Why Investors Shouldn't Be Surprised By Curaleaf Holdings, Inc.'s (TSE:CURA) 41% Share Price Surge

The Curaleaf Holdings, Inc. (TSE:CURA) share price has done very well over the last month, posting an excellent gain of 41%. But the last month did very little to improve the 71% share price decline over the last year.

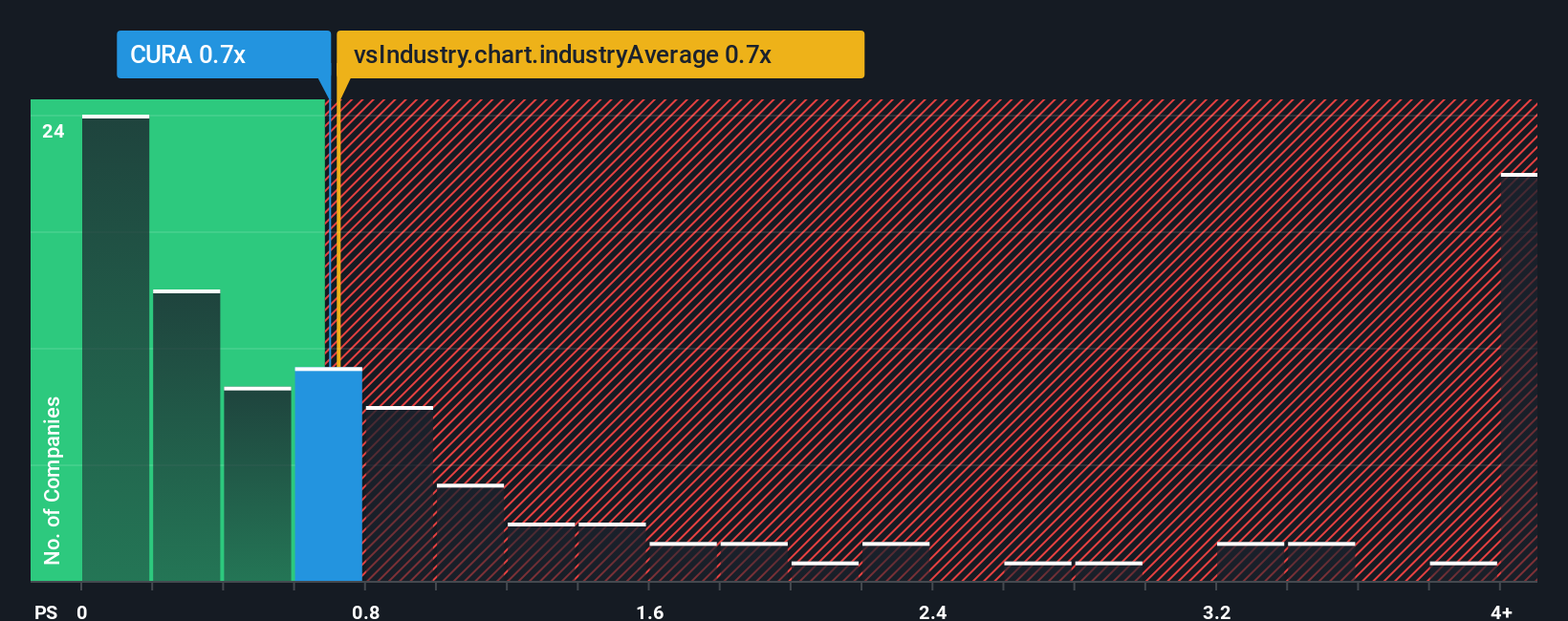

In spite of the firm bounce in price, it's still not a stretch to say that Curaleaf Holdings' price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Pharmaceuticals industry in Canada, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Curaleaf Holdings

How Curaleaf Holdings Has Been Performing

Curaleaf Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Curaleaf Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Curaleaf Holdings would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.9%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 6.7% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 3.9% per year during the coming three years according to the nine analysts following the company. With the industry predicted to deliver 5.8% growth per annum, the company is positioned for a comparable revenue result.

With this information, we can see why Curaleaf Holdings is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Curaleaf Holdings' P/S?

Its shares have lifted substantially and now Curaleaf Holdings' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Curaleaf Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Pharmaceuticals industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Curaleaf Holdings with six simple checks.

If you're unsure about the strength of Curaleaf Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CURA

Curaleaf Holdings

Produces and distributes cannabis products in the United States and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives