- Canada

- /

- Residential REITs

- /

- TSX:MI.UN

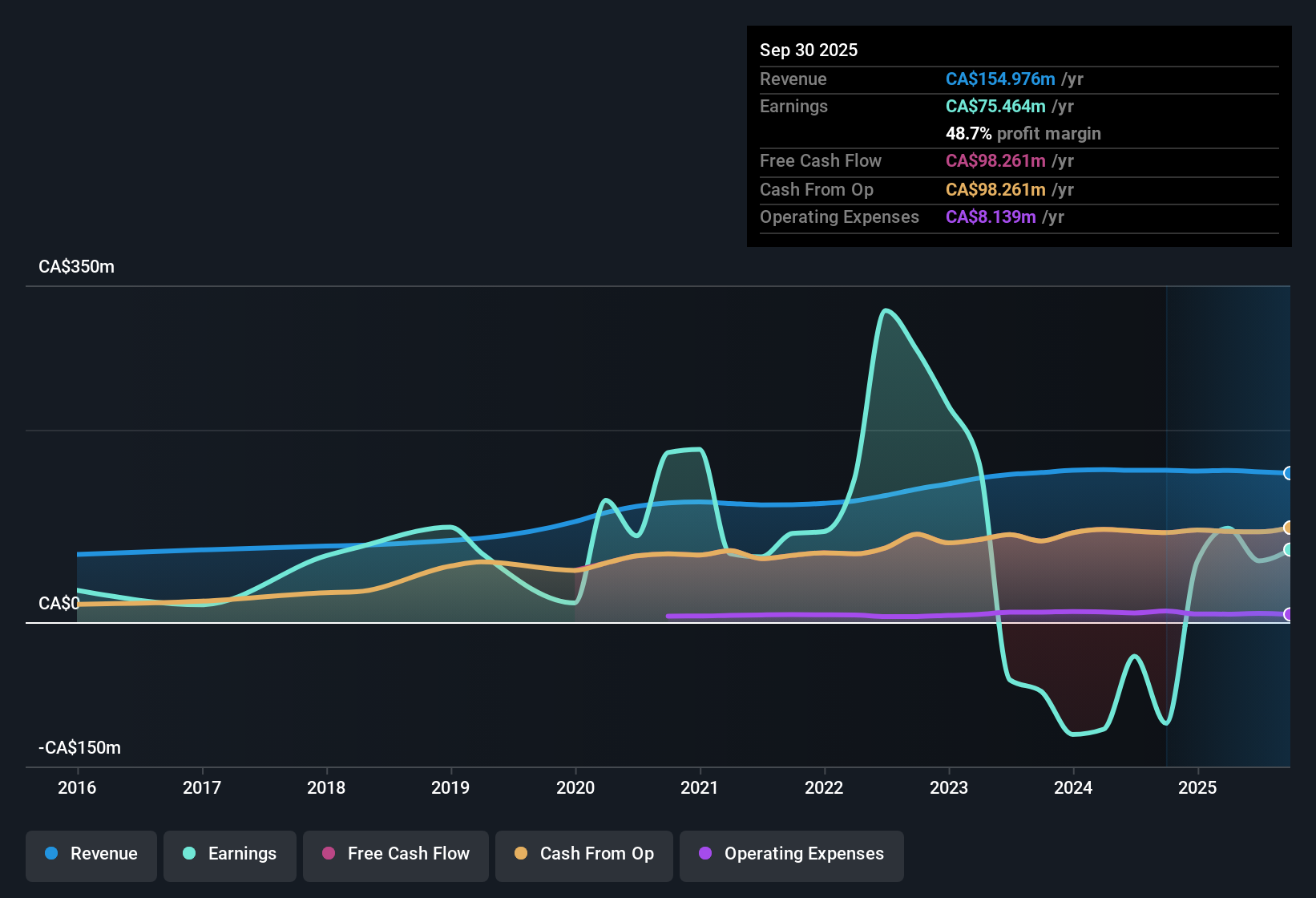

Minto Apartment REIT (TSX:MI.UN) Profitability Returns but Five-Year Earnings Decline Clouds Bullish Narrative

Reviewed by Simply Wall St

Minto Apartment Real Estate Investment Trust (TSX:MI.UN) has achieved profitability in the past year, but earnings have declined by 33.2% per year over the last five years, making the overall trend difficult to interpret. Revenue is forecast to grow at 4.7% per year, slightly trailing the Canadian market average of 5.1% per year. The trust is currently considered to have high quality earnings and is trading below estimated fair value. Investors face the challenge of weighing the company’s renewed profitability and attractive valuation against recent declines in earnings and the modest revenue growth outlook.

See our full analysis for Minto Apartment Real Estate Investment Trust.The next section examines how these results align with some of the most widely followed narratives in the market, highlighting where the numbers reinforce investor expectations and where they might challenge them.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Earnings Gap Signals Mixed Value

- Minto’s Price-To-Earnings Ratio stands at 7.6x, which is noticeably above the direct peer average of 4.8x, but well below the North American Residential REIT industry average of 27.3x.

- Although Minto has a higher P/E than its closest competitors, the general perception is that its discount to the broader sector reflects solid fundamentals and perceived defensive attributes.

- Market participants note the company’s high-quality past earnings and suggest the current multiple may attract yield-seeking investors looking for stability.

- This dynamic supports the view of the stock as a relative bargain given portfolio resilience, while also acknowledging a valuation ceiling unless growth surpasses peer trends.

Share Price Trails DCF Fair Value

- The current market price of CA$13.19 is below the DCF fair value estimate of CA$16.29, creating a notable gap for investors to consider.

- Many see this discount as highlighting value for long-term holders, especially since the trust maintains steady operational performance in a cautious real estate environment.

- Retail perspectives often cite the trust’s defensive qualities and ongoing rental demand as factors supporting potential price convergence.

- However, some caution that limited revenue growth and prior earnings declines could delay a move toward intrinsic value unless underlying fundamentals materially improve.

Profitability Returns but Topline Lags Market

- Minto’s revenue is projected to rise 4.7% per year, which is lower than the Canadian market average of 5.1% per year and signals only modest expansion ahead.

- The main investment thesis for current holders centers on steady income rather than rapid top-line growth.

- Analysts observe that while the company’s return to profitability is notable after years of earnings decline, the slower-than-market revenue outlook means the focus remains on income reliability rather than potential for significant gains.

- This balance helps explain why some view the trust as a “safe haven” exposure in a volatile market, but not a vehicle for outsized returns.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Minto Apartment Real Estate Investment Trust's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Minto’s slow revenue growth and continued earnings declines suggest limited upside for investors seeking steadier performance and stronger expansion.

If consistent progress and reliability matter to you, check out stable growth stocks screener (2074 results) for a shortlist of companies with proven growth records and dependable results.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MI.UN

Minto Apartment Real Estate Investment Trust

An open-ended real estate investment trust, owns and operates a portfolio of income-producing multi-residential rental properties located in Canada.

Second-rate dividend payer with low risk.

Market Insights

Community Narratives