- Canada

- /

- Real Estate

- /

- TSX:AIF

Altus Group (TSX:AIF) Buyback Launch: Evaluating Valuation After $350 Million Share Repurchase Announcement

Reviewed by Simply Wall St

Altus Group (TSX:AIF) just launched a significant share buyback, announcing a plan to purchase up to CAD 350 million worth of its common shares through a modified Dutch auction. This move is intended to boost value for current shareholders.

See our latest analysis for Altus Group.

Altus Group’s announcement follows a stretch of muted share price moves, with a 1-day rise of 1.15% and a modest 7-day bump. However, a 90-day share price return of -9.69% suggests some momentum faded recently. Looking at the bigger picture, the company’s 1-year total shareholder return is down 5.48%. The 5-year total return remains at 20.33%, signaling longer-term holders have seen solid gains even as 2025 brought a few bumps and some recalibration from the market. The current buyback could mark an inflection point if it helps reset sentiment and draws attention to underlying value.

If you're looking for fresh ideas beyond Altus Group, now’s the perfect chance to expand your search and discover fast growing stocks with high insider ownership

But does Altus Group’s substantial buyback signal that shares are trading at a bargain, or is the current price already factoring in expected growth and future prospects? Investors must ask if there is true value, or if the opportunity has already passed.

Most Popular Narrative: 7.5% Undervalued

Altus Group’s most widely followed narrative puts fair value at CA$60.13, compared to a last close of CA$55.64. This suggests that, according to consensus estimates, the stock could offer some upside if financial assumptions hold true.

Momentum in advanced real estate analytics and adoption of new pricing models supports sustained revenue and margin growth amid industry digitization and expanding market opportunity. Operational efficiencies, strong client retention, and cross-sell opportunities enhance long-term profitability potential. Additionally, a disciplined M&A strategy further bolsters shareholder value.

Wondering what’s driving analysts to a higher fair value? There is one bold assumption hiding in plain sight: record earnings growth and fattening margins projected just over the horizon. Want the specifics behind these bullish analyst models? The numbers behind this valuation forecast could surprise you.

Result: Fair Value of $60.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainty in commercial real estate and cautious client spending could weaken revenue growth and challenge Altus Group’s positive profit outlook.

Find out about the key risks to this Altus Group narrative.

Another View: What Do Multiples Say?

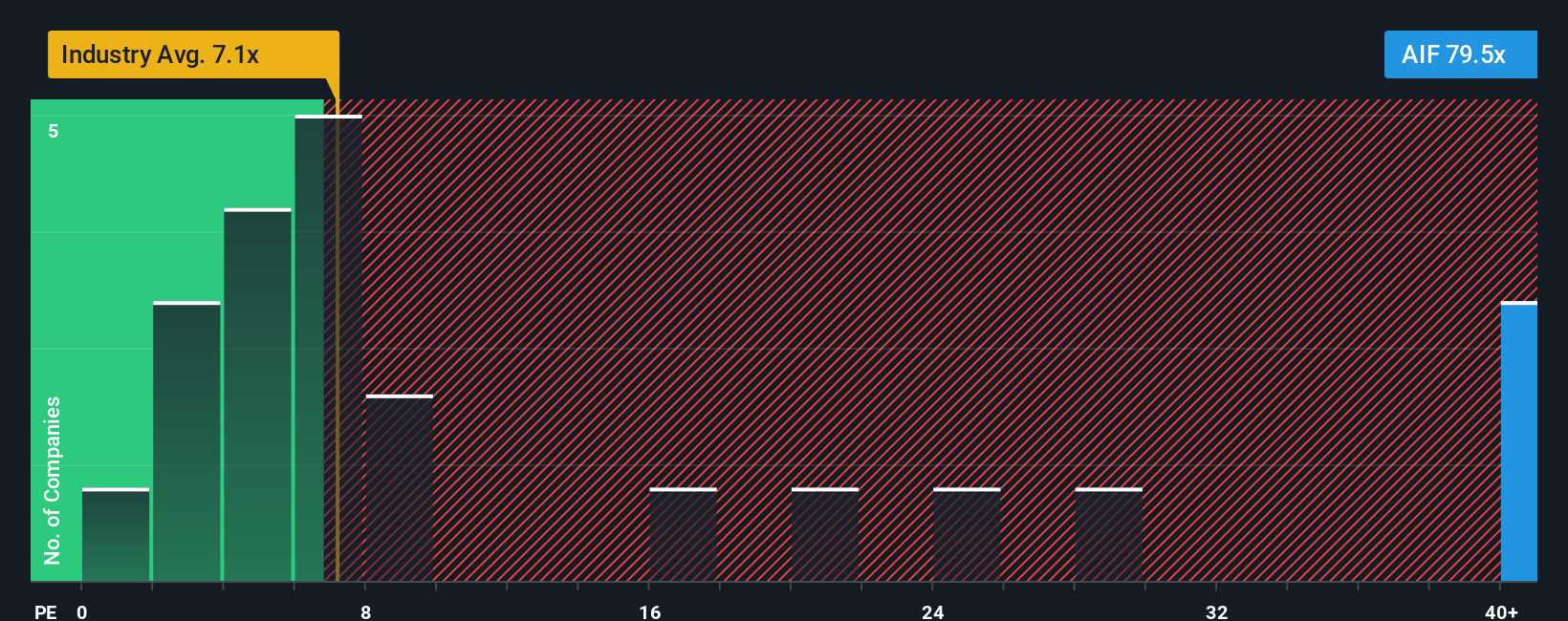

While some valuation models hint at Altus Group being undervalued, the lens of market pricing tells a different story. Altus trades at a price-to-earnings ratio of 91.6x, which is much steeper than its peer average of 36.5x and the industry average of 16.6x. Even compared to a fair ratio of 7.5x, the shares appear expensive. This wide gap raises real questions about whether the stock can grow into its price, or if there is more risk in these numbers than meets the eye.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Altus Group Narrative

If you have a different take or want to test your own perspective, you can build your own narrative and dive into the data yourself in just a few minutes. Do it your way

A great starting point for your Altus Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Great opportunities rarely stick around. Give your portfolio an edge by checking out these handpicked ideas on Simply Wall Street before the market catches on:

- Boost your cash flow by targeting proven companies with solid yield. Start with these 15 dividend stocks with yields > 3% and uncover those consistent performers.

- Tap into exponential growth with emerging tech leaders by scanning these 25 AI penny stocks, where tomorrow's AI winners are being spotted today.

- Maximize your upside potential and minimize overpaying by sifting through these 914 undervalued stocks based on cash flows to catch high-quality stocks trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AIF

Altus Group

Provides asset and funds intelligence solutions for commercial real estate (CRE) in Canada, the United States, the United Kingdom, France, Europe, the Middle East, Africa, Australia, and the Asia Pacific.

Flawless balance sheet unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026