- Canada

- /

- Metals and Mining

- /

- TSXV:MAI

Minera Alamos (TSXV:MAI) Net Loss Hits CA$1.6M, Undermining Profitability Turnaround Narrative

Reviewed by Simply Wall St

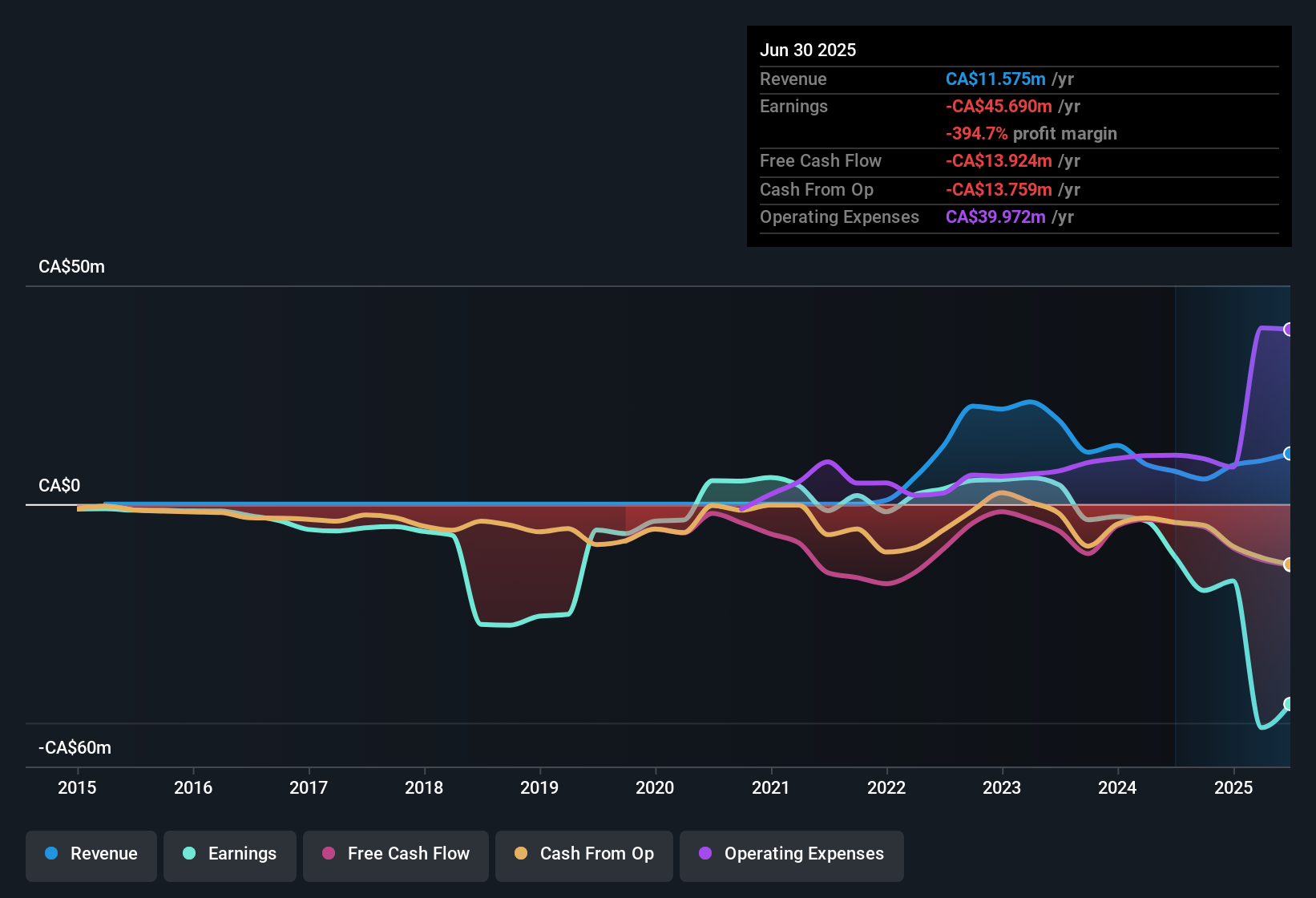

Minera Alamos (TSXV:MAI) just released its Q3 2025 financial results, reporting revenue of CA$3.1 million and a net loss of CA$1.6 million for the quarter, translating to an EPS of -CA$0.003. The company has seen revenue move from CA$2.5 million in Q1 2024, dip to CA$0 in Q3 2024, then build back up to the CA$3.1 million just reported. During this time, EPS and net income figures shifted between positive and negative. Margins remain under pressure as the business continues working towards sustainable profitability.

See our full analysis for Minera Alamos.The next step is to measure these results against the dominant narratives. Sometimes the numbers will fit the storyline and sometimes they will prompt a reassessment.

Curious how numbers become stories that shape markets? Explore Community Narratives

Annual Net Losses Deepen to CA$45.7 Million

- For the trailing twelve months, Minera Alamos reported a net loss of CA$45.7 million, a significant figure that reflects deepening losses compared to prior annual trends.

- Despite these heavy losses, the prevailing market view points to unusually aggressive forward estimates. Analysts project that earnings could rebound at a pace of 52.65% annually over the next three years.

- This rapid growth outlook heavily contrasts with the consistent negative net income reported over the past year.

- Market optimism is further challenged by the reality that profit margins showed no improvement in the latest filings. This highlights the gap between projections and current results.

- The consensus perspective underscores that while long-term forecasts are bright, durable profitability remains unproven given the magnitude of current losses.

Consensus expectations hinge on an impressive turnaround, but data shows losses are still growing. See whether the full consensus narrative explains the disconnect. 📊 Read the full Minera Alamos Consensus Narrative.

High Price-to-Sales Multiple Signals Growth Expectations

- Minera Alamos currently trades at a Price-to-Sales ratio of 41.1x, markedly higher than both the industry average (6.2x) and the peer group (9.3x). This indicates a steep premium priced in for anticipated future growth.

- Market observers note that, while shares are trading at a substantial discount to DCF fair value (CA$0.45 versus CA$1.11), this premium P/S multiple:

- sends a clear signal that current investors are betting heavily on future revenue expansion, and

- raises the stakes for management to deliver on ambitious growth forecasts to justify the elevated valuation relative to the sector.

Shareholder Dilution Weighs on Recovery Story

- Significant shareholder dilution occurred over the last twelve months, deeply impacting per-share performance even as the path to profitability is forecast to accelerate.

- Critics highlight that ongoing share issuance pits new capital against existing holders.

- This potentially undermines upside from the projected rapid growth in earnings and revenue, and

- adds skepticism that recovery in profitability will translate to proportional per-share gains for current investors.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Minera Alamos's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Minera Alamos is experiencing deepening losses, pressured margins, and ongoing dilution. These factors raise concerns about its ability to achieve reliable profitability.

If you want to focus on companies consistently delivering steady performance and reliable growth, discover stable growth stocks screener (2084 results) as a smarter, more predictable alternative right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MAI

Minera Alamos

Engages in the acquisition, exploration, development, and operation of mineral properties in Mexico.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026