- Canada

- /

- Industrial REITs

- /

- TSX:GRT.UN

Granite REIT (TSX:GRT.UN) Valuation After Q3 Revenue Growth, Lower Net Income, and Distribution Hike

Reviewed by Simply Wall St

Granite Real Estate Investment Trust (TSX:GRT.UN) just released its third quarter results, highlighting higher year-over-year revenue but lower net income. The company also announced a 4% increase to its annualized distribution, which will take effect in December.

See our latest analysis for Granite Real Estate Investment Trust.

Granite's steady climb, with a year-to-date share price return of 12.8%, suggests investors are warming to its recent distribution hike and revenue growth. However, short-term momentum has cooled following a dip in net income. Over the past year, total shareholder return stands at 8.3%, pointing to moderate but positive long-term performance as the trust navigates a shifting market.

If you’re curious about other market standouts beyond real estate, this could be a perfect time to broaden your view and discover fast growing stocks with high insider ownership

With Granite trading at a notable discount to analyst targets and anticipating higher dividends, the question is whether today's price offers real value or if the market already reflects the trust's future growth potential.

Price-to-Earnings of 16.4x: Is it justified?

Granite’s shares recently closed at CA$78.72, reflecting a Price-to-Earnings (P/E) ratio of 16.4x, which places the stock in the "good value" zone compared to its fair P/E benchmark. This suggests the market price may not fully account for Granite’s current or future earnings profile.

The Price-to-Earnings ratio measures how much investors are willing to pay per dollar of earnings. For real estate investment trusts like Granite, a moderate P/E can indicate balanced sentiment, with neither excessive optimism nor deep skepticism about the sustainability and growth of company profits.

Granite’s P/E of 16.4x is slightly below its estimated fair P/E of 16.5x, signaling a close alignment between market expectations and underlying performance. In an industry context, this P/E also stands below the global industrial REITs average of 16.7x, reinforcing the idea that the stock is trading at an attractive relative valuation. If the market gravitates toward that fair ratio, Granite’s upside potential could increase.

Explore the SWS fair ratio for Granite Real Estate Investment Trust

Result: Price-to-Earnings of 16.4x (UNDERVALUED)

However, Granite still faces potential headwinds from interest rate hikes or shifts in industrial property demand. These factors could temper its valuation upside.

Find out about the key risks to this Granite Real Estate Investment Trust narrative.

Another View: What Does Discounted Cash Flow Say?

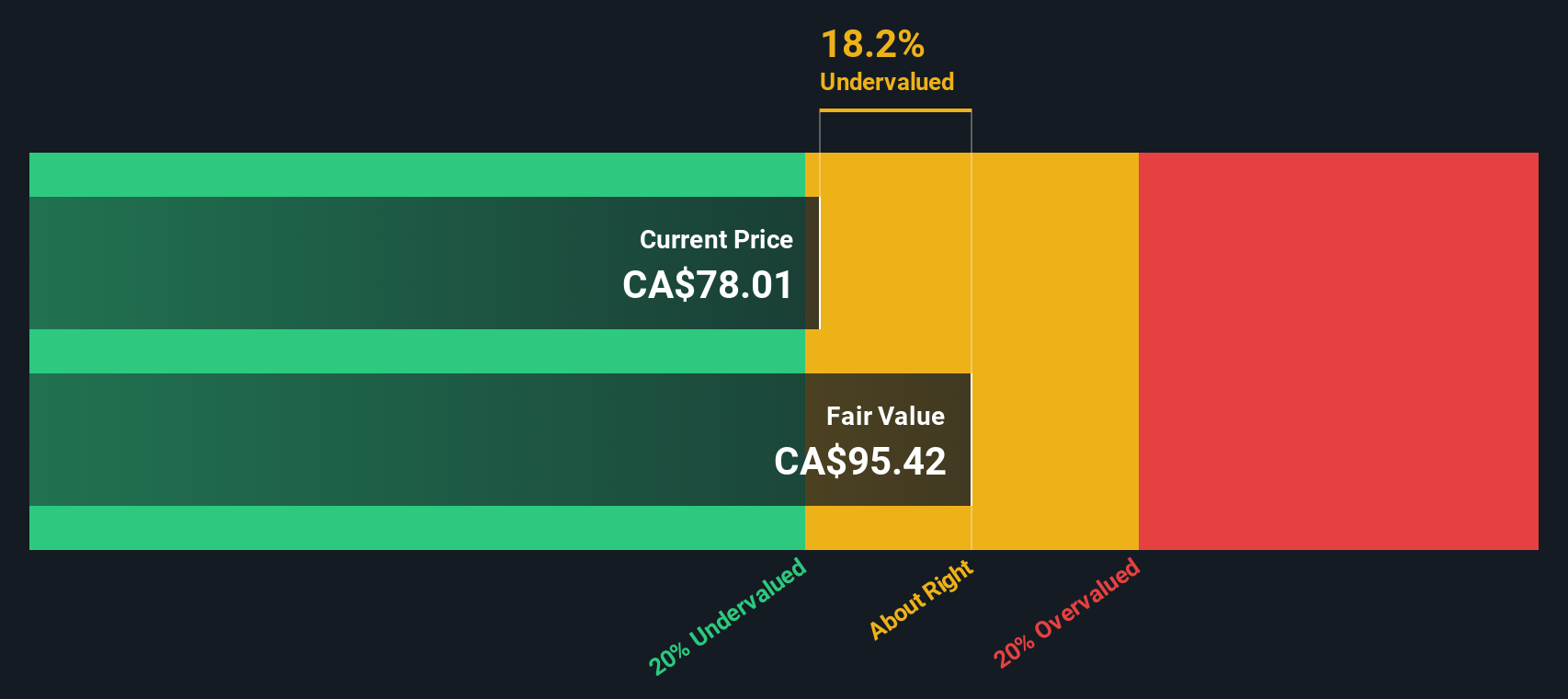

While the Price-to-Earnings ratio signals Granite may be undervalued, our SWS DCF model offers a different angle. It suggests the current share price of CA$78.72 trades about 17% below Granite’s intrinsic fair value of CA$95.10, which could indicate the market is underestimating its future cash flows. But can this estimate stand up in today’s market, or are there reasons for caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Granite Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 856 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Granite Real Estate Investment Trust Narrative

If you want to reach your own conclusions or prefer to dig into the numbers yourself, you can construct a personal narrative in just a few minutes, and Do it your way.

A great starting point for your Granite Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart portfolios thrive on fresh opportunities. Don’t settle for just one sector; expand your strategy today with handpicked stock ideas that could change your investment game.

- Catch early momentum and potential big wins by zeroing in on these 3575 penny stocks with strong financials that are showing strong financials before the crowd catches on.

- Capitalize on the AI boom by reviewing these 25 AI penny stocks that are innovating in automation, data intelligence, and machine learning technologies.

- Maximize passive income with these 15 dividend stocks with yields > 3% offering robust yields above 3% for more consistent returns in any market climate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GRT.UN

Granite Real Estate Investment Trust

Granite is a Canadian-based REIT engaged in the acquisition, development, ownership and management of logistics, warehouse and industrial properties in North America and Europe.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives