- Canada

- /

- Retail REITs

- /

- TSX:PMZ.UN

Assessing Primaris REIT (TSX:PMZ.UN) Valuation: Does the Share Price Reflect Its Growth Potential?

Reviewed by Simply Wall St

See our latest analysis for Primaris Real Estate Investment Trust.

Primaris’s share price has shown modest momentum lately, with a 4.3% gain over the past month pushing it to $15.39. While the year-to-date move is slightly negative, its 1-year total shareholder return of 2.2% and nearly 20% total return over three years point to steady longer-term progress. Investors continue to weigh ongoing sector headwinds against its improving fundamentals.

If you’re curious to expand your search for resilient performance, consider the opportunity to discover fast growing stocks with high insider ownership.

With steady profits and a share price noticeably below analyst targets, the question now is whether Primaris is an overlooked bargain or if the market is fairly reflecting future growth ahead of results.

Price-to-Earnings of 12.6x: Is it justified?

Compared to its last close at CA$15.39, Primaris trades at a price-to-earnings ratio of 12.6x, suggesting the stock is undervalued relative to its peers and the sector.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of current earnings. For real estate investment trusts, this multiple highlights investors' view of current profitability and the sustainability of future cash flows.

Primaris’s P/E of 12.6x stands below the peer average of 16.4x and is also well under the North American Retail REITs industry average of 22.8x. When compared to the estimated fair P/E of 18.9x, there is further evidence the stock could see a rerating if market sentiment changes or earnings continue to accelerate. This gap may indicate undervalued potential that the market has yet to fully recognize.

Explore the SWS fair ratio for Primaris Real Estate Investment Trust

Result: Price-to-Earnings of 12.6x (UNDERVALUED)

However, risks such as sector headwinds and shifting consumer patterns could challenge future growth. These factors may potentially limit the positive effects of fundamental improvements.

Find out about the key risks to this Primaris Real Estate Investment Trust narrative.

Another View: Discounted Cash Flow Model

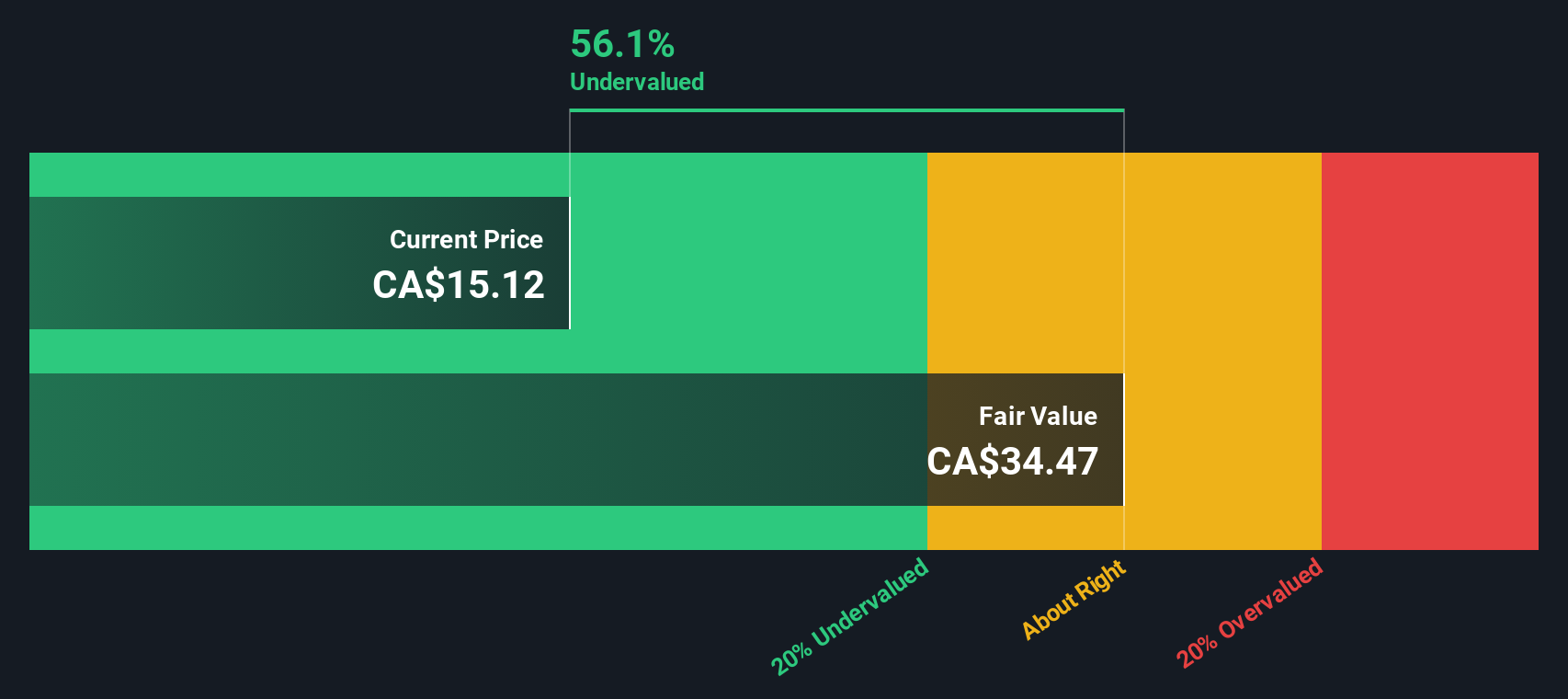

Taking a step back from earnings multiples, our DCF model suggests that Primaris could be trading significantly below its estimated fair value. This method focuses on projected future cash flows instead of current profits and may indicate deeper undervaluation. Could the market be overlooking longer-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Primaris Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Primaris Real Estate Investment Trust Narrative

If you have a different perspective or want to delve deeper into the numbers on your own, crafting your personalized narrative takes just a few minutes. Do it your way

A great starting point for your Primaris Real Estate Investment Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for Your Next Investment Move?

Your smartest opportunities might be waiting just outside your usual search. Check out these handpicked screeners to spot developing trends that others could miss.

- Uncover breakthrough innovation by tracking these 24 AI penny stocks, which are disrupting everything from healthcare to finance with artificial intelligence.

- Grow your portfolio’s income with these 16 dividend stocks with yields > 3%. These feature companies paying attractive yields above 3%, ideal for investors who appreciate steady returns.

- Get ahead of market trends with these 27 quantum computing stocks to see which stocks are making real progress in quantum computing technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PMZ.UN

Primaris Real Estate Investment Trust

Primaris is Canada’s only enclosed shopping centre focused REIT, with ownership interests primarily in enclosed shopping centres in Canadian markets.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives