Is Now the Moment to Reassess Constellation Software After a 25% Slide in 2025?

Reviewed by Bailey Pemberton

- Wondering if Constellation Software’s recent slide has finally opened a genuine value window, or if it is just a trap for latecomers? This article is going to walk through that question in plain language.

- The stock is down 3.1% over the last week, 5.5% over the last month and a hefty 25.3% year to date, even though the 3 year and 5 year returns are still up 64.6% and 122.2% respectively.

- Recent coverage has focused on Constellation’s continued appetite for niche software acquisitions and its disciplined capital allocation. Many investors see these as the engine behind its long term compounding. At the same time, commentary has started to question whether the pace of attractive deal opportunities can keep up with the company’s size, which helps explain some of the hesitation in the share price.

- On our checklist-based valuation framework, Constellation scores a 3/6 valuation score, suggesting pockets of undervaluation but not a screaming bargain. Next we will unpack what that means across different valuation approaches before finishing with a more nuanced way to think about what the market is really pricing in.

Find out why Constellation Software's -29.5% return over the last year is lagging behind its peers.

Approach 1: Constellation Software Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to today’s dollars.

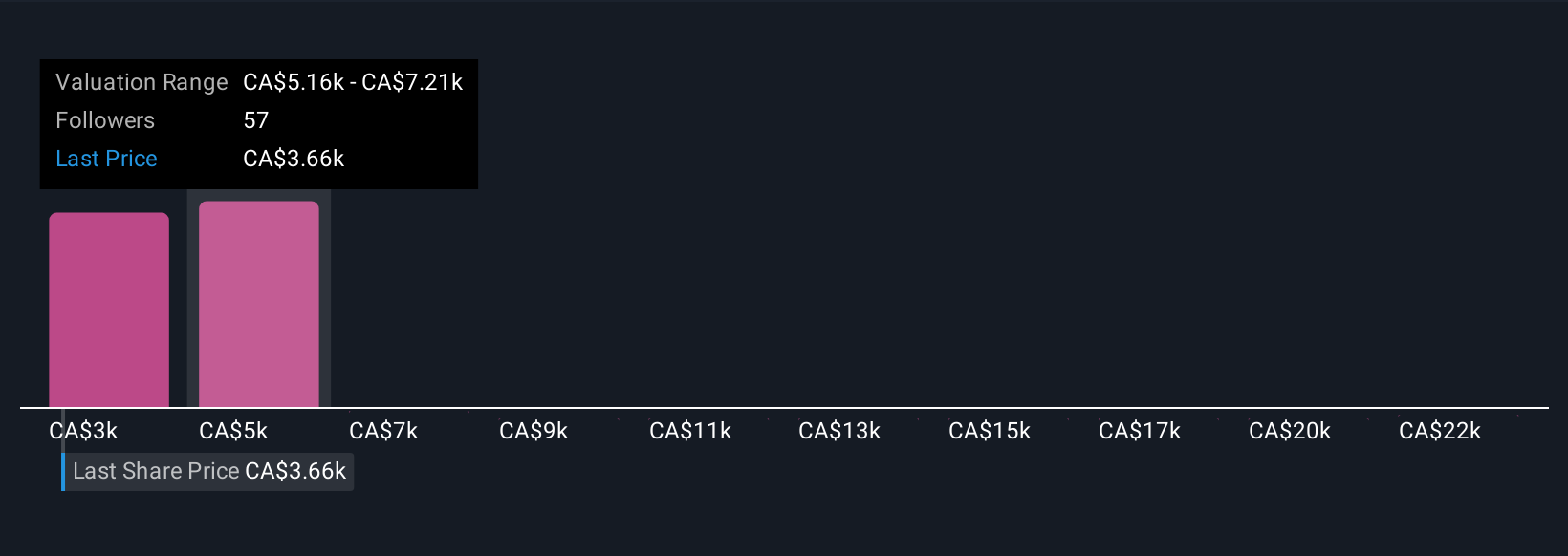

Constellation Software currently generates about $2.56 billion in free cash flow over the last twelve months. Analyst forecasts and extrapolations used in the 2 Stage Free Cash Flow to Equity model see this rising to roughly $5.95 billion by 2035, with a path that includes around $3.06 billion in 2026 and $3.66 billion in 2027. After the first few analyst covered years, Simply Wall St extends the trend with gradually slowing growth assumptions. This is typical for mature compounders.

When all those projected cash flows are discounted back and summed, the model arrives at an intrinsic value of about $5,898 per share. Compared with the current market price, this implies the stock is roughly 43.8% undervalued, a sizeable gap even allowing for uncertainty in long term forecasts.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Constellation Software is undervalued by 43.8%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

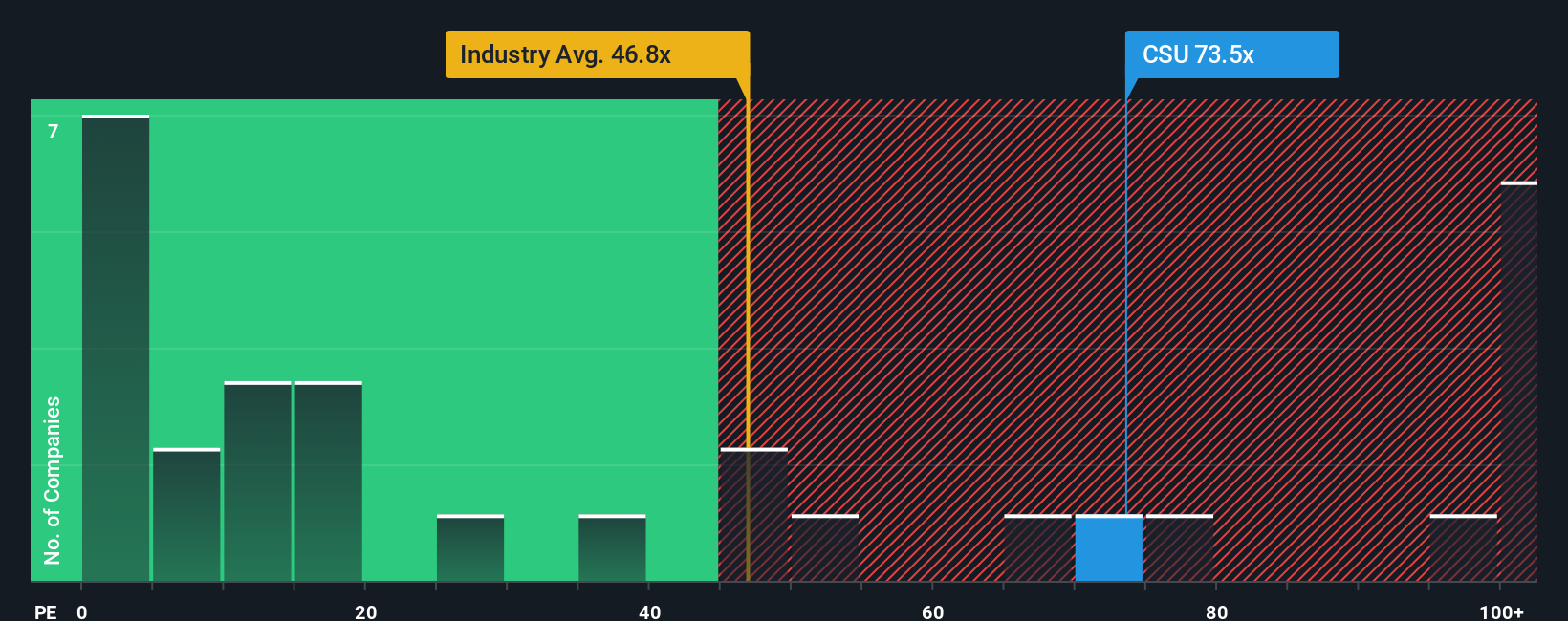

Approach 2: Constellation Software Price vs Earnings

For profitable businesses like Constellation Software, the Price to Earnings, or PE, ratio is a handy shorthand for how much investors are willing to pay today for each dollar of current earnings. It naturally blends expectations for future growth with the risk investors see in the business, so faster growing, more resilient companies usually deserve higher PE ratios than slower or riskier ones.

Constellation currently trades on a PE of about 73.25x. That is a premium to both the broader Software industry average of roughly 49.06x and the peer group average of around 59.91x. This suggests the market is pricing in stronger growth or lower risk than for typical software names. Simply Wall St’s Fair Ratio framework goes a step further by asking what PE multiple would be reasonable once you factor in Constellation’s specific earnings growth profile, margins, industry, market value and risk characteristics.

On that basis, Constellation’s Fair Ratio comes out at about 41.23x. Compared with the current 73.25x multiple, the shares look meaningfully expensive on an earnings basis using this more tailored benchmark.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Constellation Software Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your own story about a company to the numbers you see on screen. A Narrative is your view of how a business will grow, how profitable it can be and what it should be worth, translated into a financial forecast and a fair value that you can compare with today’s share price. On Simply Wall St’s Community page, used by millions of investors, Narratives make this process accessible by guiding you to set assumptions for future revenue, earnings and margins, then instantly showing the implied fair value versus the current price to help you decide whether to buy, hold or sell. Because Narratives update dynamically as fresh information like earnings reports or news arrives, they stay relevant instead of going stale. For Constellation Software, for example, one investor might build a Narrative that assumes very strong acquisition driven growth and a high fair value, while another uses more conservative growth and margins and lands on a much lower fair value.

Do you think there's more to the story for Constellation Software? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses to develop mission-critical software solutions for public and private sector markets.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026