- Canada

- /

- Retail REITs

- /

- TSX:REI.UN

RioCan (TSX:REI.UN) Valuation Check as New External Auditor PricewaterhouseCoopers Replaces Ernst & Young

Reviewed by Simply Wall St

RioCan Real Estate Investment Trust (TSX:REI.UN) just set the stage for a fresh set of eyes on its books, approving PricewaterhouseCoopers as external auditor for 2026 after nearly 20 years with Ernst & Young.

See our latest analysis for RioCan Real Estate Investment Trust.

The governance refresh comes as the units trade around CA$18.25, with recent share price returns slightly negative over the past quarter while the one year total shareholder return has been solidly positive, hinting at steady but not explosive momentum.

If this shift in oversight has you rethinking your income and real estate exposure, it might also be a good time to see how other fast growing stocks with high insider ownership compare for growth and conviction.

With units trading just below analyst targets and governance getting a reset, the real question now is whether RioCan’s solid income profile is quietly undervalued, or if the market is already pricing in its next leg of growth.

Price to Earnings of 80.6x: Is it justified?

RioCan Real Estate Investment Trust is trading on a steep price to earnings ratio of 80.6x at CA$18.25, implying a rich valuation against recent earnings.

The price to earnings multiple compares what investors pay for each dollar of current net profit. This is a particularly important yardstick for income focused, mature real estate trusts where earnings visibility is key.

In RioCan’s case, this elevated multiple sits awkwardly alongside soft historical profitability, with earnings having declined in recent years and interest payments not well covered by current earnings. This suggests the market is either looking through near term weakness or paying up aggressively for the expected earnings rebound.

The contrast is stark. The 80.6x price to earnings multiple towers above the North American Retail REITs industry average of 23.2x, the peer average of 16.2x, and even our own estimated fair price to earnings ratio of 24.6x, a level the market could ultimately gravitate toward if exuberant expectations cool.

Explore the SWS fair ratio for RioCan Real Estate Investment Trust

Result: Price-to-Earnings of 80.6x (OVERVALUED)

However, stretched valuation and slowing near term returns mean that any stumble in rent growth or development execution could quickly cool market enthusiasm.

Find out about the key risks to this RioCan Real Estate Investment Trust narrative.

Another Take on Value

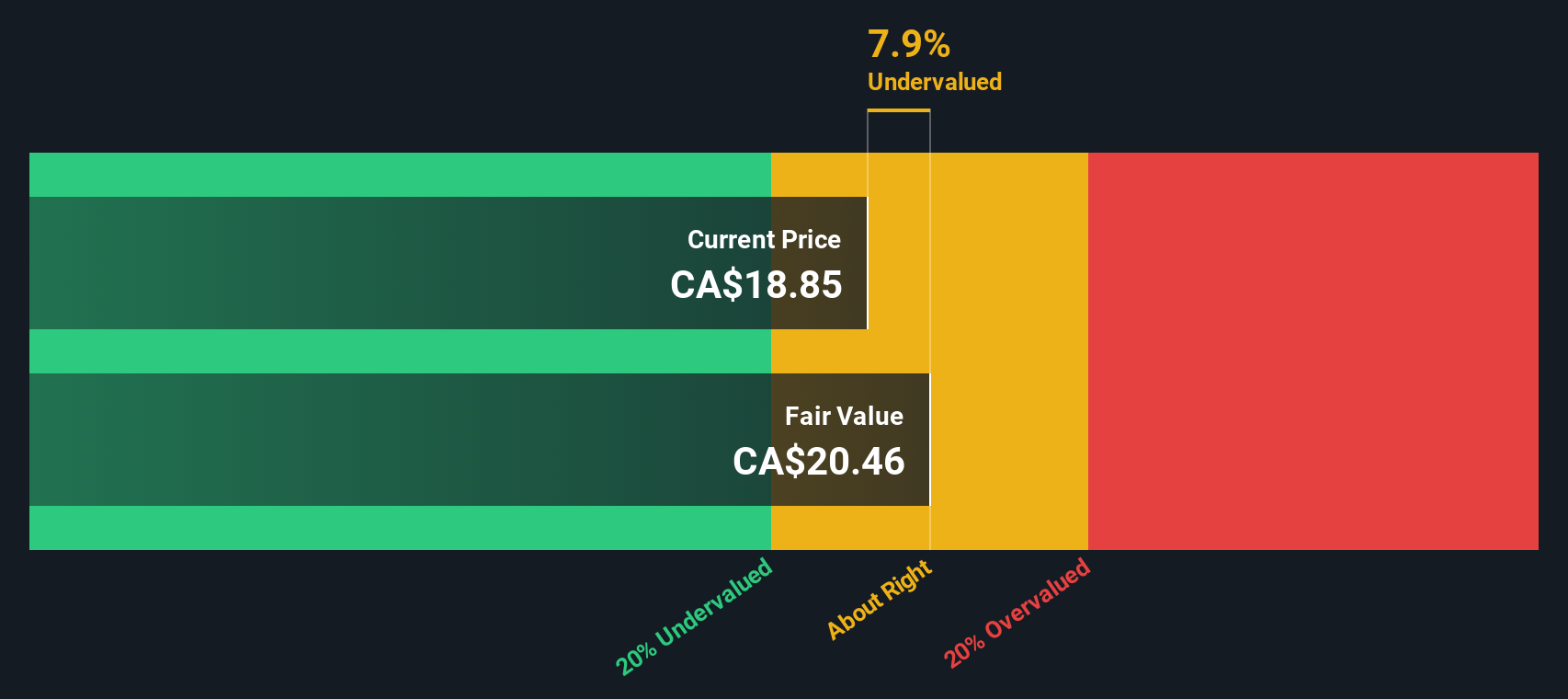

Our DCF model paints a different picture, suggesting RioCan is trading about 12% below its fair value at roughly CA$20.83. That implies the market may be underestimating future cash flows even as the earnings multiple flashes red. This raises the question: which signal deserves more weight right now?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RioCan Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RioCan Real Estate Investment Trust Narrative

If you see the numbers differently or want to stress test your own view, you can build a personalized thesis in just minutes: Do it your way.

A great starting point for your RioCan Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single idea. Use the Simply Wall St Screener to uncover focused opportunities that match your goals and help you avoid missing tomorrow’s standouts.

- Target income potential by scanning these 15 dividend stocks with yields > 3% that can strengthen your cash flow while you hold long term positions.

- Position yourself early in structural shifts by reviewing these 30 healthcare AI stocks that are reshaping how medicine, diagnostics, and patient care evolve.

- Ride breakthrough themes by assessing these 28 quantum computing stocks that could benefit as real world applications scale from labs into commercial products.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:REI.UN

RioCan Real Estate Investment Trust

RioCan meets the everyday shopping needs of Canadians through the ownership, management and development of necessity-based retail and mixed-use properties in densely populated communities.

Average dividend payer with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026