Revenues Not Telling The Story For Bitfarms Ltd. (TSE:BITF) After Shares Rise 78%

Despite an already strong run, Bitfarms Ltd. (TSE:BITF) shares have been powering on, with a gain of 78% in the last thirty days. The annual gain comes to 112% following the latest surge, making investors sit up and take notice.

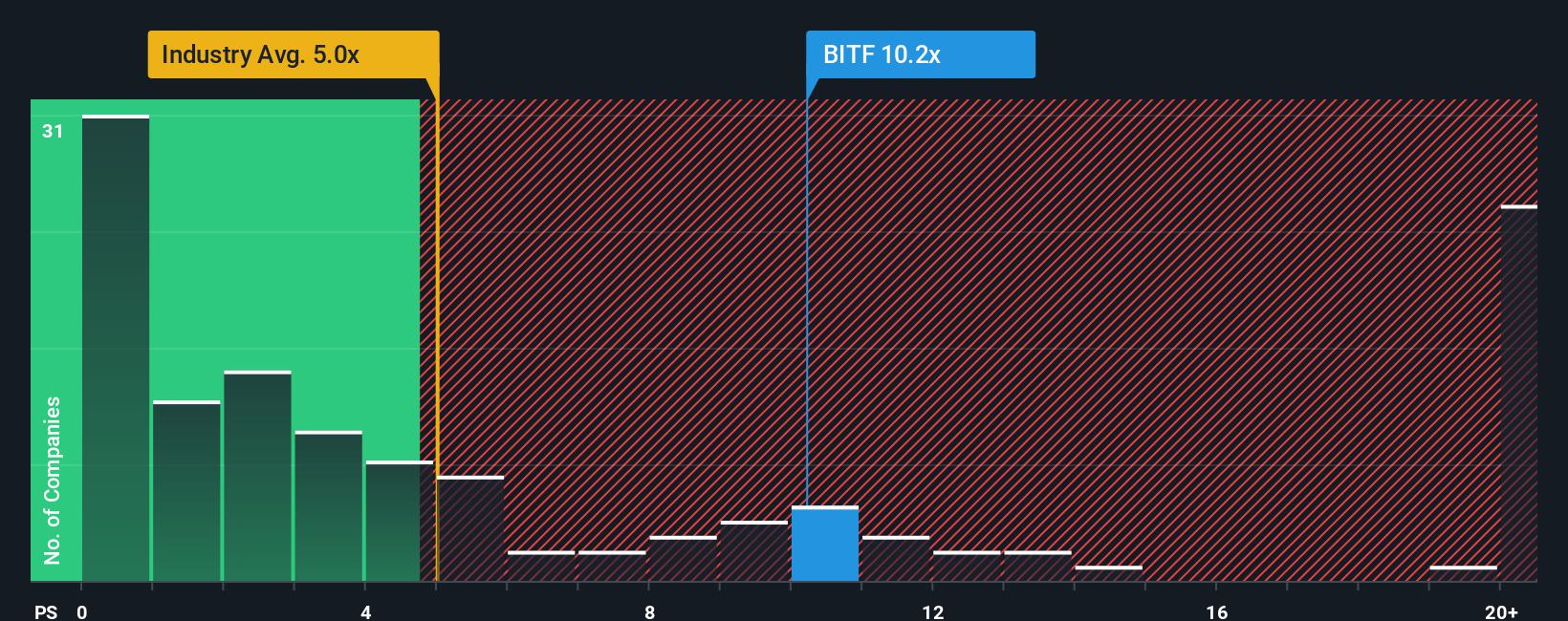

Following the firm bounce in price, Bitfarms may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 10.2x, when you consider almost half of the companies in the Software industry in Canada have P/S ratios under 5x and even P/S lower than 1.7x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Bitfarms

How Has Bitfarms Performed Recently?

Recent times have been advantageous for Bitfarms as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bitfarms.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Bitfarms' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 42% gain to the company's top line. The latest three year period has also seen an excellent 32% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 32% over the next year. With the industry predicted to deliver 34% growth , the company is positioned for a comparable revenue result.

In light of this, it's curious that Bitfarms' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

Shares in Bitfarms have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given Bitfarms' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Having said that, be aware Bitfarms is showing 4 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Bitfarms might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BITF

Bitfarms

Operates integrated bitcoin data centers in Canada, the United States, Paraguay, and Argentina.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives