- Canada

- /

- Metals and Mining

- /

- TSXV:HPY

TSX Opportunities: Happy Creek Minerals And 2 More Promising Penny Stocks

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of manageable yet unresolved inflation and potential rate cuts by the Fed, investors are keenly observing opportunities that may arise from these economic shifts. Penny stocks, though an older term, continue to represent intriguing prospects for those interested in smaller or less-established companies with potential for growth. By focusing on stocks with strong financials and clear growth paths, investors can uncover promising opportunities within this often-overlooked segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.63 | CA$63.72M | ✅ 3 ⚠️ 4 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.235 | CA$1.96M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.32 | CA$48.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.04 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.88 | CA$598.77M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.17 | CA$352.05M | ✅ 2 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.95 | CA$195.41M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.92 | CA$183.67M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.69 | CA$7.99M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 428 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Happy Creek Minerals (TSXV:HPY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Happy Creek Minerals Ltd. is involved in the acquisition, exploration, and development of mineral properties in Canada with a market cap of CA$20.66 million.

Operations: Happy Creek Minerals Ltd. does not report any revenue segments.

Market Cap: CA$20.66M

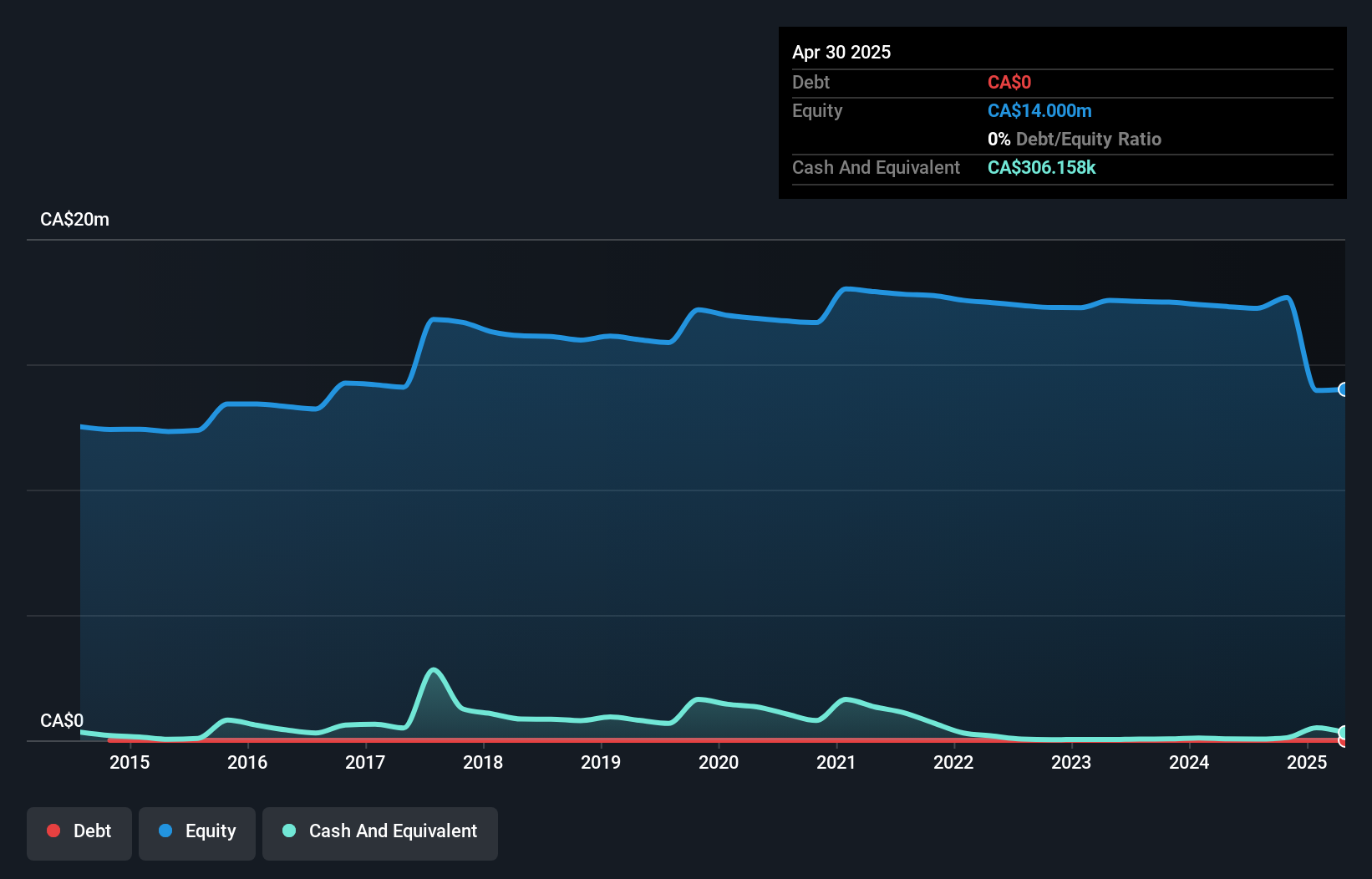

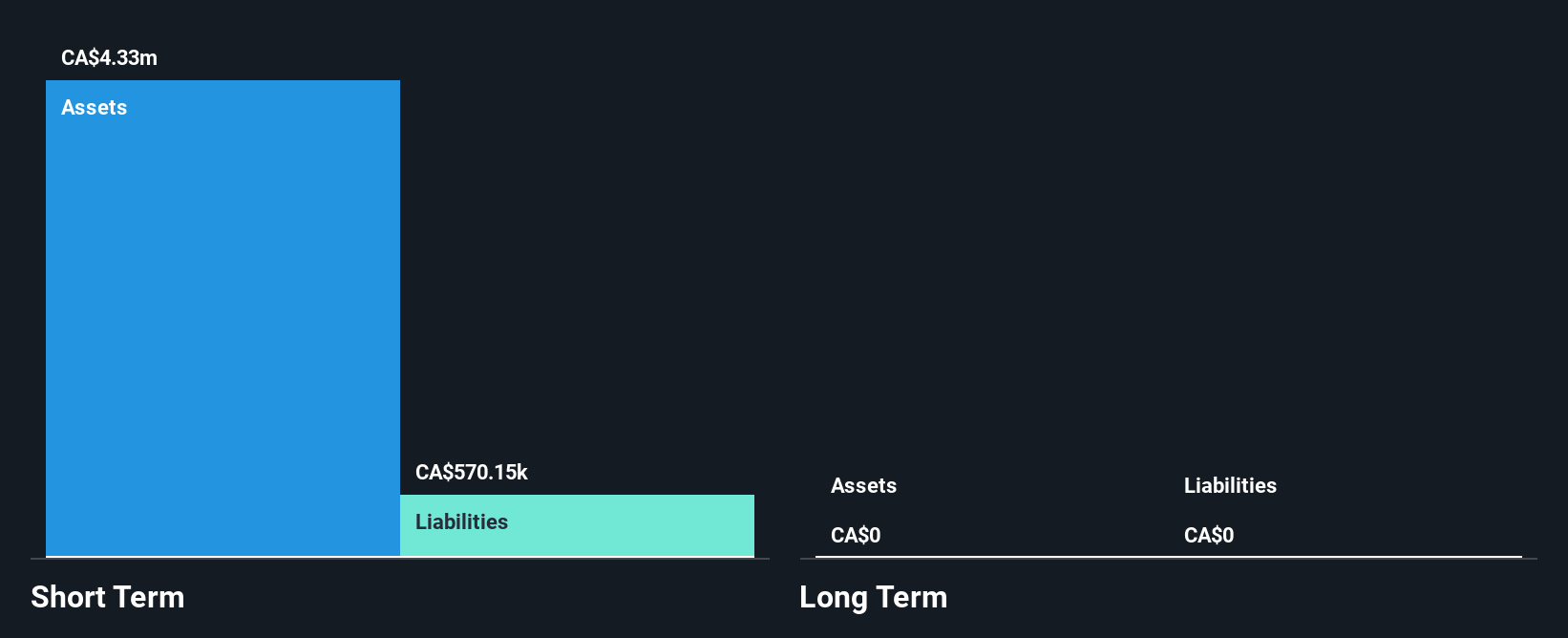

Happy Creek Minerals Ltd., with a market cap of CA$20.66 million, is pre-revenue and has faced increasing losses over the past five years. Despite its unprofitability, the company remains debt-free and recently raised CA$3.75 million through private placements to bolster its cash runway beyond the current 4-5 month estimate. Its management team and board are considered experienced, but volatility remains high relative to other Canadian stocks. The auditor's doubt about its going concern status underscores financial challenges, though short-term assets exceed both short- and long-term liabilities, providing some balance sheet stability in this speculative investment space.

- Navigate through the intricacies of Happy Creek Minerals with our comprehensive balance sheet health report here.

- Explore historical data to track Happy Creek Minerals' performance over time in our past results report.

Patriot Resources (TSXV:MAGA.H)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Patriot Resources Corp. operates in Canada, manufacturing and selling hair care and pet care products with a market cap of CA$10.93 million.

Operations: Patriot Resources Corp. currently does not have any reported revenue segments.

Market Cap: CA$10.93M

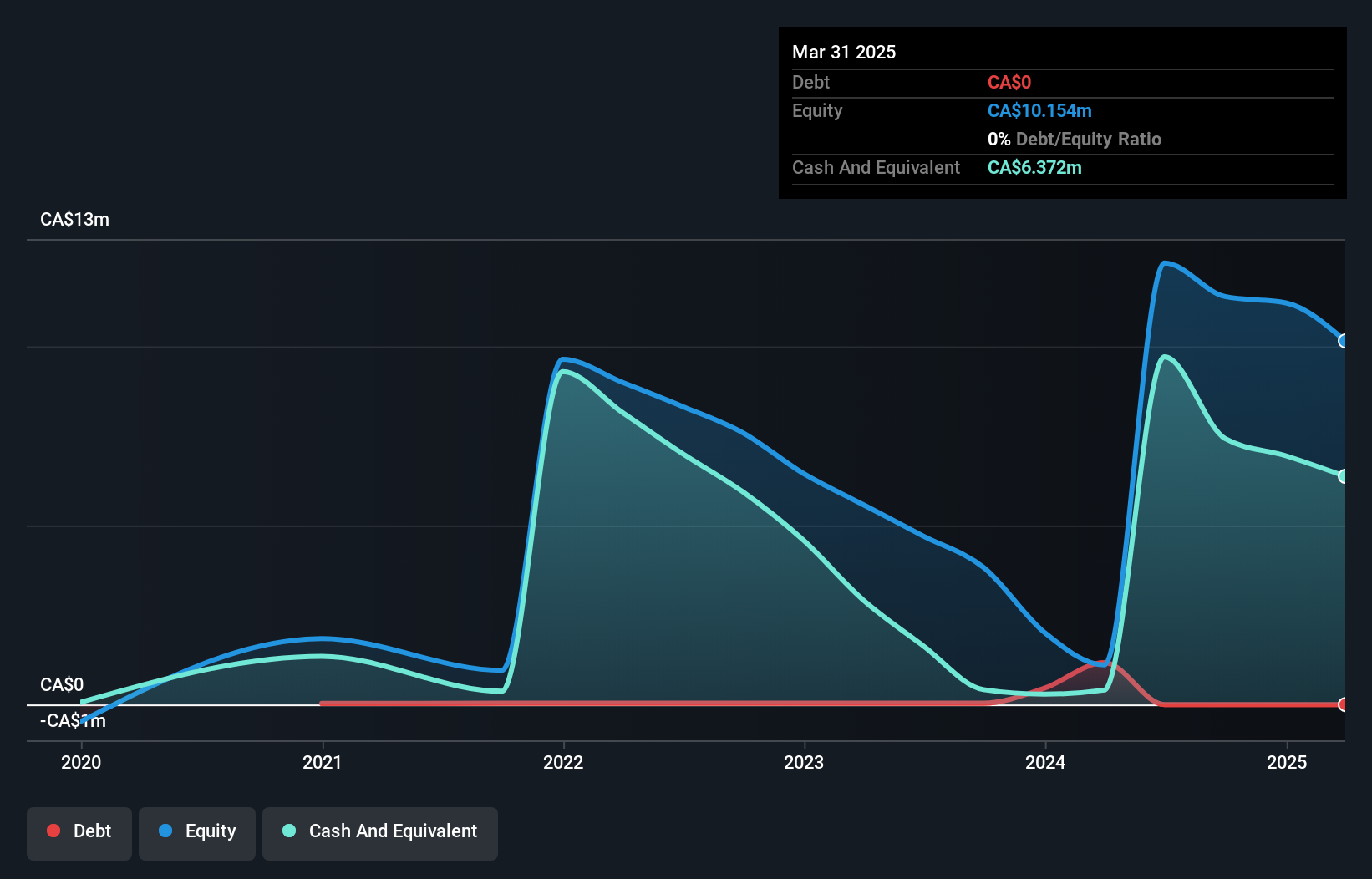

Patriot Resources Corp., with a CA$10.93 million market cap, operates in the hair and pet care product sectors but remains pre-revenue, reporting only CA$4K in revenue. Despite this, it maintains a strong financial position with no debt and sufficient cash runway for over three years based on current free cash flow. The management team and board are experienced, averaging over three years of tenure each. While unprofitable, Patriot has reduced its losses by 39% annually over five years. Recent quarterly results show improvement with net losses decreasing significantly from the previous year’s figures.

- Get an in-depth perspective on Patriot Resources' performance by reading our balance sheet health report here.

- Gain insights into Patriot Resources' past trends and performance with our report on the company's historical track record.

SPARQ Systems (TSXV:SPRQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SPARQ Systems Inc. designs, manufactures, and sells single-phase microinverters for residential and commercial solar electric applications, with a market cap of CA$85.36 million.

Operations: SPARQ Systems Inc. has not reported any revenue segments.

Market Cap: CA$85.36M

SPARQ Systems Inc., with a market cap of CA$85.36 million, remains unprofitable but debt-free, and its short-term assets exceed liabilities. Despite lacking significant revenue (CA$2M), the company has more than a year of cash runway based on current free cash flow trends. Recent developments include commencing commercial production of microinverters in India, potentially enhancing future revenue streams. Earnings results for Q1 2025 showed a net loss of CA$1.07 million, consistent with previous losses per share from continuing operations at CA$0.01. The board is experienced, though management tenure data is insufficient to assess experience levels fully.

- Click here to discover the nuances of SPARQ Systems with our detailed analytical financial health report.

- Assess SPARQ Systems' previous results with our detailed historical performance reports.

Seize The Opportunity

- Navigate through the entire inventory of 428 TSX Penny Stocks here.

- Ready To Venture Into Other Investment Styles? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Happy Creek Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HPY

Happy Creek Minerals

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives