In Canada, recent economic indicators suggest a stabilization in the labor market and inflation rates within the Bank of Canada's target range, contributing to a robust backdrop for investors. Amidst these conditions, penny stocks—often representing smaller or newer companies—remain an intriguing option for those seeking value and growth potential. Despite their vintage name, penny stocks can still offer significant opportunities when backed by strong financials, as we'll explore with several standout examples from the Canadian market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$3.35 | CA$84.69M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.29 | CA$2.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.365 | CA$54.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Zedcor (TSXV:ZDC) | CA$4.96 | CA$510.85M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.28 | CA$824.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.11 | CA$22.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.70 | CA$427.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.57 | CA$183.23M | ✅ 2 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.89 | CA$9.33M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 417 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

AKITA Drilling (TSX:AKT.A)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AKITA Drilling Ltd. is an oil and gas drilling contractor operating in Canada and the United States, with a market cap of CA$80.48 million.

Operations: The company's revenue is primarily generated from its Contract Drilling Services segment, which accounted for CA$223.34 million.

Market Cap: CA$80.48M

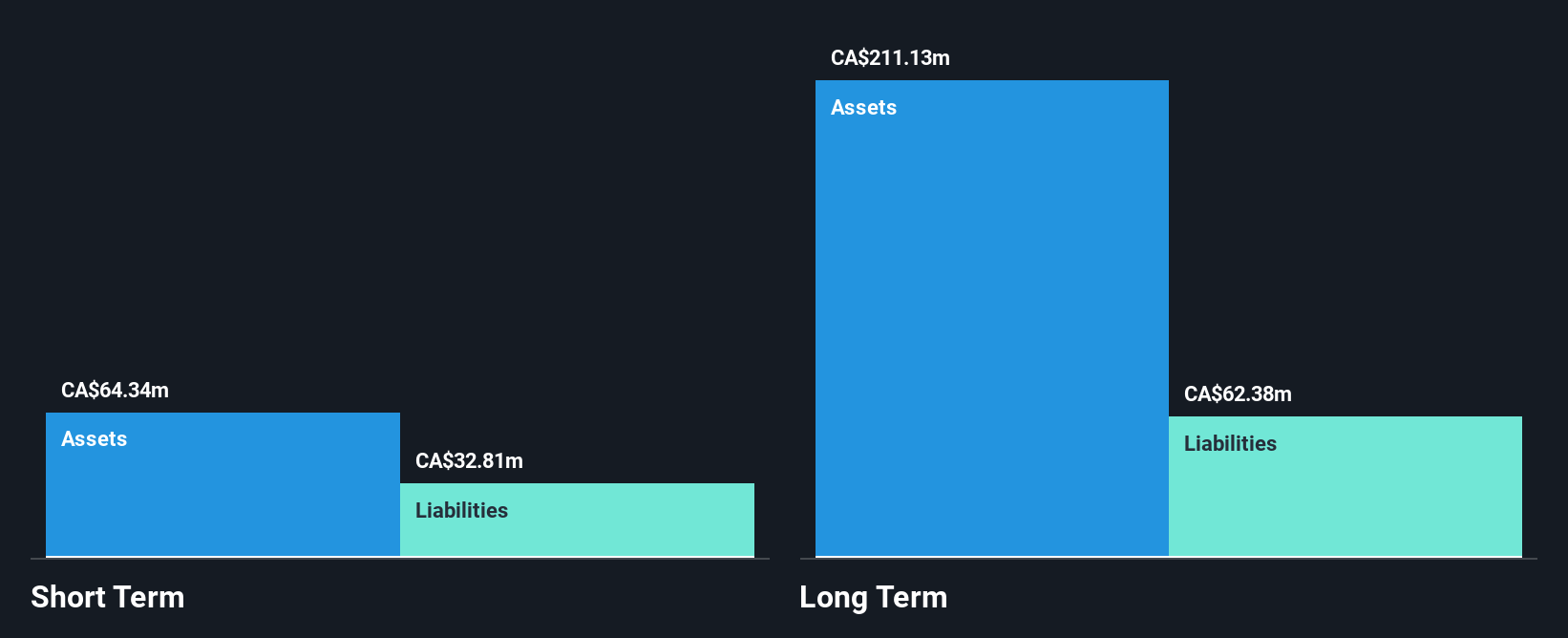

AKITA Drilling Ltd. has demonstrated significant financial improvements, with net profit margins increasing from 2.6% to 9.7% over the past year and earnings growing by a very large 344.9%, surpassing industry trends. The company’s short-term assets exceed its short-term liabilities, though they fall short of covering long-term obligations. AKITA's debt levels are well-managed, with interest payments covered 3.6 times by EBIT and operating cash flow nearly matching debt levels at 99.6%. Recent announcements include a share repurchase program aimed at enhancing shareholder value, funded through working capital without increasing leverage significantly.

- Dive into the specifics of AKITA Drilling here with our thorough balance sheet health report.

- Explore AKITA Drilling's analyst forecasts in our growth report.

MediPharm Labs (TSX:LABS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MediPharm Labs Corp. is a pharmaceutical company specializing in the production and sale of purified cannabis extracts, concentrates, active pharmaceutical ingredients, and advanced derivative products across Canada, Australia, Germany, and internationally with a market cap of CA$29.45 million.

Operations: The company generates revenue primarily from the production and sales of cannabis extracts and derivative products, totaling CA$44.45 million.

Market Cap: CA$29.45M

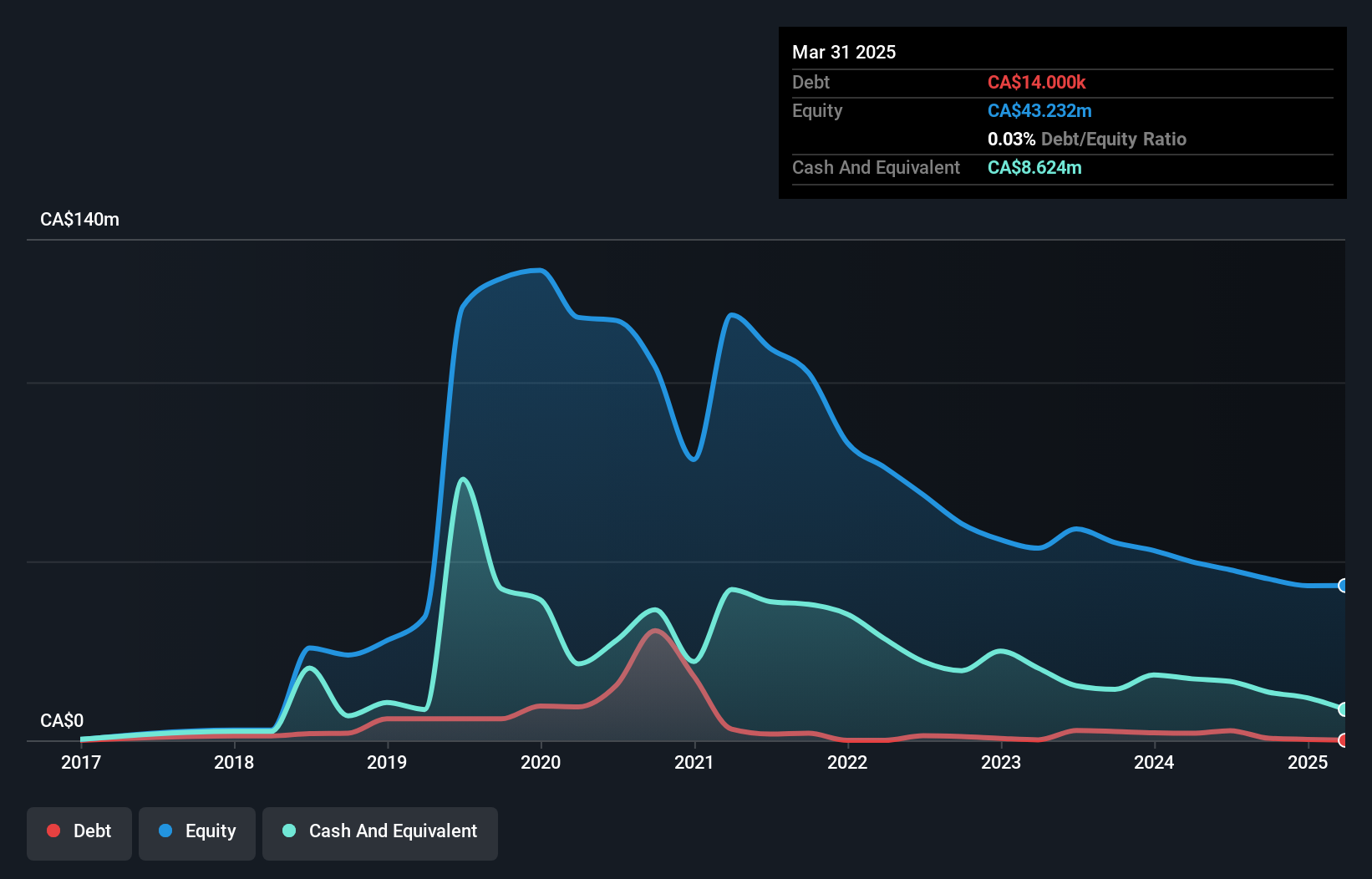

MediPharm Labs Corp. has shown resilience despite being unprofitable, with revenue increasing to CA$11.81 million in Q2 2025 from CA$10.35 million the previous year. The company's innovative product launches, such as the Shake & Puff CBN THC Nighttime Inhaler, highlight its commitment to expanding its pharma-grade cannabinoid offerings. MediPharm's financial health is bolstered by a reduced debt-to-equity ratio and sufficient cash runway for over a year at stable free cash flow levels. Although profitability remains elusive, the company trades at good value compared to peers and maintains experienced management and board teams with significant tenure.

- Click here and access our complete financial health analysis report to understand the dynamics of MediPharm Labs.

- Gain insights into MediPharm Labs' future direction by reviewing our growth report.

Kutcho Copper (TSXV:KC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kutcho Copper Corp. is involved in the acquisition and exploration of resource properties in Canada, with a market cap of CA$25.19 million.

Operations: Kutcho Copper Corp. has not reported any revenue segments.

Market Cap: CA$25.19M

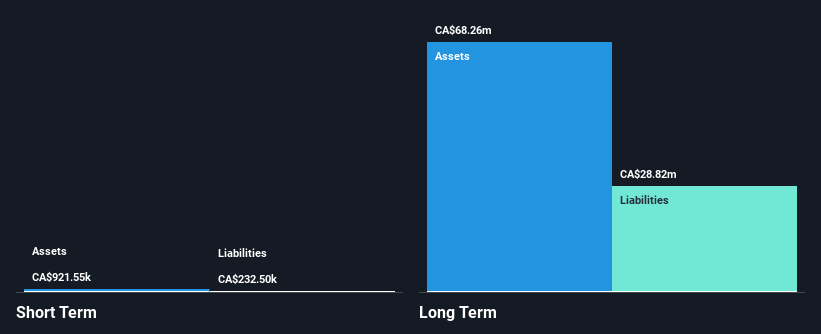

Kutcho Copper Corp. is pre-revenue and unprofitable, yet it has made strides by reducing losses over the past five years at a significant rate. The company reported a net loss of CA$1.33 million for Q1 2025, slightly improved from the previous year. Despite having no revenue streams, Kutcho Copper has eliminated its debt and maintains a cash runway exceeding three years under stable conditions. However, concerns persist regarding its ability to continue as a going concern due to substantial long-term liabilities not covered by short-term assets. The management team is experienced with an average tenure of nearly 13 years.

- Get an in-depth perspective on Kutcho Copper's performance by reading our balance sheet health report here.

- Gain insights into Kutcho Copper's past trends and performance with our report on the company's historical track record.

Where To Now?

- Click this link to deep-dive into the 417 companies within our TSX Penny Stocks screener.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LABS

MediPharm Labs

Operates as a pharmaceutical company that produces and sells purified, pharmaceutical-quality cannabis extracts, concentrates, active pharmaceutical ingredients, and advanced derivative products in Canada, Australia, Germany, and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives