- Canada

- /

- Metals and Mining

- /

- TSXV:THX

TSX Penny Stocks With Market Caps Over CA$6M To Watch

Reviewed by Simply Wall St

As the Canadian market navigates the current landscape, recent volatility has been driven by shifts in sentiment around artificial intelligence valuations and broader economic indicators. Despite these fluctuations, corporate fundamentals remain strong, suggesting opportunities for investors willing to explore diverse sectors. Penny stocks, though an older term, continue to represent potential value for those interested in smaller or newer companies with solid financial foundations. In this article, we explore a selection of penny stocks that stand out due to their financial strength and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.20 | CA$55.62M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.19 | CA$220.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.51M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.10 | CA$731.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.08 | CA$21.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.17 | CA$928.32M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.81 | CA$142.62M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.13 | CA$201.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.73 | CA$9.08M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 417 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

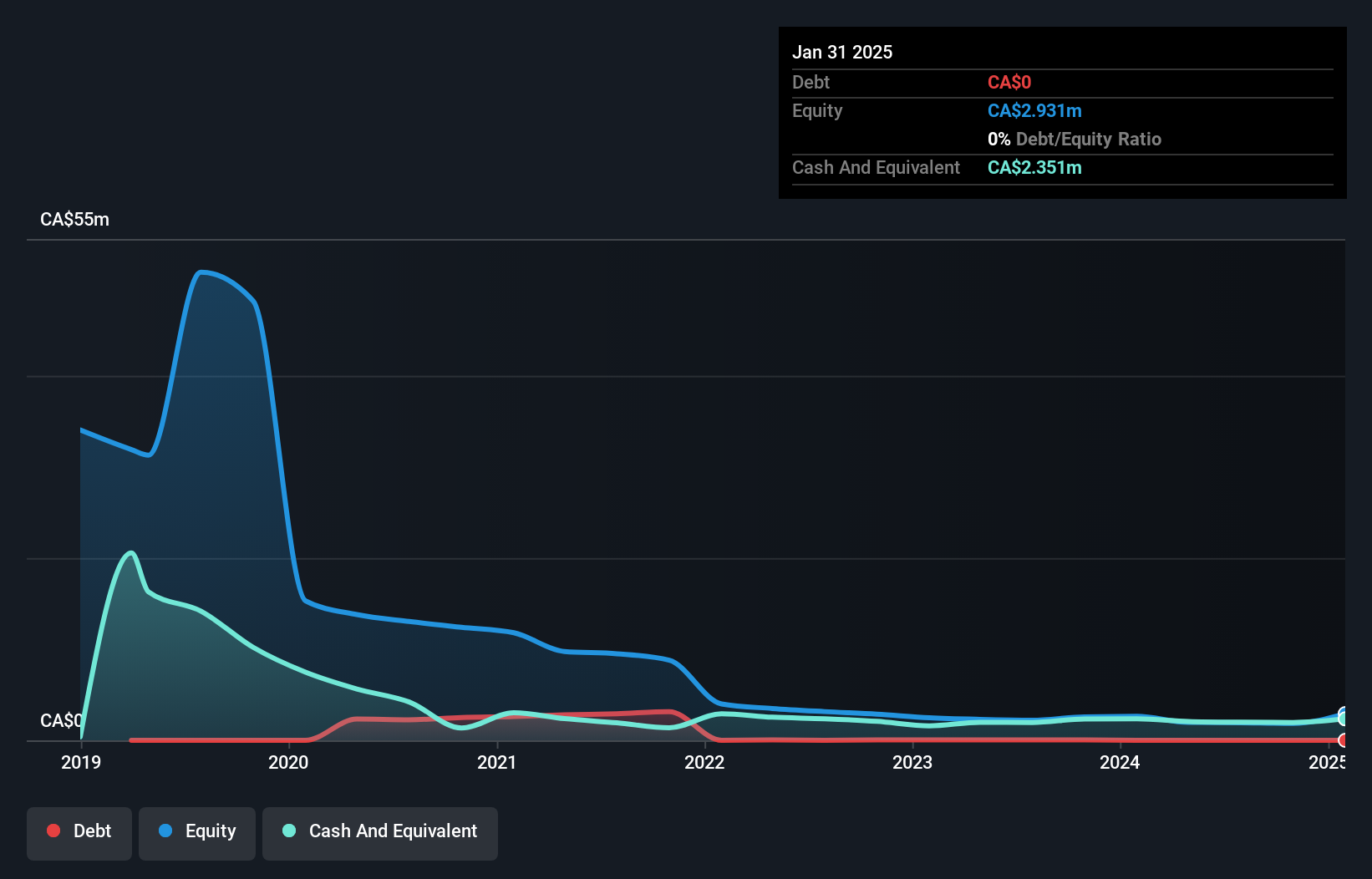

Stock Trend Capital (CNSX:PUMP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stock Trend Capital Inc. is an investment company focused on the crypto, Canadian cannabis, and artificial intelligence industries, with a market cap of CA$6.60 million.

Operations: The company's revenue segment, Corporate and Development, reported a figure of -CA$0.22 million.

Market Cap: CA$6.6M

Stock Trend Capital Inc., with a market cap of CA$6.60 million, is pre-revenue and focuses on the crypto, Canadian cannabis, and AI sectors. Despite becoming profitable this year with high-quality earnings and a strong return on equity of 25.5%, the company faces concerns about its ability to continue as a going concern according to its auditor's recent report. The stock has experienced significant volatility over the past three months but offers potential value with a price-to-earnings ratio below the Canadian market average. Management is experienced, though short-term financial stability remains uncertain due to ongoing losses.

- Click to explore a detailed breakdown of our findings in Stock Trend Capital's financial health report.

- Examine Stock Trend Capital's past performance report to understand how it has performed in prior years.

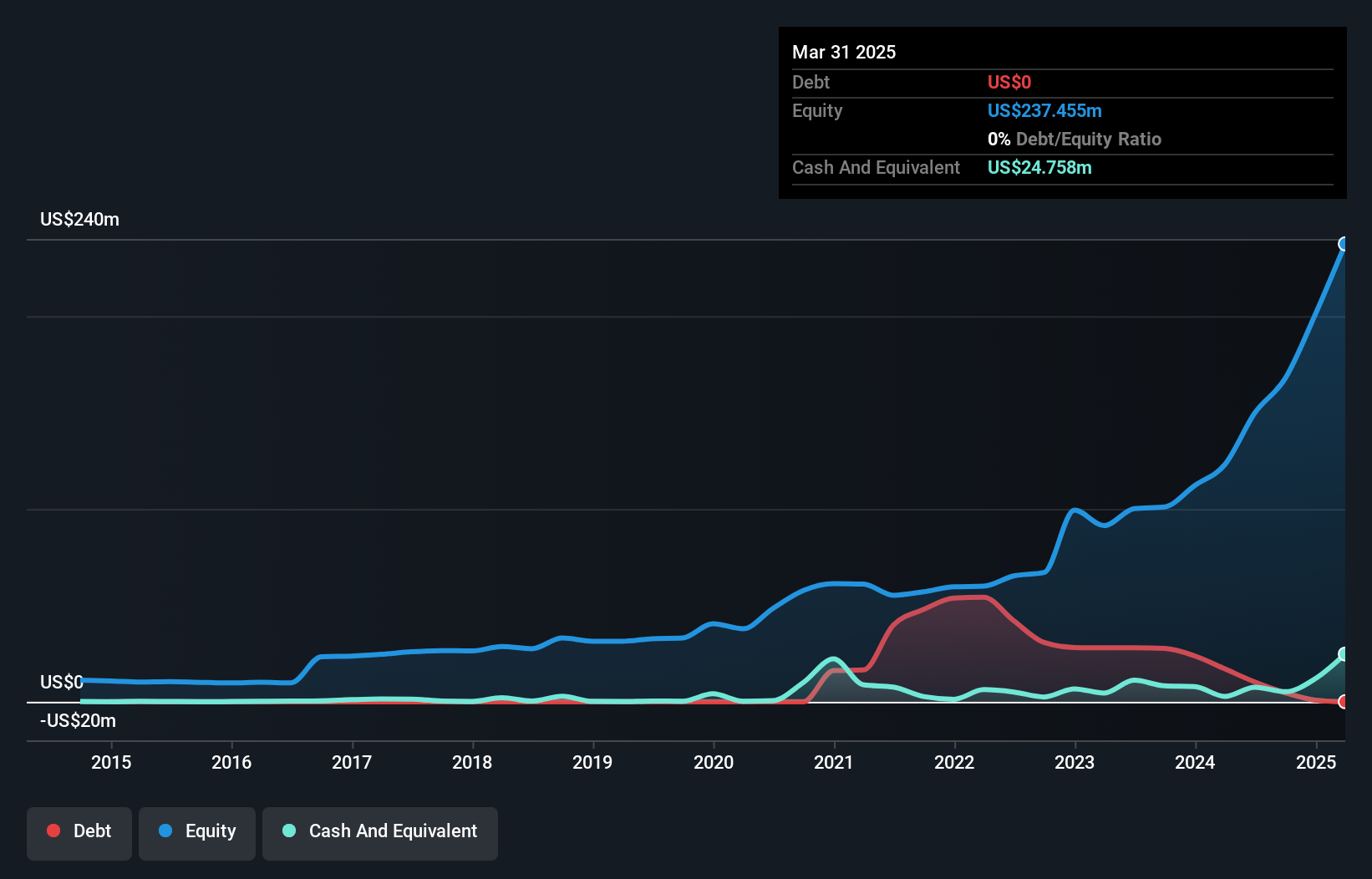

Thor Explorations (TSXV:THX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thor Explorations Ltd., along with its subsidiaries, operates as a gold producer and explorer with a market cap of CA$731.83 million.

Operations: The company generates revenue primarily from its Segilola Mine Project, which contributed $252.80 million.

Market Cap: CA$731.83M

Thor Explorations Ltd. has shown robust financial performance, with a market cap of CA$731.83 million and significant revenue from its Segilola Mine Project, totaling US$252.80 million. The company is trading at 79.3% below its estimated fair value and boasts an outstanding return on equity of 48.8%. Despite a forecasted earnings decline over the next three years, Thor's current net profit margins have improved significantly from last year, reaching 54.4%. The company remains debt-free and has recently expanded its interest in the Douta Gold Project to full ownership, enhancing its resource base for future growth opportunities.

- Navigate through the intricacies of Thor Explorations with our comprehensive balance sheet health report here.

- Gain insights into Thor Explorations' future direction by reviewing our growth report.

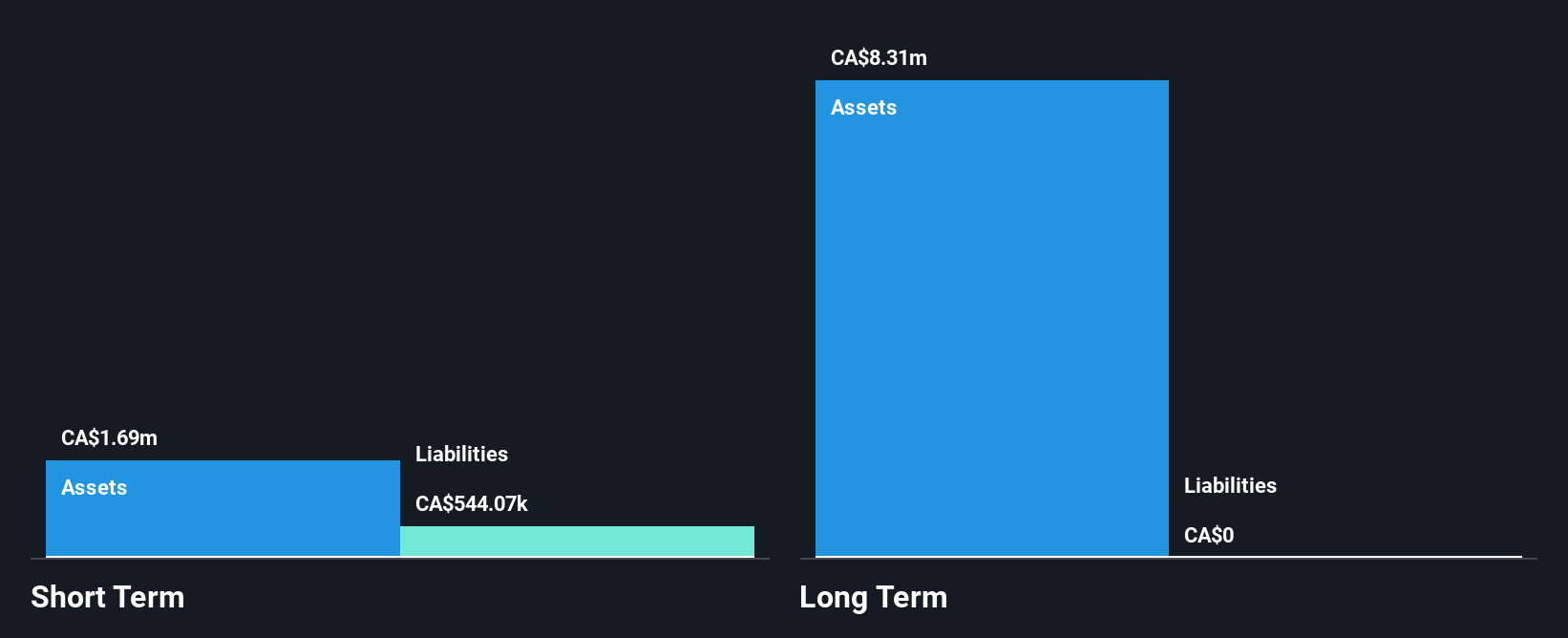

Viscount Mining (TSXV:VML)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viscount Mining Corp. focuses on the evaluation and exploration of mineral properties in the United States, with a market cap of CA$72.08 million.

Operations: Viscount Mining Corp. currently does not report any revenue segments as it is focused on the evaluation and exploration of mineral properties in the United States.

Market Cap: CA$72.08M

Viscount Mining Corp., with a market cap of CA$72.08 million, is pre-revenue and focuses on mineral exploration in the United States. The company recently advanced its Silver Cliff Project in Colorado, targeting both silver and copper-gold deposits. Noteworthy is their NI 43-101 compliant resource at the Kate Silver Resource, hosting 10.3 million ounces measured and indicated at an average grade of 72 g/t silver. Despite being debt-free, Viscount faces financial constraints with less than a year of cash runway based on current free cash flow trends, highlighting potential funding challenges as it progresses exploration efforts.

- Click here and access our complete financial health analysis report to understand the dynamics of Viscount Mining.

- Evaluate Viscount Mining's historical performance by accessing our past performance report.

Make It Happen

- Reveal the 417 hidden gems among our TSX Penny Stocks screener with a single click here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thor Explorations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:THX

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives