As the Canadian market navigates a landscape of improved labour productivity and modest inflation, investors are keenly observing how these factors might influence corporate earnings and consumer spending. In this context, growth companies with high insider ownership can be particularly appealing, as they often suggest strong confidence from those closest to the business in its long-term potential.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Robex Resources (TSXV:RBX) | 24.4% | 87.4% |

| Propel Holdings (TSX:PRL) | 36.2% | 31.8% |

| Orla Mining (TSX:OLA) | 11.2% | 74% |

| First National Financial (TSX:FN) | 38.4% | 22.1% |

| Enterprise Group (TSX:E) | 32.1% | 70.3% |

| Discovery Silver (TSX:DSV) | 14.0% | 57.8% |

| CEMATRIX (TSX:CEMX) | 10.5% | 76.6% |

| Burcon NutraScience (TSX:BU) | 15.2% | 125.9% |

| Aritzia (TSX:ATZ) | 17.2% | 27.6% |

| Allied Gold (TSX:AAUC) | 16% | 86.7% |

Let's uncover some gems from our specialized screener.

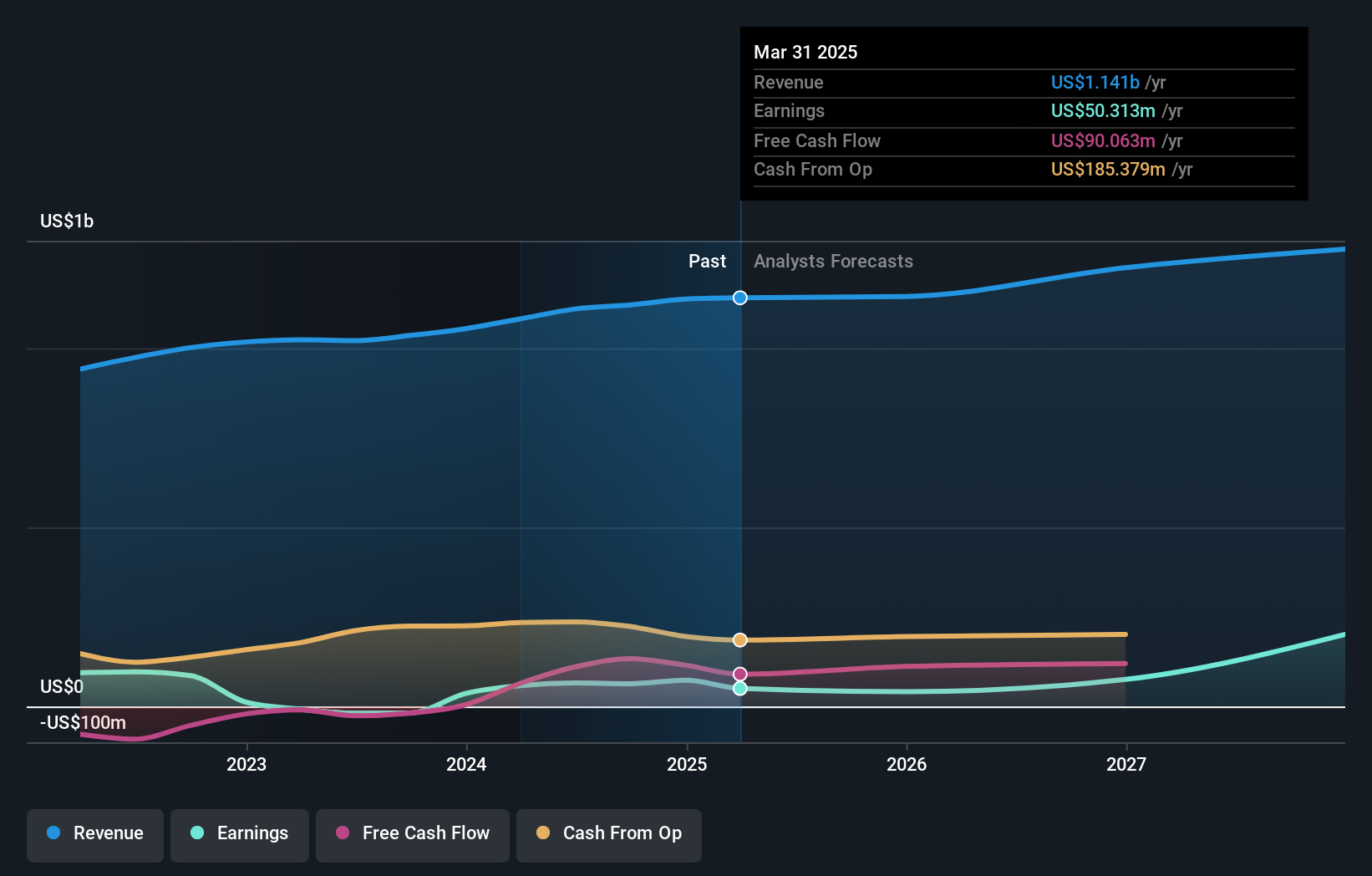

Green Thumb Industries (CNSX:GTII)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Green Thumb Industries Inc. is involved in the manufacturing, distribution, marketing, and sale of cannabis products for both medical and adult-use markets in the United States, with a market cap of CA$2.62 billion.

Operations: Green Thumb Industries generates revenue through its Retail segment, which accounts for $820.25 million, and its Consumer Packaged Goods segment, contributing $681.87 million.

Insider Ownership: 10.2%

Green Thumb Industries shows potential as a growth company with significant insider ownership, despite recent challenges. While earnings are forecast to grow significantly at 34.42% annually, revenue growth is slower at 4.7%. The company trades well below its estimated fair value but faces declining profit margins and net losses in Q2 2025. Recent share buybacks and a shelf registration filing for US$167.75 million indicate strategic financial maneuvers amidst fluctuating market conditions and price compression impacts on gross profit.

- Delve into the full analysis future growth report here for a deeper understanding of Green Thumb Industries.

- According our valuation report, there's an indication that Green Thumb Industries' share price might be on the expensive side.

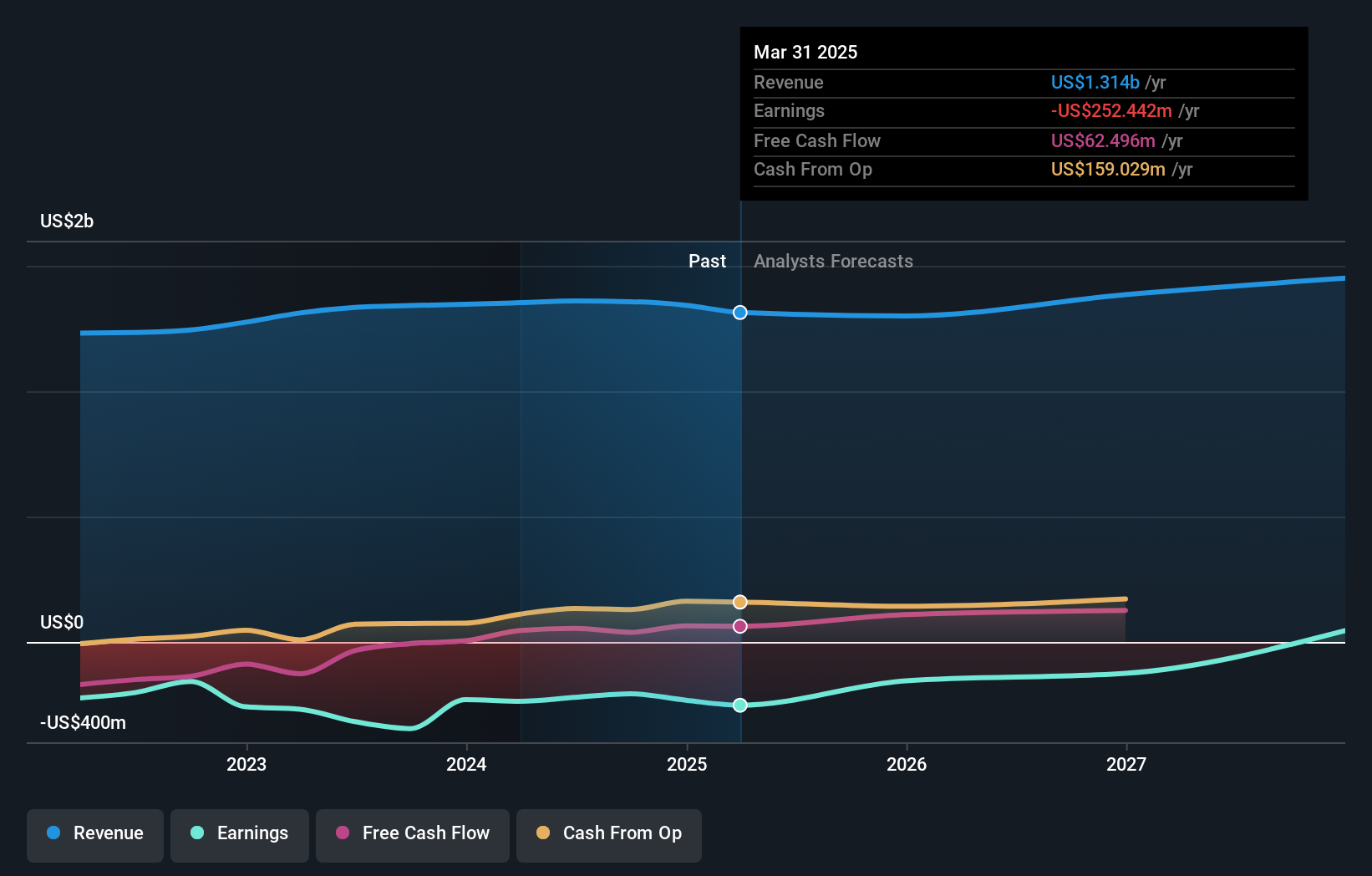

Curaleaf Holdings (TSX:CURA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Curaleaf Holdings, Inc. is involved in the production and distribution of cannabis products both in the United States and internationally, with a market cap of CA$2.87 billion.

Operations: The company's revenue primarily comes from its cultivation, production, distribution, and sale of cannabis, amounting to $1.29 billion.

Insider Ownership: 18.6%

Curaleaf Holdings is navigating a period of transformation with recent executive appointments, including Rahul Pinto as President, enhancing its leadership team. Despite reporting a net loss of US$53.16 million in Q2 2025 and experiencing revenue decline, the company is forecasted to grow earnings by 65.33% annually and become profitable within three years. While trading at 67.6% below fair value estimates, Curaleaf's insider transactions show more buying than selling recently but not in substantial volumes.

- Get an in-depth perspective on Curaleaf Holdings' performance by reading our analyst estimates report here.

- Our valuation report here indicates Curaleaf Holdings may be undervalued.

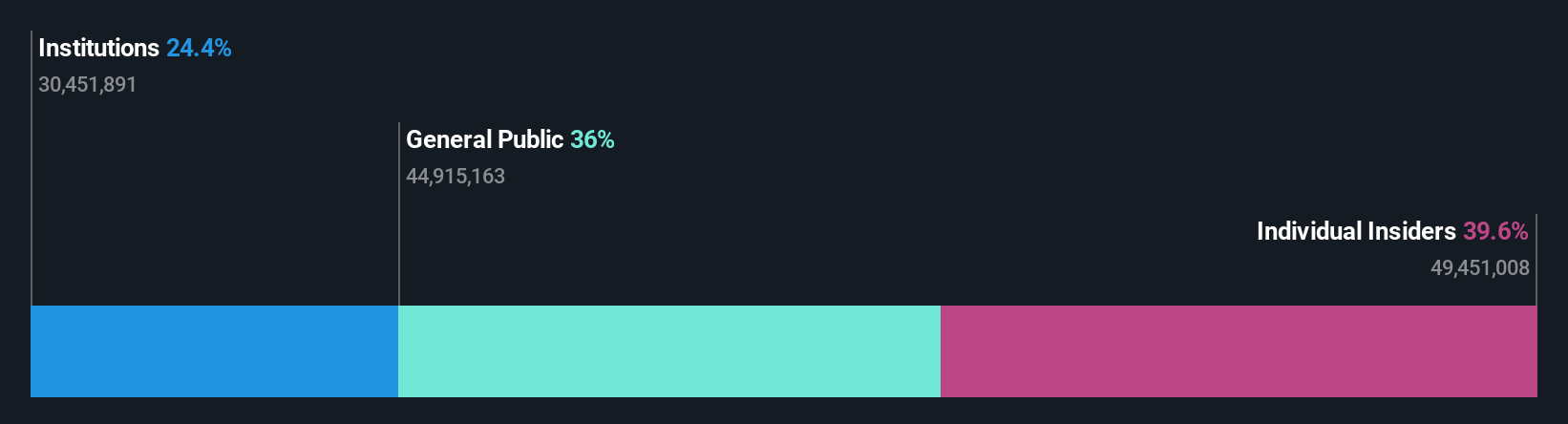

Maple Leaf Foods (TSX:MFI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Maple Leaf Foods Inc., along with its subsidiaries, produces food products in Canada, the United States, Japan, China, and internationally, with a market capitalization of CA$4.20 billion.

Operations: Maple Leaf Foods generates revenue from its food production activities across Canada, the United States, Japan, China, and other international markets.

Insider Ownership: 39.9%

Maple Leaf Foods is experiencing robust earnings growth, forecasted at 22.5% annually, outpacing the Canadian market. Recent Q2 results show a turnaround with net income of C$57.78 million from a prior loss, though revenue growth remains modest at 3.5%. Despite trading below estimated fair value and insiders buying more than selling recently, financial challenges persist with interest payments not well covered by earnings. The company maintains a reliable dividend of C$0.96 annually per share.

- Click here and access our complete growth analysis report to understand the dynamics of Maple Leaf Foods.

- Our valuation report here indicates Maple Leaf Foods may be overvalued.

Key Takeaways

- Take a closer look at our Fast Growing TSX Companies With High Insider Ownership list of 46 companies by clicking here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:GTII

Green Thumb Industries

Manufactures, distributes, markets, and sells of cannabis products for medical and adult-use in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives