- Canada

- /

- Metals and Mining

- /

- TSXV:DMX

TSX Penny Stocks: 3 Picks With Market Caps Under CA$70M

Reviewed by Simply Wall St

The Canadian market has shown resilience, with the TSX only 4% off its record high, buoyed by a strong performance in the materials sector. In such a climate, investors might consider exploring penny stocks—smaller or newer companies that offer potential growth at lower price points. Despite being an older term, penny stocks can still provide valuable opportunities when they possess robust financials and clear growth trajectories.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.73 | CA$73.84M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.73 | CA$68.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.61 | CA$419.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.90 | CA$1.12B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.08 | CA$580.58M | ✅ 4 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.70 | CA$283.88M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.56 | CA$539.85M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.62 | CA$126.48M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.35 | CA$91.2M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.49 | CA$12.89M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 927 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Alpha Exploration (TSXV:ALEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alpha Exploration Ltd. focuses on acquiring, exploring, and developing mineral resource properties with a market cap of CA$66.66 million.

Operations: Alpha Exploration Ltd. currently does not report any revenue segments.

Market Cap: CA$66.66M

Alpha Exploration Ltd., with a market cap of CA$66.66 million, is a pre-revenue company focused on mineral exploration. Despite no long-term liabilities and no debt, the company's financial stability is uncertain as its auditor expressed doubts about its ability to continue as a going concern. The recent private placement raised CAD 6 million, potentially extending its cash runway beyond three months. Noteworthy drilling results from the Kerkasha license in Eritrea highlight promising prospects for gold and base metals, with plans to define resources by early 2026. However, investors should consider the inherent risks associated with pre-revenue exploration ventures.

- Take a closer look at Alpha Exploration's potential here in our financial health report.

- Review our historical performance report to gain insights into Alpha Exploration's track record.

District Metals (TSXV:DMX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: District Metals Corp. is a junior mineral exploration stage company focused on acquiring, exploring, and evaluating natural resource properties with a market cap of CA$42.03 million.

Operations: District Metals Corp. does not report any revenue segments as it is currently in the exploration stage of its business operations.

Market Cap: CA$42.03M

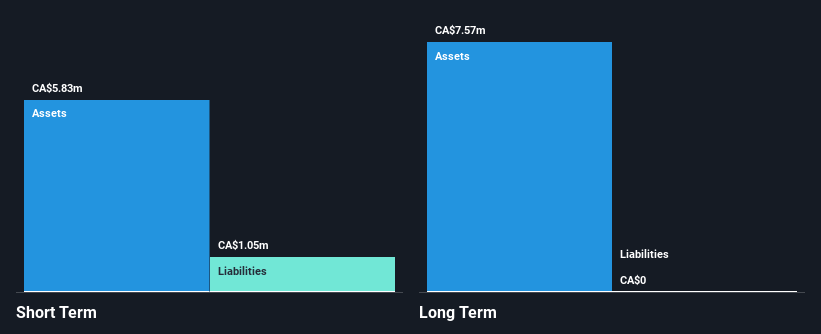

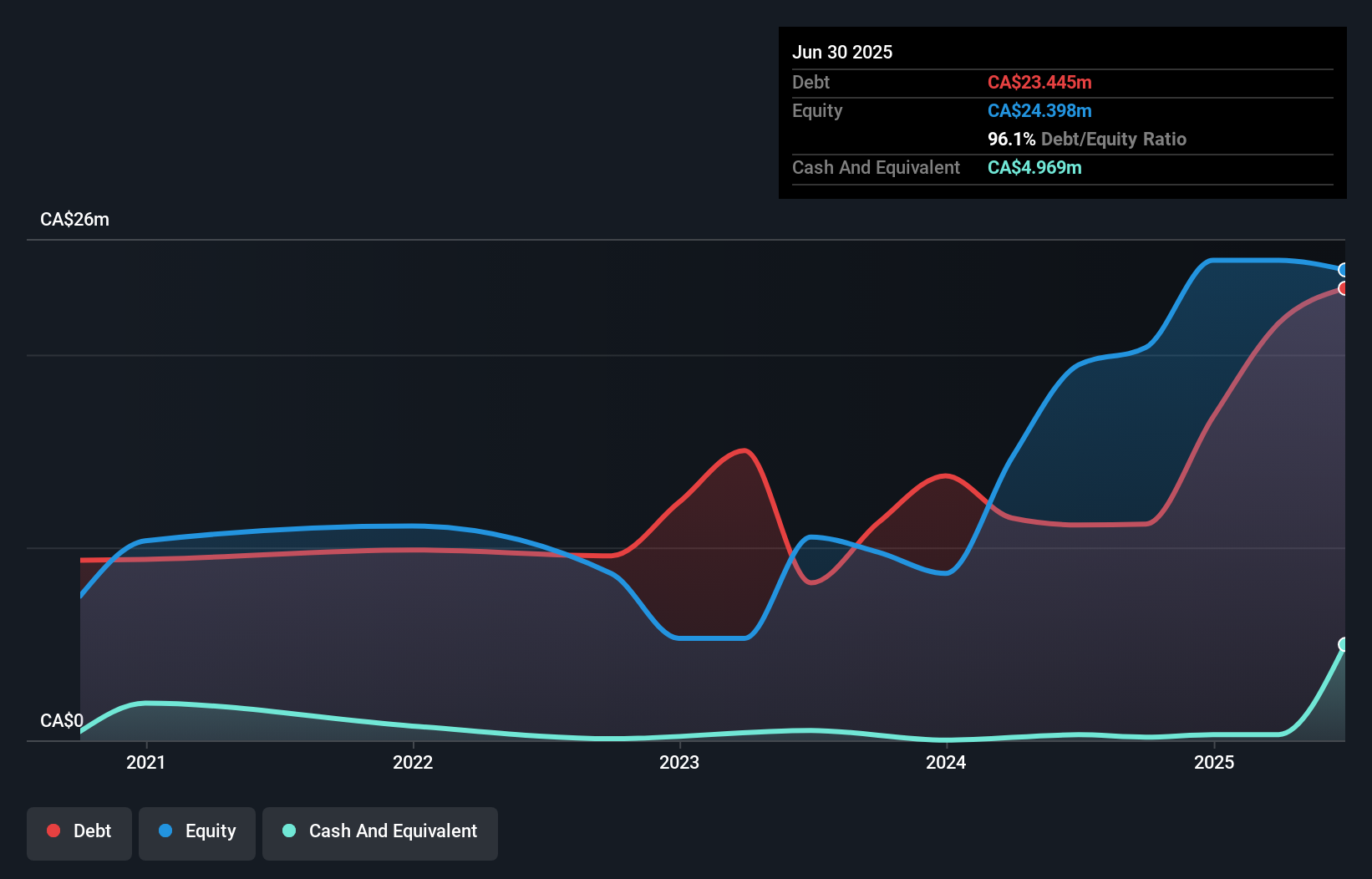

District Metals Corp., with a market cap of CA$42.03 million, is a pre-revenue mineral exploration company. It has no long-term liabilities and remains debt-free, but faces financial constraints with less than a year of cash runway. Recent developments include the NI 43-101 Mineral Resource Estimate for the Viken Energy Metals Deposit in Sweden, now recognized as the second-largest uranium deposit globally. Ongoing drilling at Tomtebo and Stollberg properties shows promising mineralization prospects, supported by collaborations like that with Boliden Mineral AB. Despite these advancements, investors should weigh the risks inherent in early-stage exploration companies.

- Dive into the specifics of District Metals here with our thorough balance sheet health report.

- Gain insights into District Metals' historical outcomes by reviewing our past performance report.

LSL Pharma Group (TSXV:LSL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: LSL Pharma Group Inc. is engaged in the development, manufacturing, and commercialization of sterile pharmaceutical and natural health products in Canada with a market cap of CA$40.44 million.

Operations: The company's revenue is derived from its Vitamins & Nutrition Products segment, which generated CA$15.82 million.

Market Cap: CA$40.44M

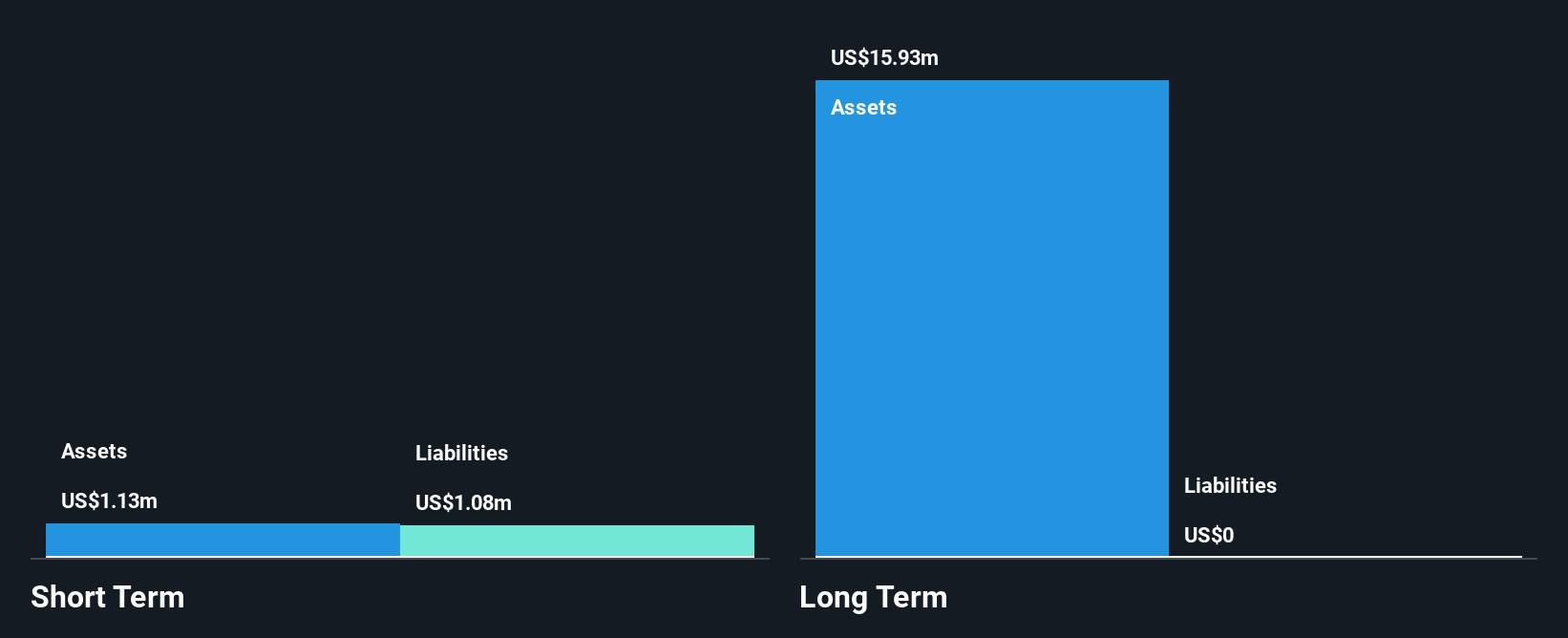

LSL Pharma Group, with a market cap of CA$40.44 million, is focused on expanding its sterile pharmaceutical offerings in Canada. The company recently signed agreements to market exclusive prescription eye drops, pending regulatory approvals. Despite these strategic moves, LSL remains unprofitable with increasing losses over the past five years and a high net debt to equity ratio of 54.2%. The management and board are relatively inexperienced, but recent additions like Louis Laflamme bring valuable expertise from the medtech sector. Financially strained with no cash runway based on free cash flow estimates, LSL raised additional capital for operations.

- Click here to discover the nuances of LSL Pharma Group with our detailed analytical financial health report.

- Learn about LSL Pharma Group's historical performance here.

Make It Happen

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 924 more companies for you to explore.Click here to unveil our expertly curated list of 927 TSX Penny Stocks.

- Interested In Other Possibilities? Explore 21 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:DMX

District Metals

A junior mineral exploration stage company, acquires, explores, and evaluates mineral resource properties.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives