- Canada

- /

- Consumer Finance

- /

- TSX:PRL

3 TSX Stocks Estimated To Be 25% To 32% Below Intrinsic Value

Reviewed by Simply Wall St

As trade tensions ease with new agreements and the Bank of Canada maintains a neutral monetary policy, the Canadian market is experiencing a period of cautious optimism. In this environment, identifying stocks that are trading below their intrinsic value can be an advantageous strategy for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| K92 Mining (TSX:KNT) | CA$13.33 | CA$23.69 | 43.7% |

| Docebo (TSX:DCBO) | CA$36.94 | CA$61.80 | 40.2% |

| Badger Infrastructure Solutions (TSX:BDGI) | CA$42.60 | CA$76.80 | 44.5% |

| Enterprise Group (TSX:E) | CA$1.71 | CA$3.08 | 44.5% |

| VersaBank (TSX:VBNK) | CA$15.47 | CA$30.62 | 49.5% |

| Lithium Royalty (TSX:LIRC) | CA$5.43 | CA$8.51 | 36.2% |

| Tantalus Systems Holding (TSX:GRID) | CA$2.45 | CA$4.74 | 48.3% |

| Kits Eyecare (TSX:KITS) | CA$11.60 | CA$22.45 | 48.3% |

| Tidewater Midstream and Infrastructure (TSX:TWM) | CA$0.215 | CA$0.38 | 43.2% |

| CAE (TSX:CAE) | CA$36.09 | CA$57.11 | 36.8% |

Here's a peek at a few of the choices from the screener.

Aris Mining (TSX:ARIS)

Overview: Aris Mining Corporation, with a market cap of CA$1.46 billion, is involved in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

Operations: Aris Mining Corporation generates its revenue through the acquisition, exploration, development, and operation of gold properties located in Canada, Colombia, and Guyana.

Estimated Discount To Fair Value: 26.5%

Aris Mining's recent financial performance highlights its potential as an undervalued stock based on cash flows. The company reported Q1 2025 sales of US$157.53 million, a significant increase from the previous year, with net income rising to US$2.37 million from a loss previously. Despite shareholder dilution, Aris is trading at CA$8.45, below the estimated fair value of CA$11.5, and forecasts suggest robust earnings growth significantly outpacing the Canadian market average over the next three years.

- The analysis detailed in our Aris Mining growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Aris Mining.

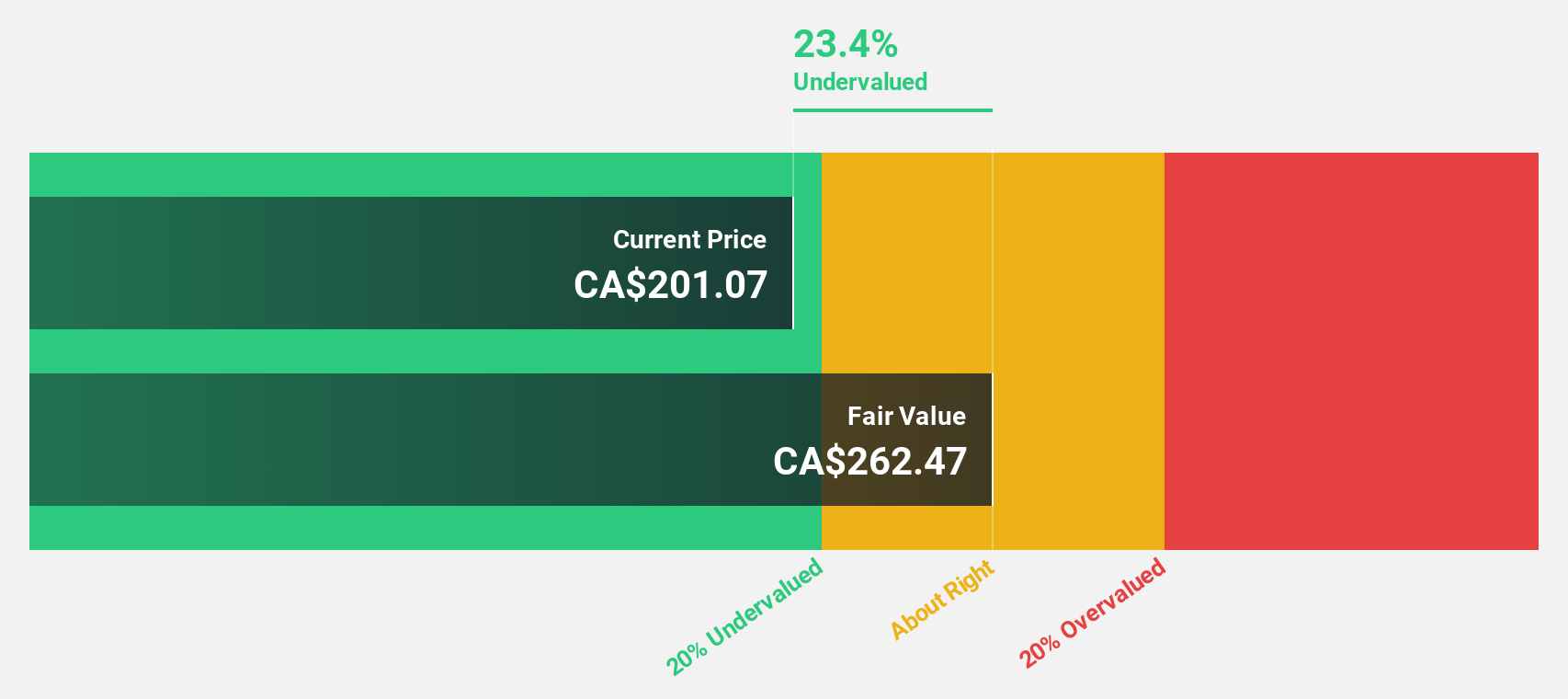

Kinaxis (TSX:KXS)

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada, with a market cap of CA$5.44 billion.

Operations: The company generates revenue from its software and programming segment, amounting to $496.53 million.

Estimated Discount To Fair Value: 25%

Kinaxis is trading at CA$192.44, below its estimated fair value of CA$256.47, suggesting it may be undervalued based on cash flows. Despite a decline in net profit margins from 3.4% to 2%, the company forecasts robust earnings growth of 74.8% annually, outpacing the Canadian market's average growth rate. Recent strategic partnerships and product innovations enhance its supply chain solutions, potentially supporting long-term revenue growth and operational efficiency improvements amidst global disruptions.

- In light of our recent growth report, it seems possible that Kinaxis' financial performance will exceed current levels.

- Navigate through the intricacies of Kinaxis with our comprehensive financial health report here.

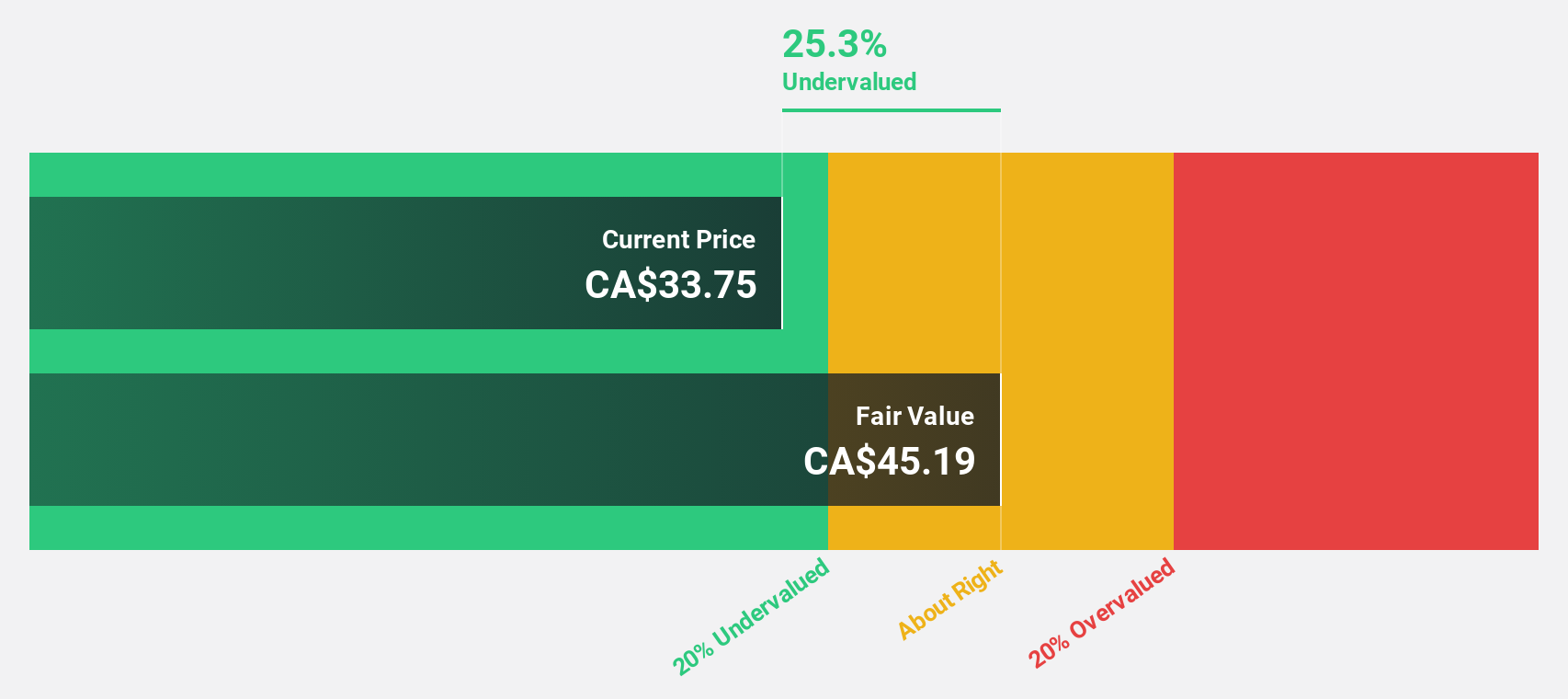

Propel Holdings (TSX:PRL)

Overview: Propel Holdings Inc., along with its subsidiaries, operates as a financial technology company with a market cap of CA$1.25 billion.

Operations: The company generates revenue primarily through its financial technology operations.

Estimated Discount To Fair Value: 32%

Propel Holdings, trading at CA$32.17, is significantly undervalued with a fair value estimate of CA$47.28. Recent earnings show strong growth, with revenue rising to US$138.94 million and net income at US$23.5 million for Q1 2025. Despite a dividend increase to CAD 0.72 per share annually, the dividend isn't well covered by free cash flows, and debt coverage by operating cash flow remains weak; however, refinancing efforts have reduced interest costs significantly.

- Our growth report here indicates Propel Holdings may be poised for an improving outlook.

- Dive into the specifics of Propel Holdings here with our thorough financial health report.

Where To Now?

- Click through to start exploring the rest of the 16 Undervalued TSX Stocks Based On Cash Flows now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PRL

Exceptional growth potential and undervalued.

Market Insights

Community Narratives