revenue is derived from several mines in West Africa, including Ity Mine ($1.03 billion), Mana Mine ($516.60 million), Houndé Mine ($959.90 million), Lafigué Mine ($599.40 million), and Sabodala Massawa Mine ($791.10 million).

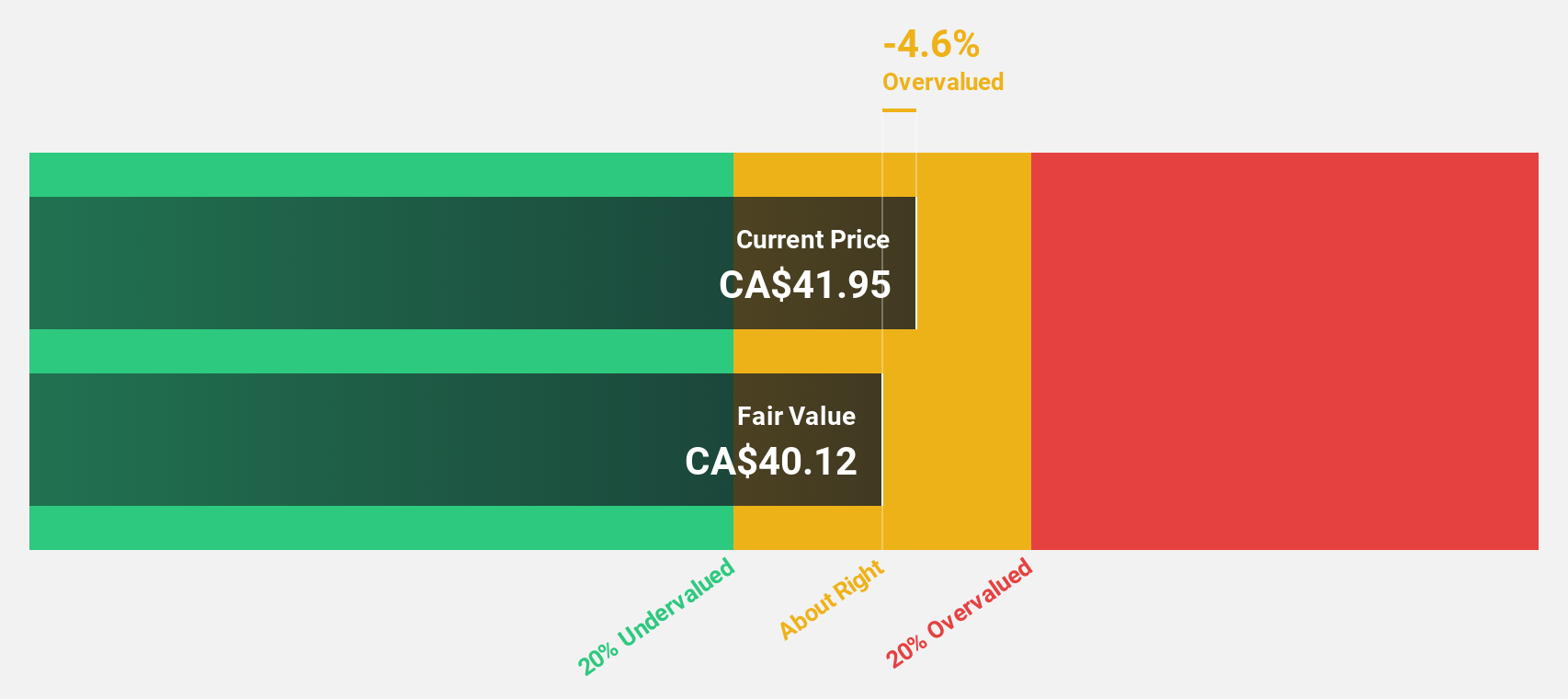

Estimated Discount To Fair Value: 29.9%

Endeavour Mining is trading at CA$65.4, well below its estimated fair value of CA$93.29, highlighting potential undervaluation based on cash flows. The company reported substantial earnings growth with net income reaching US$167.3 million in Q3 2025 compared to a loss the previous year, and revenues increased to US$910.1 million from US$706 million year-on-year. Despite an unstable dividend track record, Endeavour's earnings are forecasted to grow significantly over the next three years.

- In light of our recent growth report, it seems possible that Endeavour Mining's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Endeavour Mining's balance sheet health report.

Topicus.com (TSXV:TOI)

Overview: Topicus.com Inc. operates in the Netherlands and internationally, offering vertical market software and platforms, with a market cap of CA$10.71 billion.

Operations: The company generates revenue of €1.48 billion from its software and programming segment.

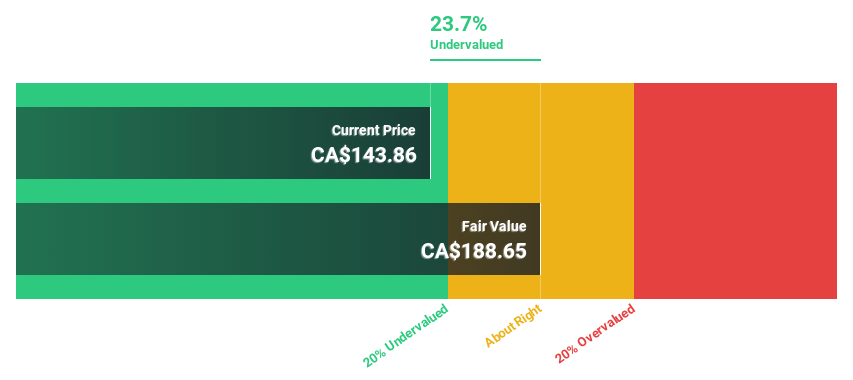

Estimated Discount To Fair Value: 43.7%

Topicus.com is trading at CA$128.5, significantly below its estimated fair value of CA$228.13, suggesting it may be undervalued based on cash flows. Despite a recent net loss of EUR 78.19 million in Q3 2025 due to large one-off items, revenue grew to EUR 387.89 million from the previous year. Analysts anticipate earnings growth of over 85% annually for the next three years, although profit margins have declined and debt levels are high.

- Insights from our recent growth report point to a promising forecast for Topicus.com's business outlook.

- Get an in-depth perspective on Topicus.com's balance sheet by reading our health report here.

Where To Now?

- Explore the 28 names from our Undervalued TSX Stocks Based On Cash Flows screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endeavour Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EDV

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026