- Canada

- /

- Metals and Mining

- /

- TSXV:MJS

TSX Penny Stocks Under CA$60M Market Cap: Discovering Promising Opportunities

Reviewed by Simply Wall St

As the Canadian TSX index experiences a modest 3% rise amidst stabilizing yields and contained inflation, investors are increasingly looking for opportunities in smaller, potentially high-growth segments of the market. Penny stocks, while an older term, continue to capture attention due to their ability to represent smaller or newer companies with significant upside potential. By focusing on those with strong financials and clear growth paths, investors can uncover promising opportunities within this intriguing investment area.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.78 | CA$175.48M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.73 | CA$453.58M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.04M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$641.48M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$379.19M | ★★★★★☆ |

| New Gold (TSX:NGD) | CA$3.89 | CA$3.2B | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$1.92 | CA$192.45M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.04 | CA$210.81M | ★★★★☆☆ |

Click here to see the full list of 938 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

InnoCan Pharma (CNSX:INNO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: InnoCan Pharma Corporation is a pharmaceutical technology company that develops drug delivery platforms combining cannabidiol (CBD) with other pharmaceutical ingredients across the United States, Canada, Europe, and internationally, with a market cap of CA$66.73 million.

Operations: The company generates revenue primarily from online sales, amounting to $28.86 million.

Market Cap: CA$66.73M

InnoCan Pharma Corporation, with a market cap of CA$66.73 million, remains pre-revenue and unprofitable but has shown progress by reducing losses over the past five years. Its innovative LPT-CBD platform has recently gained traction with a patent in India and positive feedback from the FDA for chronic pain management applications. Despite high volatility and negative return on equity, InnoCan benefits from being debt-free and having sufficient short-term assets to cover liabilities. The company also maintains a cash runway for 1.5 years, supported by recent private placements totaling CAD 635,444.60 to bolster its financial position further.

- Take a closer look at InnoCan Pharma's potential here in our financial health report.

- Gain insights into InnoCan Pharma's past trends and performance with our report on the company's historical track record.

Foraco International (TSX:FAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Foraco International SA, with a market cap of CA$192.45 million, offers drilling services across North America, Europe, the Middle East, Africa, South America, and the Asia Pacific.

Operations: Foraco International's revenue is derived from two main segments: Water, contributing $38.15 million, and Mining, generating $255.31 million.

Market Cap: CA$192.45M

Foraco International, with a market cap of CA$192.45 million, shows a mixed financial picture. Despite negative earnings growth over the past year, its net profit margins have improved from 7.8% to 9.5%. The company’s revenue is primarily driven by its mining segment at US$255.31 million and water services at US$38.15 million, with no pre-revenue concerns. Foraco's short-term assets of US$102.7 million comfortably cover both short- and long-term liabilities, though it carries a high net debt to equity ratio of 67.2%. Recent earnings reported an increase in net income to US$3.36 million for Q4 2024 compared to the previous year.

- Click to explore a detailed breakdown of our findings in Foraco International's financial health report.

- Assess Foraco International's future earnings estimates with our detailed growth reports.

Majestic Gold (TSXV:MJS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Majestic Gold Corp. is a mining company engaged in the exploration, development, and operation of mining properties in China, Australia, and Canada, with a market cap of CA$93.84 million.

Operations: The company generates $66.19 million from its activities related to the exploration, development, and operation of mining properties.

Market Cap: CA$93.84M

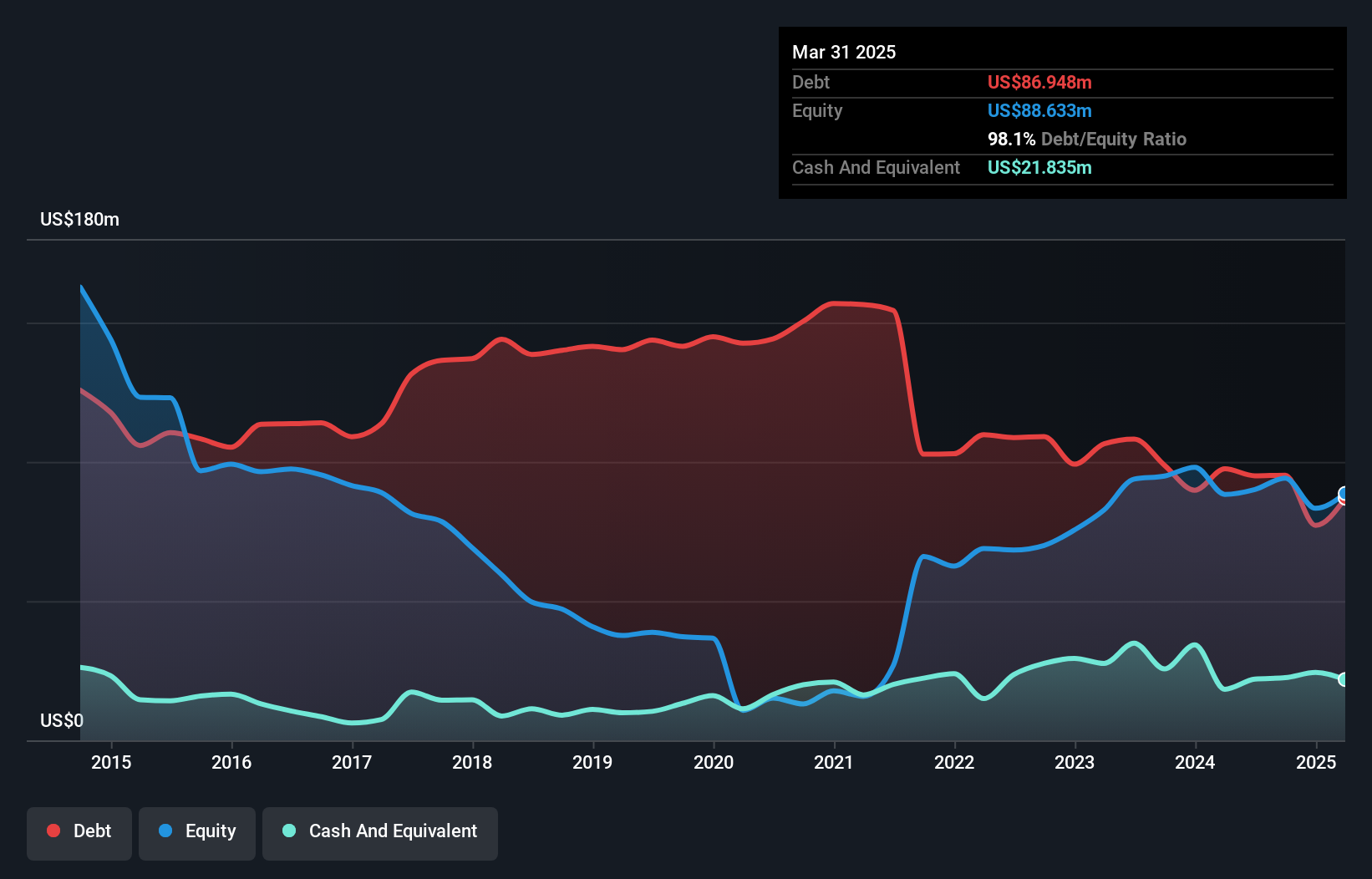

Majestic Gold Corp., with a market cap of CA$93.84 million, has demonstrated solid financial performance with earnings growth of 36% over the past year, outpacing the Metals and Mining industry. The company reported sales of US$51.97 million for the first nine months of 2024, alongside a net income increase to US$8.58 million. Majestic Gold is debt-free, enhancing its financial stability, and its short-term assets significantly exceed liabilities. Despite trading at 65.6% below estimated fair value and having stable weekly volatility at 10%, it maintains high-quality earnings without shareholder dilution concerns in the past year.

- Dive into the specifics of Majestic Gold here with our thorough balance sheet health report.

- Explore historical data to track Majestic Gold's performance over time in our past results report.

Seize The Opportunity

- Navigate through the entire inventory of 938 TSX Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MJS

Majestic Gold

A mining company, focuses on exploration, development, and operation of mining properties in China, Australia, and Canada.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives