- Canada

- /

- Metals and Mining

- /

- TSXV:HAN

TSX Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

As the year draws to a close, the Canadian market has navigated through policy shifts and global uncertainties, yet remains on track for its strongest calendar-year return since 2009. In this context of resilience and growth, investors might find opportunities in lesser-known corners of the market. Penny stocks, often representing smaller or newer companies, still hold potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.08 | CA$52.58M | ✅ 3 ⚠️ 3 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.08 | CA$233.05M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.44 | CA$145.14M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.34 | CA$51.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.29 | CA$858.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.14 | CA$22.59M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.78 | CA$141.1M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.17 | CA$205.34M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.78 | CA$10.64M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 392 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Alta Copper (TSX:ATCU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alta Copper Corp. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada and Peru, with a market cap of CA$87.51 million.

Operations: Currently, there are no reported revenue segments for this mineral exploration company focused on properties in Canada and Peru.

Market Cap: CA$87.51M

Alta Copper Corp. operates as a pre-revenue mineral exploration company with a market cap of CA$87.51 million, focusing on properties in Canada and Peru. Despite being debt-free, its financial position is constrained by less than a year of cash runway and no significant revenue streams. Recent earnings reports show reduced net losses compared to previous periods, indicating some cost management improvements. The experienced board and management team have maintained stability without shareholder dilution over the past year, yet the company's negative return on equity reflects ongoing unprofitability challenges in achieving profitable growth within the competitive metals and mining sector.

- Get an in-depth perspective on Alta Copper's performance by reading our balance sheet health report here.

- Evaluate Alta Copper's historical performance by accessing our past performance report.

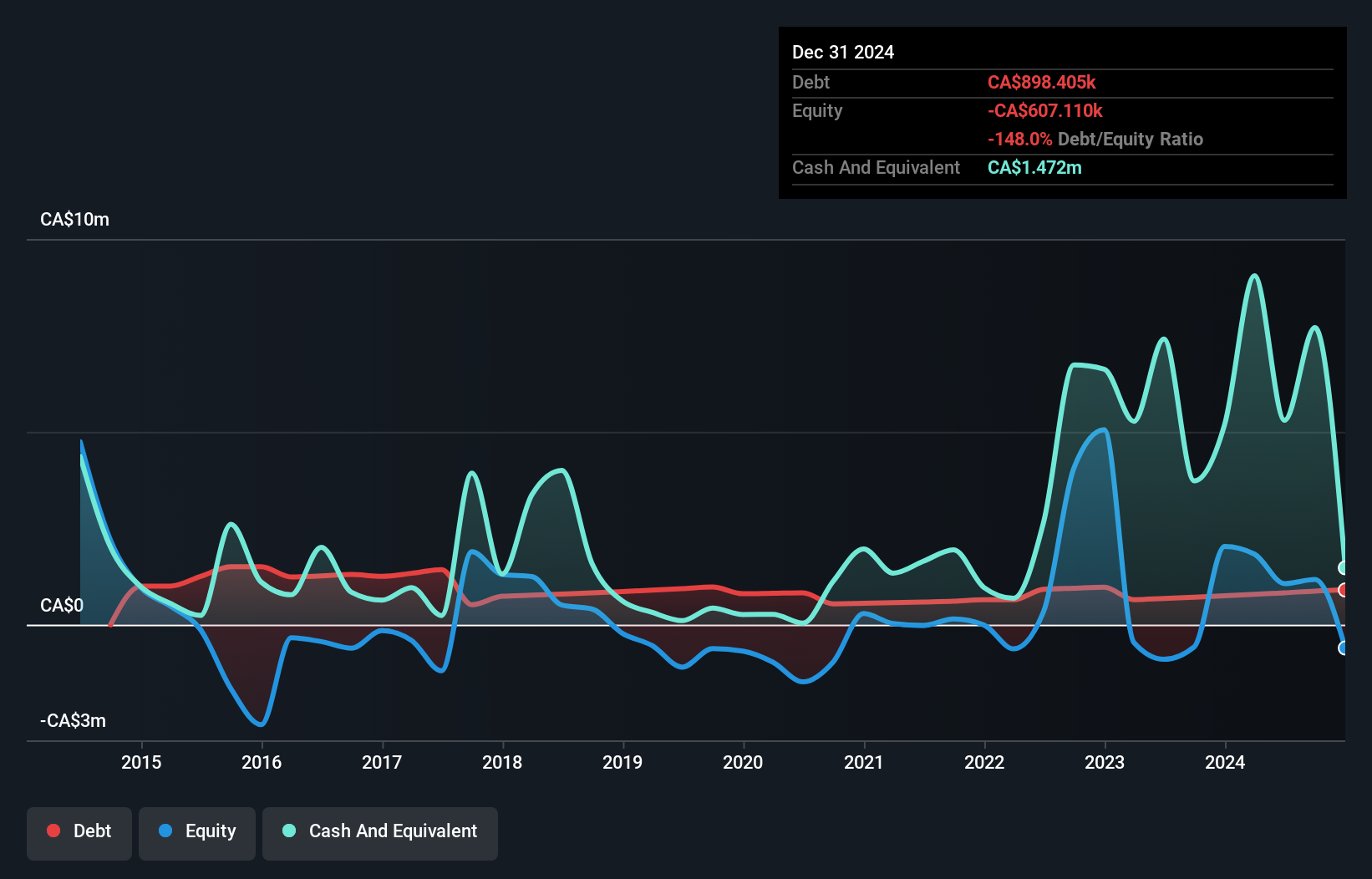

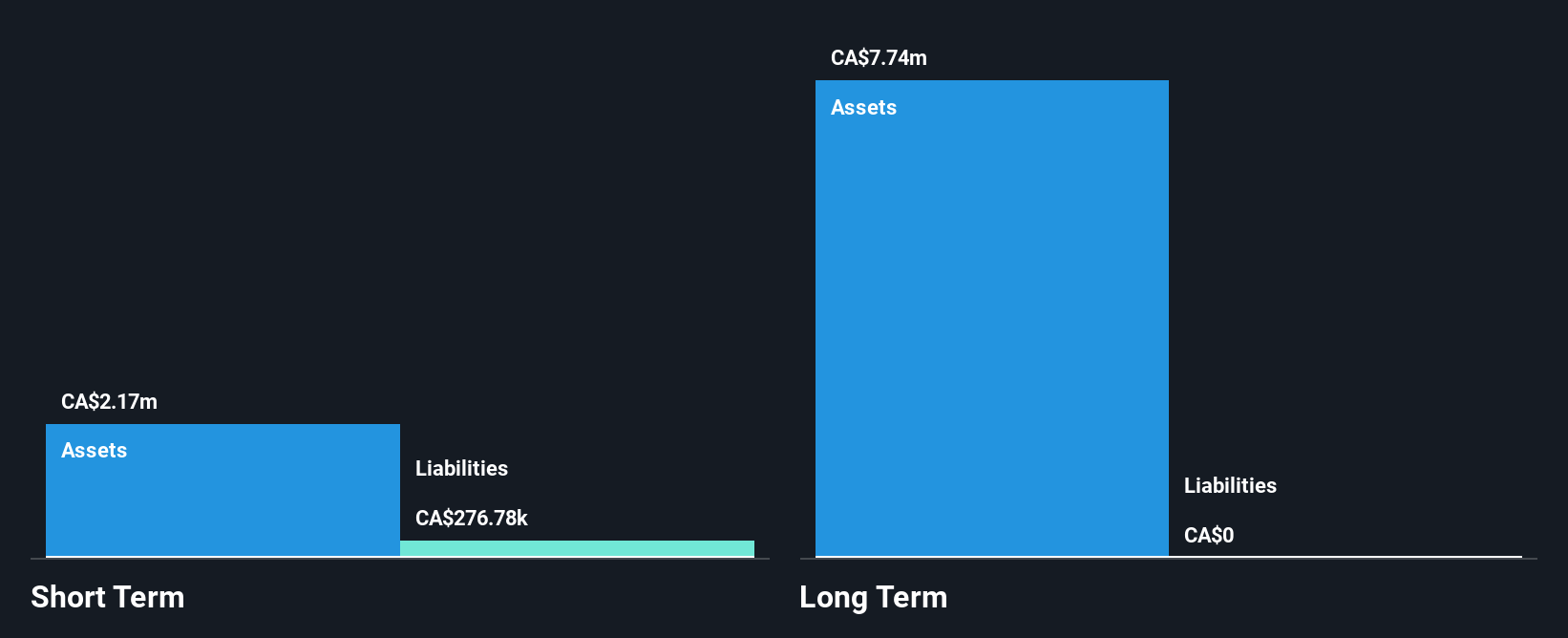

Amarc Resources (TSXV:AHR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amarc Resources Ltd. focuses on acquiring, exploring, and developing mineral properties in Canada with a market cap of CA$250.11 million.

Operations: No revenue segments are reported for this company.

Market Cap: CA$250.11M

Amarc Resources Ltd., with a market cap of CA$250.11 million, is a pre-revenue mineral exploration company focusing on expanding its AuRORA Deposit in the JOY District. Recent drilling results indicate promising high-grade copper-gold-silver mineralization, suggesting potential for significant expansion. The 2025 exploration program, funded by Freeport-McMoRan Mineral Properties Canada Inc., underscores confidence in the project's prospects. Despite being unprofitable and having negative return on equity, Amarc's seasoned management and board offer stability. The company maintains more cash than debt but faces challenges with short-term liabilities slightly exceeding assets and limited cash runway if free cash flow continues to decline.

- Dive into the specifics of Amarc Resources here with our thorough balance sheet health report.

- Learn about Amarc Resources' historical performance here.

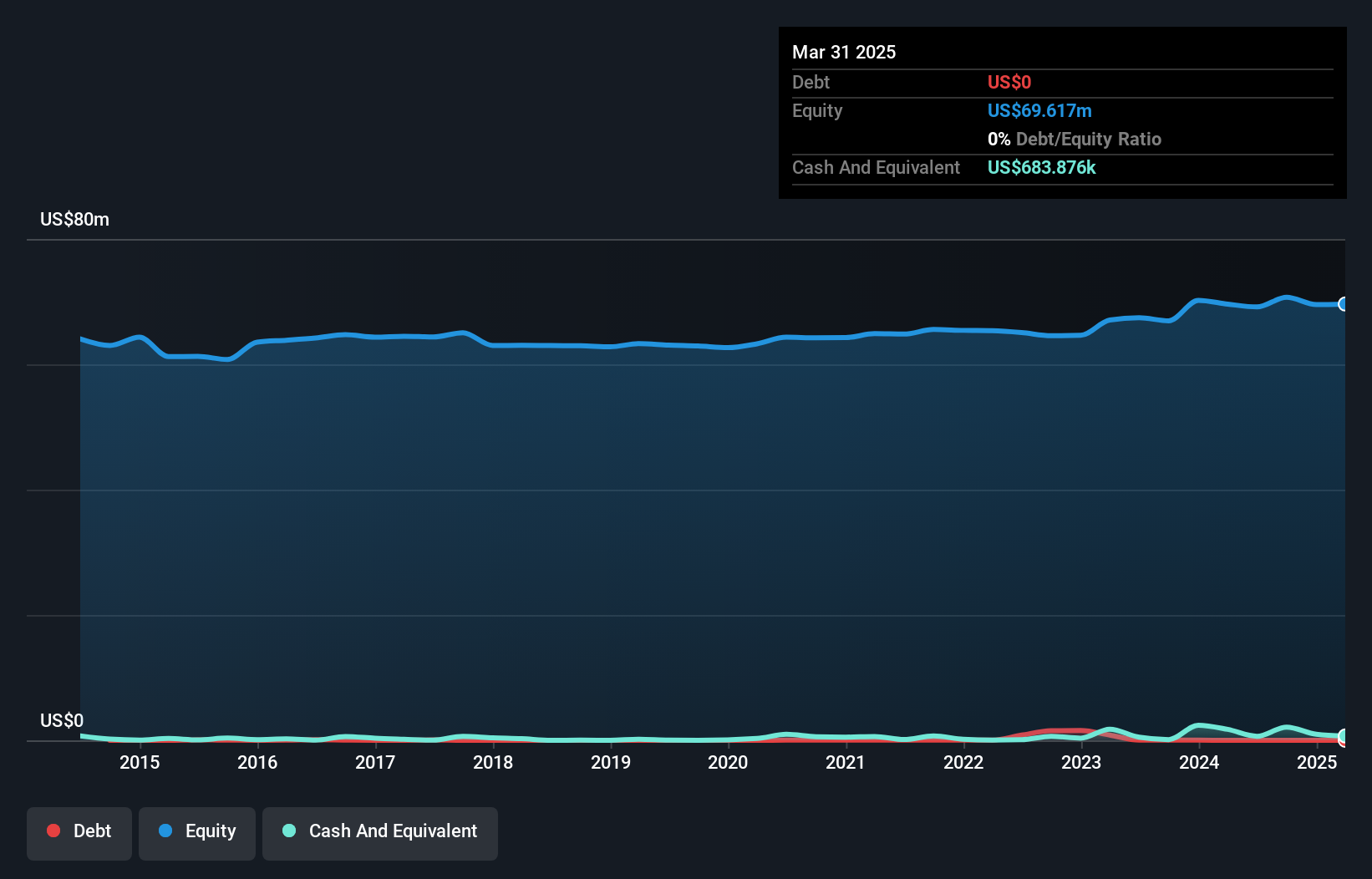

Hannan Metals (TSXV:HAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hannan Metals Ltd. is a junior mineral exploration company focused on acquiring and exploring mineral properties in Canada, Ireland, and Peru, with a market cap of CA$112.38 million.

Operations: Currently, the company does not report any revenue segments.

Market Cap: CA$112.38M

Hannan Metals Ltd., with a market cap of CA$112.38 million, is a pre-revenue mineral exploration company focusing on projects in Canada, Ireland, and Peru. Recent fieldwork at its Valiente project in Peru has identified high-grade gold and silver mineralization, suggesting potential for district-scale expansion. Despite being unprofitable with increasing losses over the past five years, Hannan remains debt-free and recently announced a private placement to raise up to CA$5 million. The company's seasoned management team and board provide stability as they navigate challenges such as limited cash runway while exploring promising new mineral zones.

- Click here to discover the nuances of Hannan Metals with our detailed analytical financial health report.

- Understand Hannan Metals' track record by examining our performance history report.

Next Steps

- Embark on your investment journey to our 392 TSX Penny Stocks selection here.

- Want To Explore Some Alternatives? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hannan Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HAN

Hannan Metals

A junior mineral exploration company, engages in the acquisition and exploration of mineral properties in Canada, Ireland, and Peru.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026