- Canada

- /

- Energy Services

- /

- TSXV:SDI

3 TSX Penny Stocks With Market Caps Over CA$20M

Reviewed by Simply Wall St

Summer temperatures are heating up, and so is the stock market. Investors have little to complain about so far this season, with the TSX climbing steadily and not registering a single move greater than 1% in either direction for three months. This stretch of low volatility and consistent gains has been supported by a backdrop of easing uncertainty and growing clarity across key policy fronts. Penny stocks, often smaller or newer companies, can offer intriguing opportunities when backed by solid financials. While the term might evoke earlier market trends, these stocks remain relevant as they provide potential value and growth that larger firms sometimes miss.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Foraco International (TSX:FAR) | CA$1.60 | CA$160.77M | ✅ 4 ⚠️ 1 View Analysis > |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.73 | CA$492.32M | ✅ 3 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.58 | CA$99M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.91 | CA$194.9M | ✅ 2 ⚠️ 1 View Analysis > |

| Avino Silver & Gold Mines (TSX:ASM) | CA$4.44 | CA$638.9M | ✅ 3 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.91 | CA$168.32M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.89 | CA$186.17M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.40 | CA$7.19M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 451 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Nickel 28 Capital (TSXV:NKL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nickel 28 Capital Corp. is a base metals company with operations in Papua New Guinea, Quebec, British Columbia, Australia, and Yukon, and has a market cap of CA$67.75 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: CA$67.75M

Nickel 28 Capital Corp., with a market cap of CA$67.75 million, is pre-revenue and unprofitable, with losses increasing at 27.3% annually over the past five years. Despite this, its debt-to-equity ratio has improved significantly from 170.9% to 45.7%, and its net debt to equity ratio is satisfactory at 35.1%. The company has adequate short-term assets to cover liabilities but faces challenges with long-term liabilities totaling $40.7 million against $8.8 million in short-term assets. Recent board changes and ongoing legal issues may impact investor confidence, while buybacks indicate management's belief in undervaluation potential.

- Click to explore a detailed breakdown of our findings in Nickel 28 Capital's financial health report.

- Evaluate Nickel 28 Capital's historical performance by accessing our past performance report.

Stampede Drilling (TSXV:SDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Stampede Drilling Inc. offers oilfield services to the oil and natural gas industry in North America, with a market cap of CA$29.99 million.

Operations: The company generates revenue primarily through its contract drilling segment, which accounted for CA$77.98 million.

Market Cap: CA$29.99M

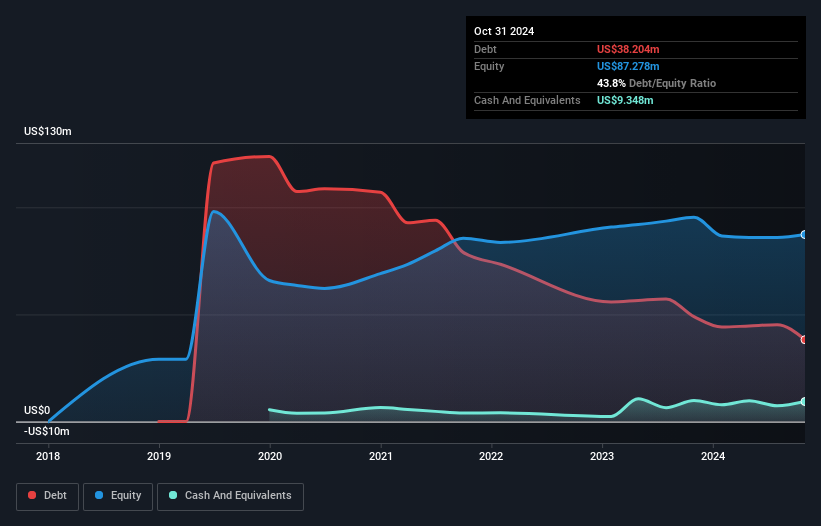

Stampede Drilling Inc., with a market cap of CA$29.99 million, has faced challenges with declining revenues, reporting CA$6.01 million in Q2 2025 compared to CA$9.92 million the previous year, and a net loss of CA$3 million. Despite this, its debt management is satisfactory, with a net debt to equity ratio of 21.2% and operating cash flow covering 93.6% of its debt. The company extended its credit agreement maturity to 2028 for financial flexibility but struggles with high share price volatility and lower profit margins at 2.1%, down from last year's 13.4%. Earnings are forecasted to grow significantly by analysts at approximately 55% annually.

- Dive into the specifics of Stampede Drilling here with our thorough balance sheet health report.

- Assess Stampede Drilling's future earnings estimates with our detailed growth reports.

Theralase Technologies (TSXV:TLT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Theralase Technologies Inc. is a clinical stage pharmaceutical company focused on the research, development, and commercialization of light activated photodynamic compounds for treating cancers, bacteria, and viruses globally, with a market cap of CA$53.98 million.

Operations: The company generates revenue from its Device segment, amounting to CA$0.95 million.

Market Cap: CA$53.98M

Theralase Technologies, with a market cap of CA$53.98 million, is pre-revenue and focuses on light-activated photodynamic compounds for cancer treatment. Recent private placements raised over CA$1.24 million, providing some financial runway despite its short-term liabilities exceeding assets by CA$0.3 million as of March 2025. The company is progressing in its clinical trials for bladder cancer treatment and plans to submit a New Drug Application to Health Canada and the FDA by late 2026. The promising preclinical results presented at major oncology meetings highlight potential breakthroughs in cancer therapy but underscore the inherent risks associated with clinical-stage biotech investments.

- Click here to discover the nuances of Theralase Technologies with our detailed analytical financial health report.

- Examine Theralase Technologies' earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Take a closer look at our TSX Penny Stocks list of 451 companies by clicking here.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SDI

Stampede Drilling

Provides oilfield services to the oil and natural gas industry in North America.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives