- Canada

- /

- Office REITs

- /

- TSX:AP.UN

Allied Properties REIT (TSX:AP.UN): Valuation Insights Following Major New Lease Signing at The Well

Reviewed by Simply Wall St

Allied Properties Real Estate Investment Trust (TSX:AP.UN) just secured a major office lease at The Well in Toronto. This move highlights ongoing leasing momentum and may offer some reassurance for investors facing a tough office market.

See our latest analysis for Allied Properties Real Estate Investment Trust.

After a challenging stretch, including a sharp 12% drop in the past month and a total shareholder return of -20% over the past year, Allied’s latest lease signing at The Well signals renewed momentum. Investors will be watching closely to see if positive leasing activity can help stabilize confidence and spark a turnaround.

Curious about what else is making waves in the market right now? It might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading about 43% below their estimated intrinsic value and nearly 20% below consensus analyst targets, is Allied currently undervalued with room for upside? Or is the market already pricing in all the future growth?

Price-to-Sales of 3x: Is it justified?

Allied Properties Real Estate Investment Trust is currently trading at a price-to-sales ratio of 3x, which stands out when compared to both industry peers and the company's own fundamentals. At a last close of CA$13, the market is assigning a premium on revenues despite Allied's current challenges.

The price-to-sales (P/S) ratio measures the company's stock price relative to its revenue, providing insight into how much investors are willing to pay per dollar of sales. In real estate investment trusts, this metric helps gauge whether the stock price accurately reflects revenue generation, regardless of short-term profitability swings.

This 3x P/S ratio is notably higher than the North American Office REITs industry average of 2.1x and also above Allied's own peer average of 1.5x. When put against the estimated fair price-to-sales ratio of just 2.7x, the current valuation signals the market may be overpricing Allied's revenue potential in its present context, especially given the company’s string of quarterly losses.

Explore the SWS fair ratio for Allied Properties Real Estate Investment Trust

Result: Price-to-Sales of 3x (OVERVALUED)

However, Allied continues to face weak net income trends and lingering market skepticism. These factors could challenge any near-term recovery in the share price.

Find out about the key risks to this Allied Properties Real Estate Investment Trust narrative.

Another View: SWS DCF Model Finds Undervaluation

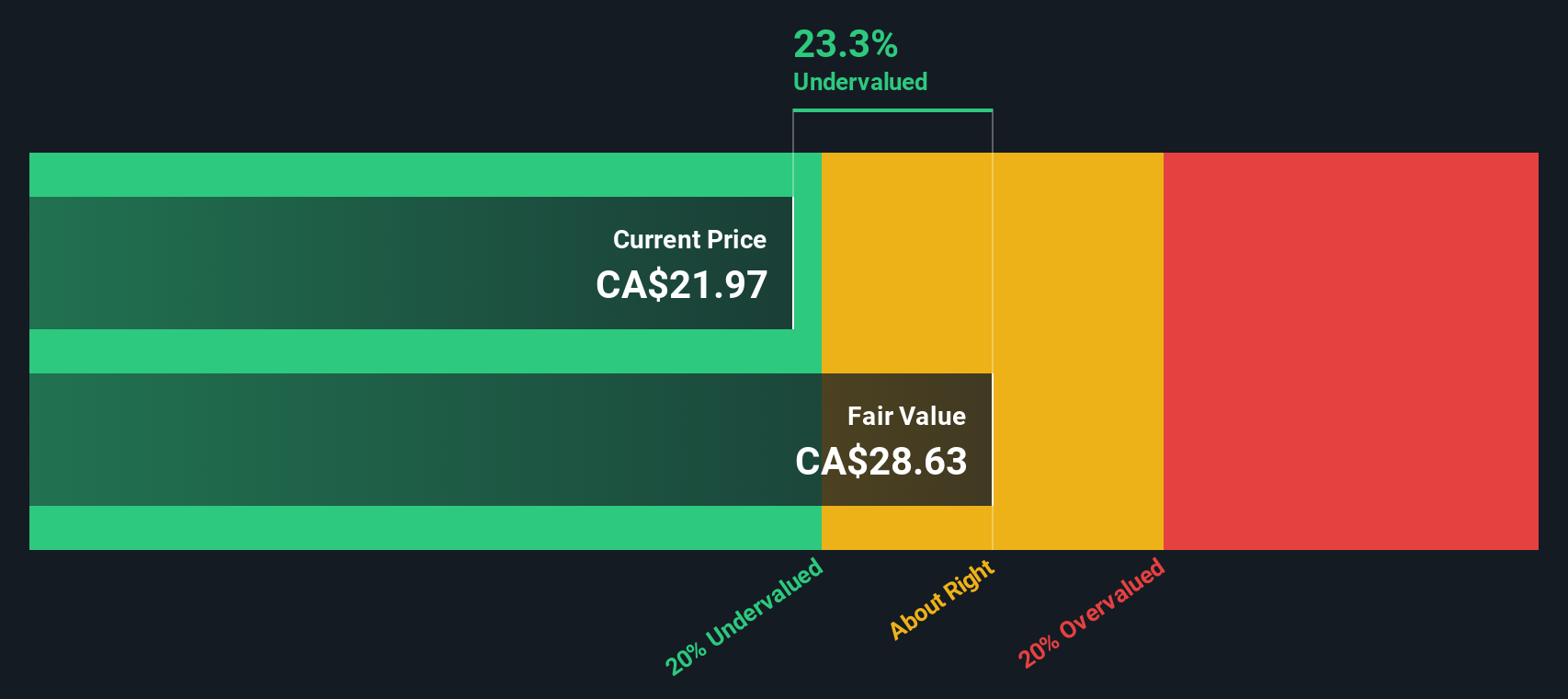

While the price-to-sales ratio suggests Allied is overvalued compared to peers, our DCF model paints a different picture. It estimates a fair value of CA$22.73 per share, which suggests notable undervaluation. Could the market be overlooking long-term cash flow potential, or is the discount a sign of risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Allied Properties Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Allied Properties Real Estate Investment Trust Narrative

If you see things differently or want to dive into the numbers yourself, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your Allied Properties Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for the ordinary when you could uncover exceptional opportunities? Take action and use the Simply Wall Street Screener to find stocks with game-changing potential before everyone else.

- Boost your income by tapping into steady earners with these 15 dividend stocks with yields > 3% offering attractive yields above 3%.

- Catalyze your portfolio growth with these 25 AI penny stocks identified as leaders in innovative artificial intelligence solutions.

- Seize opportunities where value meets potential by using these 914 undervalued stocks based on cash flows to spot stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AP.UN

Allied Properties Real Estate Investment Trust

Allied is a leading owner-operator of distinctive urban workspace in Canada’s major cities.

Established dividend payer with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026