In the current economic landscape, Canadian markets are navigating a complex environment shaped by new tariffs and shifting global trade dynamics. Despite these challenges, growth companies with substantial insider ownership can present unique opportunities for investors seeking to capitalize on potential corporate resilience and alignment of interests.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Tenaz Energy (TSX:TNZ) | 10.3% | 151.2% |

| SolarBank (NEOE:SUNN) | 15.9% | 52.1% |

| Robex Resources (TSXV:RBX) | 24.4% | 90.6% |

| Propel Holdings (TSX:PRL) | 36.3% | 31.1% |

| Orla Mining (TSX:OLA) | 11.2% | 44.8% |

| Enterprise Group (TSX:E) | 32.2% | 70.3% |

| Discovery Silver (TSX:DSV) | 15.1% | 39.5% |

| Burcon NutraScience (TSX:BU) | 15.3% | 125.9% |

| Aritzia (TSX:ATZ) | 17.3% | 27.6% |

| Allied Gold (TSX:AAUC) | 16% | 64.1% |

Let's review some notable picks from our screened stocks.

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells apparel and accessories for women in the United States and Canada, with a market capitalization of approximately CA$8.33 billion.

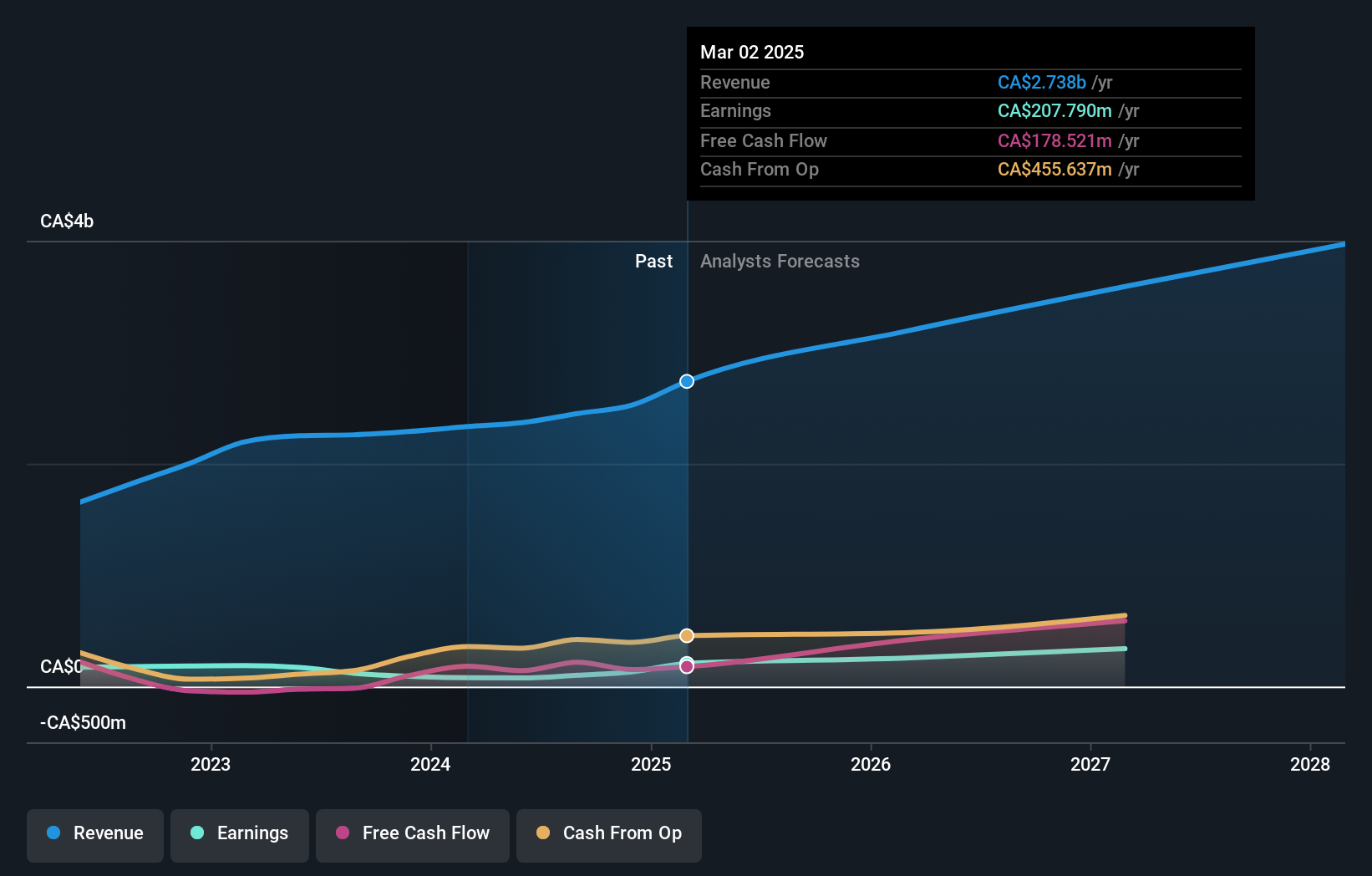

Operations: The company's revenue is primarily derived from its apparel segment, which generated CA$2.90 billion.

Insider Ownership: 17.3%

Aritzia's strong growth trajectory is underscored by significant insider ownership, aligning management interests with shareholders. The company reported impressive earnings growth, with net income rising to C$42.39 million in Q1 2026 from C$15.83 million a year ago. Analysts forecast annual earnings growth of 27.6%, outpacing the Canadian market average, while revenue is expected to grow between 13% and 19% for fiscal year 2026. Aritzia's share repurchase program further demonstrates confidence in its valuation and future prospects.

- Get an in-depth perspective on Aritzia's performance by reading our analyst estimates report here.

- Our valuation report here indicates Aritzia may be undervalued.

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands, with a market capitalization of CA$2.79 billion.

Operations: The company's revenue is derived from its easyhome segment, contributing CA$150.86 million, and its easyfinancial segment, generating CA$1.41 billion.

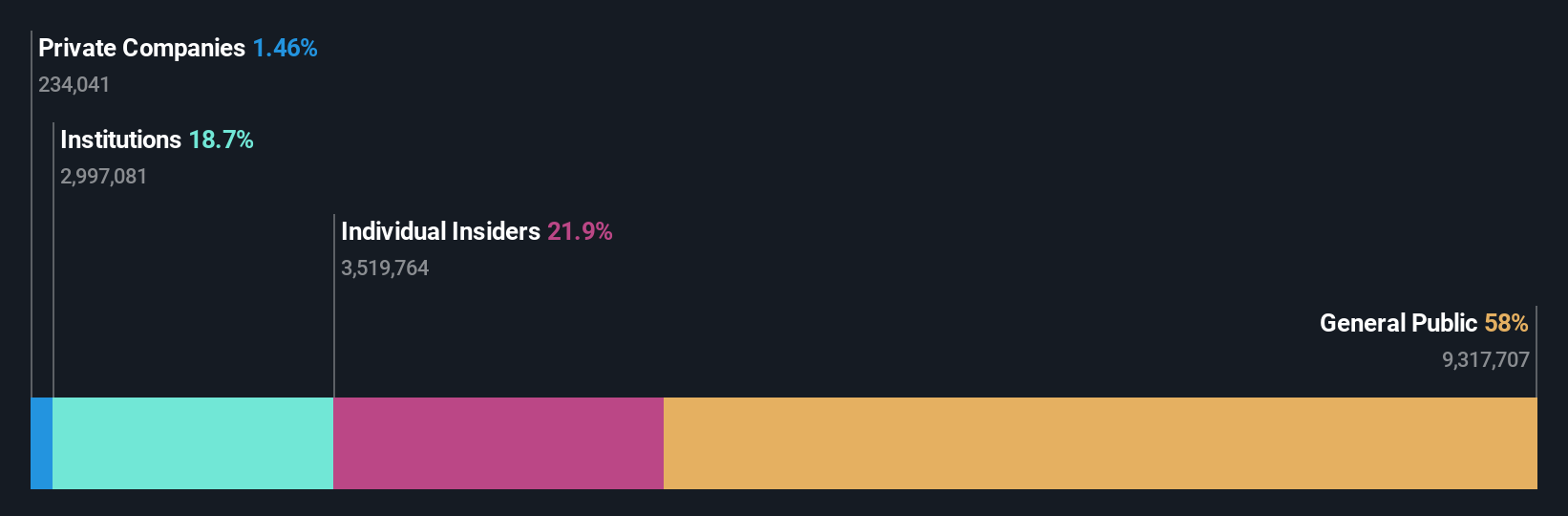

Insider Ownership: 21.9%

goeasy's growth potential is supported by insider confidence, evidenced by more shares bought than sold recently. Earnings have grown 16.4% annually over five years, with future growth forecast at 18.2%, outpacing the Canadian market. Revenue is expected to increase significantly at 29.5% per year. Despite a dividend not well-covered by free cash flow, goeasy trades below its estimated fair value and has completed a CAD 70.8 million share buyback, indicating management's belief in its undervaluation.

- Dive into the specifics of goeasy here with our thorough growth forecast report.

- The analysis detailed in our goeasy valuation report hints at an deflated share price compared to its estimated value.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stingray Group Inc. is a music, media, and technology company operating in Canada, the United States, and internationally with a market cap of CA$708.60 million.

Operations: The company generates revenue from its Radio segment, amounting to CA$132.35 million, and its Broadcasting and Commercial Music segment, which brings in CA$254.54 million.

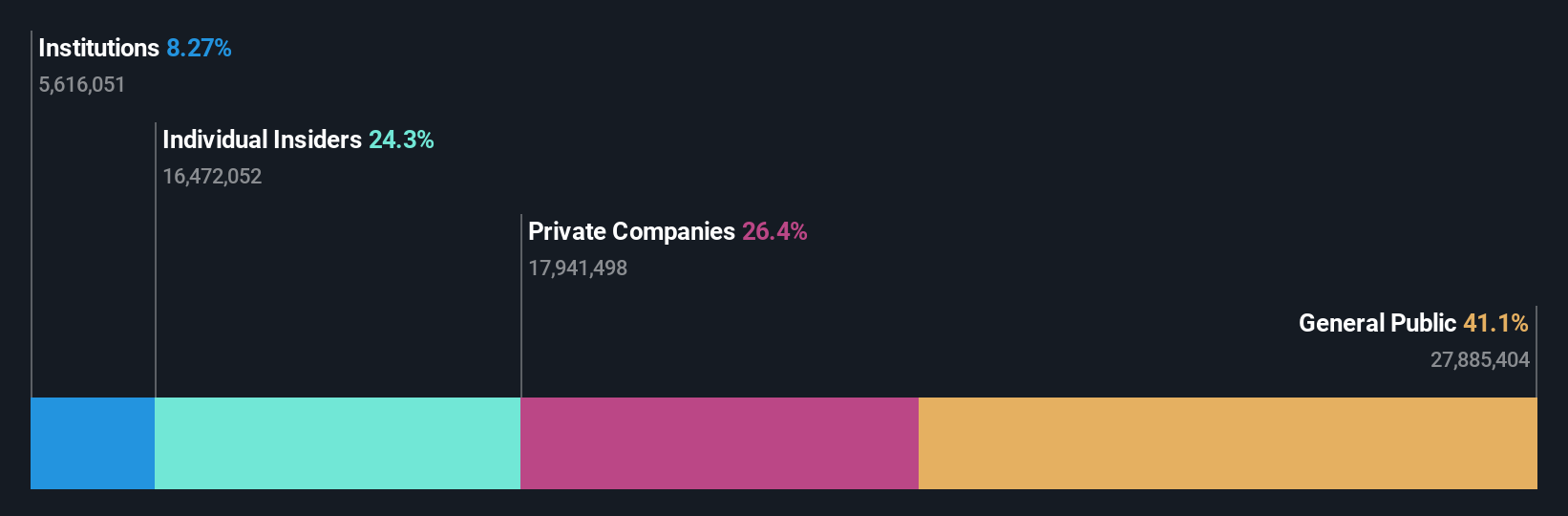

Insider Ownership: 22.8%

Stingray Group's growth trajectory is bolstered by significant insider ownership, with earnings forecast to grow 30.8% annually, surpassing the Canadian market. Despite trading 62.4% below estimated fair value, it carries high debt levels. Recent profitability and a reliable 2.81% dividend enhance its appeal, while strategic moves like digital signage at BMO's new branch showcase innovation. Executive changes include François-Charles Sirois not seeking re-election and an interim CFO appointment due to health reasons of the current CFO.

- Unlock comprehensive insights into our analysis of Stingray Group stock in this growth report.

- According our valuation report, there's an indication that Stingray Group's share price might be on the cheaper side.

Turning Ideas Into Actions

- Get an in-depth perspective on all 47 Fast Growing TSX Companies With High Insider Ownership by using our screener here.

- Curious About Other Options? The end of cancer? These 25 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RAY.A

Stingray Group

Operates as a music, media, and technology company in Canada, the United States, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives