As the Canadian market navigates policy shifts and global uncertainties, investors have found reasons to be grateful, with the TSX on track for its strongest calendar-year return since 2009. In this context, penny stocks—though an outdated term—still capture attention due to their potential for growth and affordability. These smaller or newer companies can offer a unique blend of value and opportunity when backed by strong financials, making them intriguing prospects for those seeking under-the-radar investments.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.09 | CA$52.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.02 | CA$228.51M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.41 | CA$142.12M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.57M | ✅ 3 ⚠️ 1 View Analysis > |

| Monument Mining (TSXV:MMY) | CA$1.14 | CA$393.42M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.24 | CA$824.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.19M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.75 | CA$139.58M | ✅ 2 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.05 | CA$193.98M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 390 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Railtown AI Technologies (CNSX:RAIL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Railtown AI Technologies Inc. is a Canadian company focused on developing and commercializing software technology, with a market cap of CA$70.98 million.

Operations: Railtown AI Technologies Inc. has not reported any specific revenue segments.

Market Cap: CA$70.98M

Railtown AI Technologies, with a market cap of CA$70.98 million, is currently pre-revenue, making it a speculative investment within the penny stock space. The company has no significant revenue streams but holds promise through recent strategic partnerships. A collaboration with TELUS will see Railtown deploy AI solutions via TELUS' Sovereign AI Factory, enhancing its position in Canada's software development sector. Additionally, an MOU with Uniserve Communications expands Railtown's reach to 3,000 SMEs by integrating its AI tools into Uniserve's infrastructure. These partnerships could potentially pave the way for future revenue growth and market penetration.

- Click here and access our complete financial health analysis report to understand the dynamics of Railtown AI Technologies.

- Gain insights into Railtown AI Technologies' historical outcomes by reviewing our past performance report.

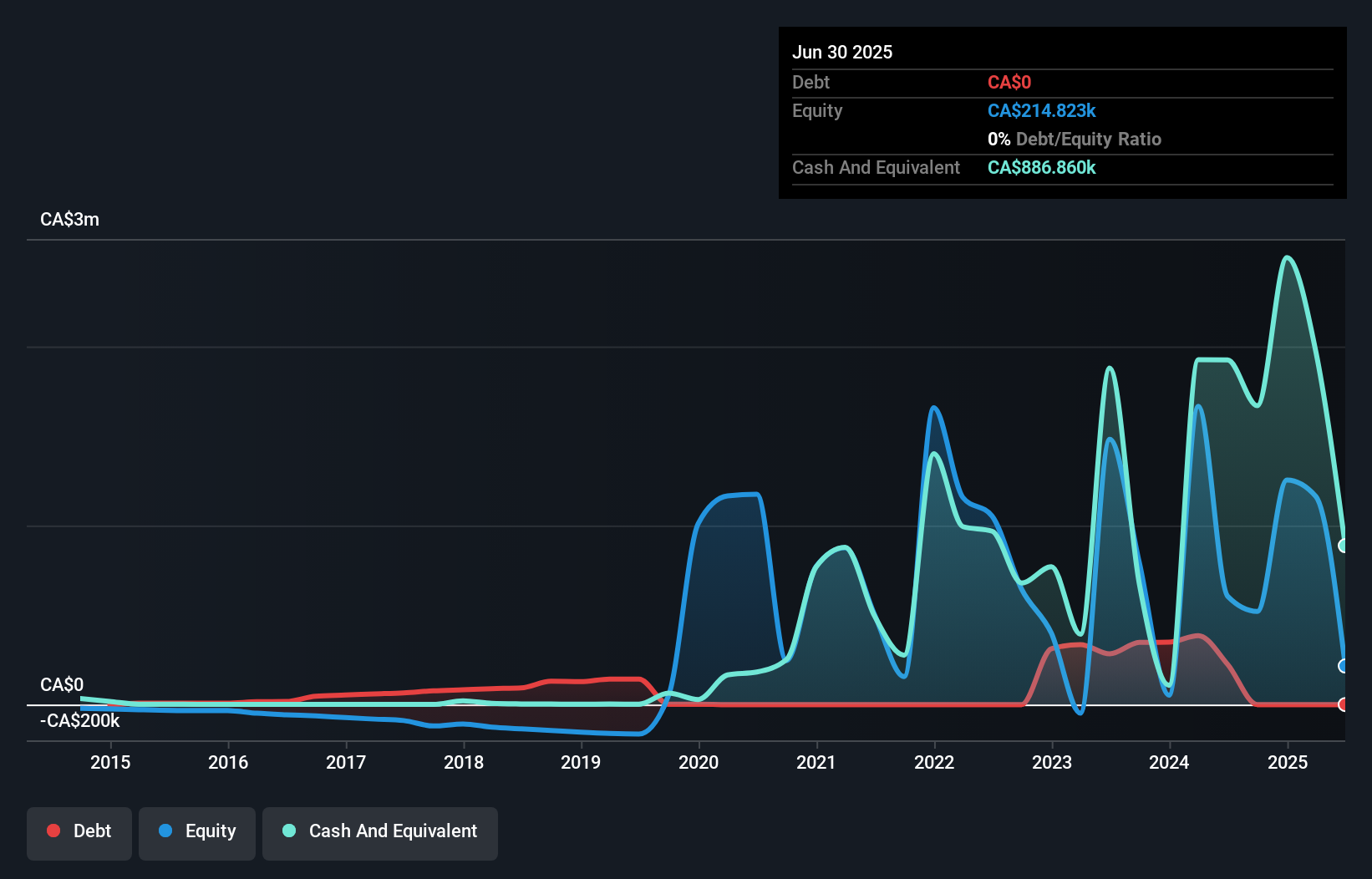

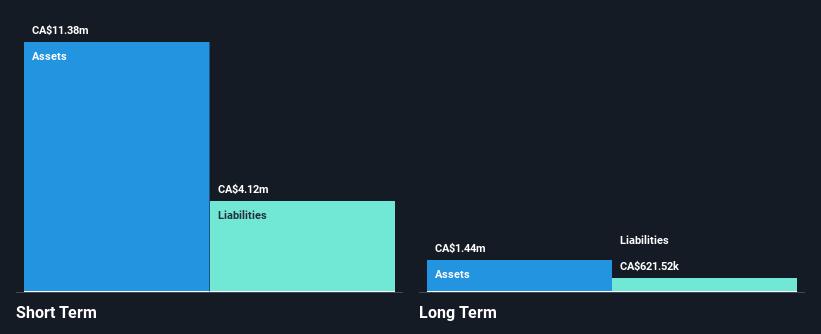

BeWhere Holdings (TSXV:BEW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BeWhere Holdings Inc. is an industrial Internet of Things (IIoT) solutions company that designs, manufactures, and sells hardware with sensors and software applications for tracking real-time information on equipment, tools, and inventory both in-transit and at facilities, with a market cap of CA$78.58 million.

Operations: The company generates its revenue from the Software & Programming segment, amounting to CA$20.50 million.

Market Cap: CA$78.58M

BeWhere Holdings, with a market cap of CA$78.58 million, has shown steady revenue growth in its Software & Programming segment, reporting CA$6.08 million in Q3 2025 sales. Despite its low return on equity and negative earnings growth over the past year, BeWhere's seasoned management and board bring stability. The company successfully connected its IoT devices to AST SpaceMobile's satellite network, enhancing global connectivity potential for industries like logistics and agriculture. Collaborations such as those with Speedy Transport demonstrate practical applications of their technology, offering real-time asset tracking solutions that improve operational efficiency across North America.

- Get an in-depth perspective on BeWhere Holdings' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into BeWhere Holdings' track record.

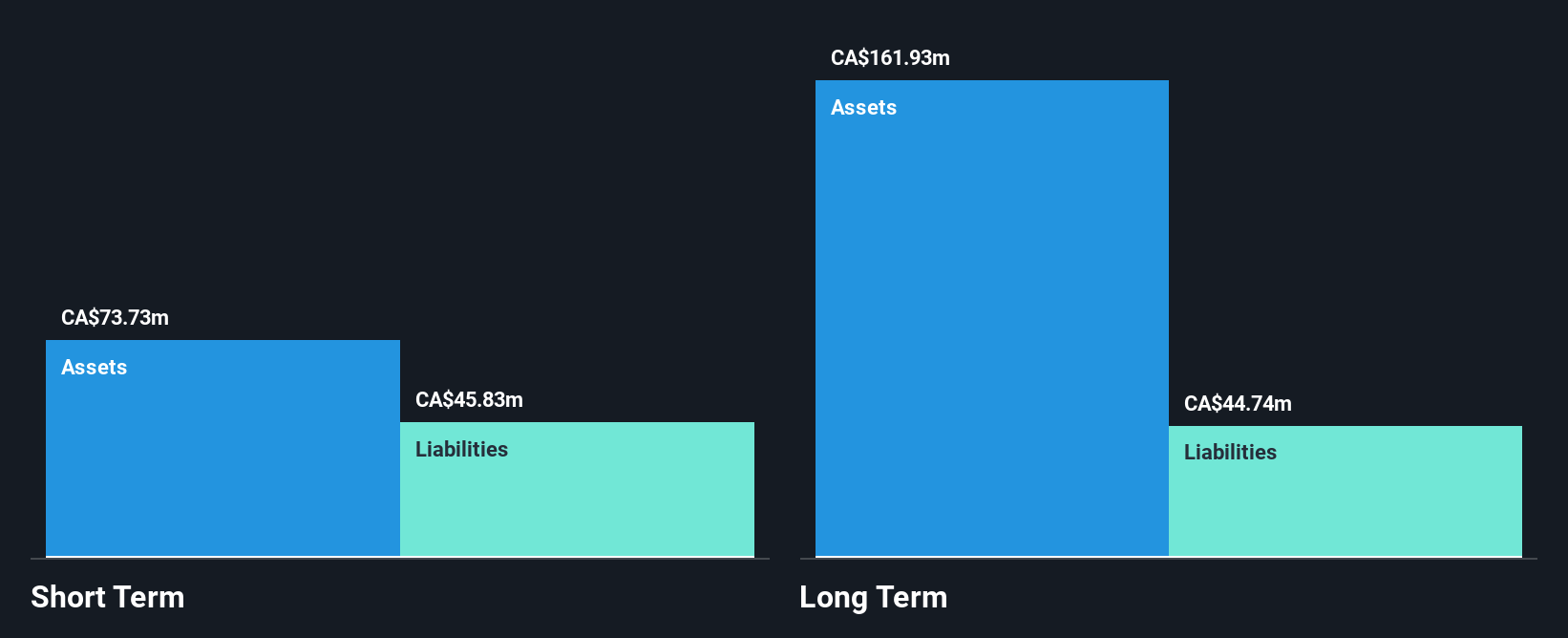

High Tide (TSXV:HITI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Tide Inc. operates in the cannabis retail sector in Canada with a market cap of CA$316.21 million.

Operations: The company's revenue is derived from two main segments: E-commerce, contributing CA$23.13 million, and Bricks and Mortar, generating CA$545.12 million.

Market Cap: CA$316.21M

High Tide Inc., with a market cap of CA$316.21 million, operates in the cannabis retail sector, generating substantial revenue from its Bricks and Mortar segment. Despite being unprofitable, the company has a positive cash flow and sufficient runway for over three years. High Tide's experienced board and management team have overseen significant expansion, recently opening new Canna Cabana locations across Ontario and Alberta to strengthen its market presence. While trading below analyst price targets, indicating potential value appreciation, High Tide's debt levels are well-managed with more cash than total debt, supporting financial stability amidst growth initiatives.

- Unlock comprehensive insights into our analysis of High Tide stock in this financial health report.

- Assess High Tide's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Dive into all 390 of the TSX Penny Stocks we have identified here.

- Looking For Alternative Opportunities? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeWhere Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BEW

BeWhere Holdings

An industrial Internet of Things (IIoT) solutions company, designs, manufactures, and sells hardware with sensors and software applications to track real-time information on equipment, tools, and inventory in-transit and at facilities.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026