Stingray Group (TSX:RAY.A): Assessing Valuation Following Strong Earnings and Dividend Hike

Reviewed by Simply Wall St

Stingray Group (TSX:RAY.A) released its second quarter earnings, revealing strong year-over-year growth in both sales and net income. The company also announced a 13% dividend increase, which caught the attention of investors.

See our latest analysis for Stingray Group.

Stingray Group’s momentum has clearly accelerated, with the share price jumping 74.87% year-to-date and delivering a 70.07% total shareholder return over the past 12 months. The recent earnings beat and dividend hike have reinforced investor optimism and built on already robust multi-year gains.

If you want to see which other companies are showing similarly strong momentum, now is a great time to broaden your investing search and discover fast growing stocks with high insider ownership

But with the share price already posting spectacular gains, is Stingray Group’s valuation still attractive, or has the market fully priced in its surge in earnings and dividend growth, leaving limited room for further upside?

Most Popular Narrative: 1% Overvalued

With Stingray Group shares closing at CA$13.29, the most widely followed narrative puts its fair value almost exactly in line at CA$13.17. The price is nudging just slightly above this consensus based on upbeat future expectations.

The introduction of Stingray's content (music and ambiance channels) as default options on Samsung's new commercial TV content platform (BTX/VXT), with global SVOD integration, creates a new scalable DTC subscription revenue stream, supporting both revenue growth and higher margins.

Curious about the calculation behind this razor-thin fair value gap? Analysts are bold on recurring revenue, margin expansion, and their outlook for market-defining channel deals. The real financial twist is still hidden. Find out which profit levers underpin the narrative’s price target.

Result: Fair Value of $13.17 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued shifts toward personalized streaming and heavy reliance on ad revenue could quickly upend Stingray Group’s bullish outlook if trends worsen.

Find out about the key risks to this Stingray Group narrative.

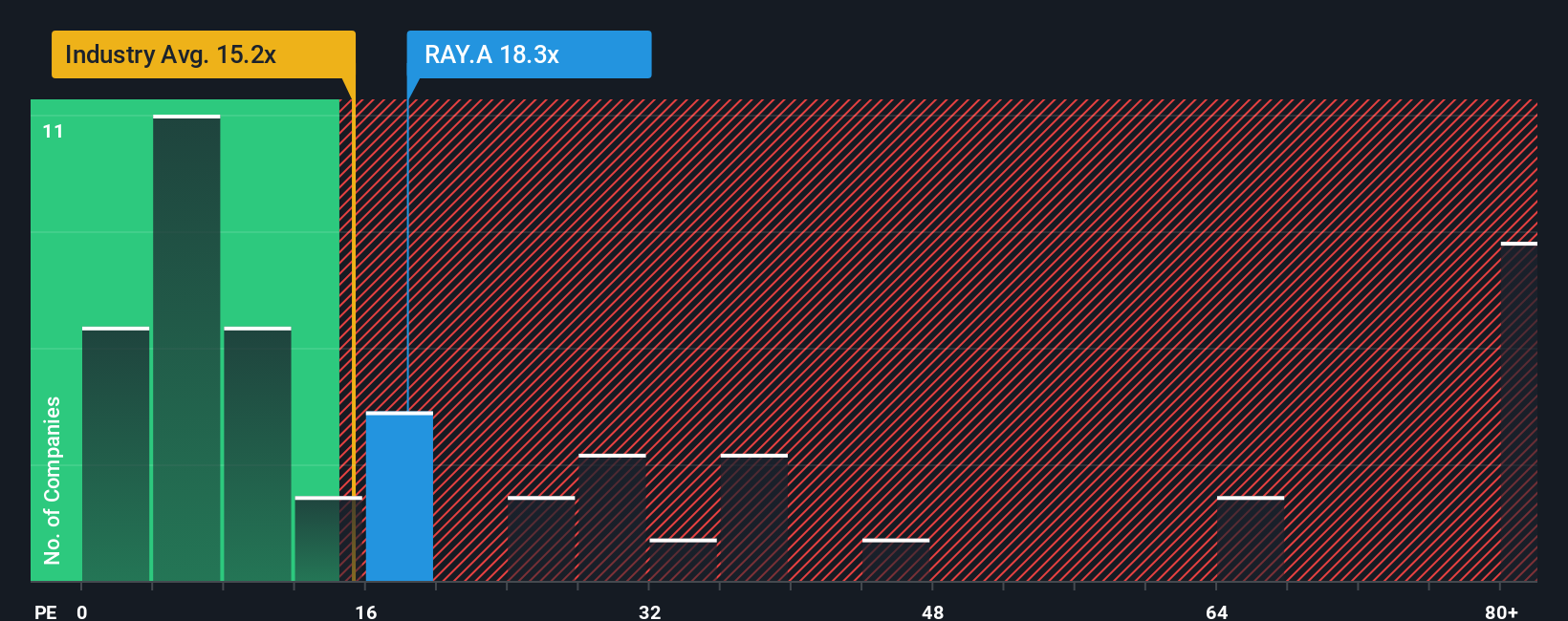

Another View: Are the Multiples Flashing a Warning?

Looking at the price-to-earnings ratio, Stingray Group trades at 17.4x, which is higher than both its North American media peers at 16.1x and the industry "fair ratio" of 20x. While not the most expensive, this premium over peers could signal increased risk if growth slows. Is the market too optimistic or is this deserved?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stingray Group Narrative

If you see the story differently or prefer your own hands-on approach, you can dig into the numbers and craft a narrative in just a few minutes: Do it your way

A great starting point for your Stingray Group research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit yourself to just one success story. Use the Simply Wall Street Screener to uncover new investment opportunities tailored for forward-thinking investors like you. These compelling markets offer potential you don’t want to miss:

- Capitalize on fast-growing companies by searching through these 3585 penny stocks with strong financials, which are poised for breakout momentum and financial resilience.

- Accelerate your portfolio’s future by tapping into the next wave of intelligent innovation with these 27 AI penny stocks, featuring businesses advancing artificial intelligence.

- Boost your income with these 15 dividend stocks with yields > 3%, highlighting stocks that combine attractive yields with a history of strong shareholder returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RAY.A

Stingray Group

Operates as a music, media, and technology company in Canada, the United States, and internationally.

High growth potential established dividend payer.

Similar Companies

Market Insights

Community Narratives