- Canada

- /

- Metals and Mining

- /

- TSXV:CNC

Canada Nickel (TSXV:CNC) Weighs Carbon Capture Push but Is Decarbonization Enough to Shape Its Future?

Reviewed by Sasha Jovanovic

- Canada Nickel Company recently announced the launch of an in-situ carbon sequestration pilot study at its Crawford Nickel Project in Ontario, collaborating with the U.S. DOE ARPA-E team led by the University of Texas at Austin to investigate carbon capture in ultramafic rocks.

- This comes as Canada Nickel's Crawford project is reportedly under serious consideration for federal fast-tracking, which could accelerate permitting for critical minerals projects aligned with Canada’s decarbonization goals.

- With the federal government considering fast-tracking for Crawford, we’ll explore how this could influence Canada Nickel’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Canada Nickel's Investment Narrative?

To be a shareholder in Canada Nickel today, you need to buy into a story defined by early-stage, high-upside potential but also meaningful risks. At the heart of the investor narrative is the Crawford Nickel Project, a proposed world-scale critical minerals site with ambitions stretching into clean technology, responsible mining, and potentially game-changing carbon sequestration. The recent news about the in-situ carbon sequestration pilot is more than a scientific milestone, it could meaningfully shift the short-term catalysts if successful, especially as federal fast-tracking for permitting is now under consideration. If regulatory momentum coincides with successful technical validation, it could accelerate timelines or strengthen Canada Nickel’s footing in the race for decarbonized metals. That said, the risks remain real: unprofitability persists, the cash runway is under a year, and near-term dilution or financing overhang could intensify if large-scale funding needs arise. While the science and government attention are encouraging, near-term business risks around funding and delivery remain just as critical as ever.

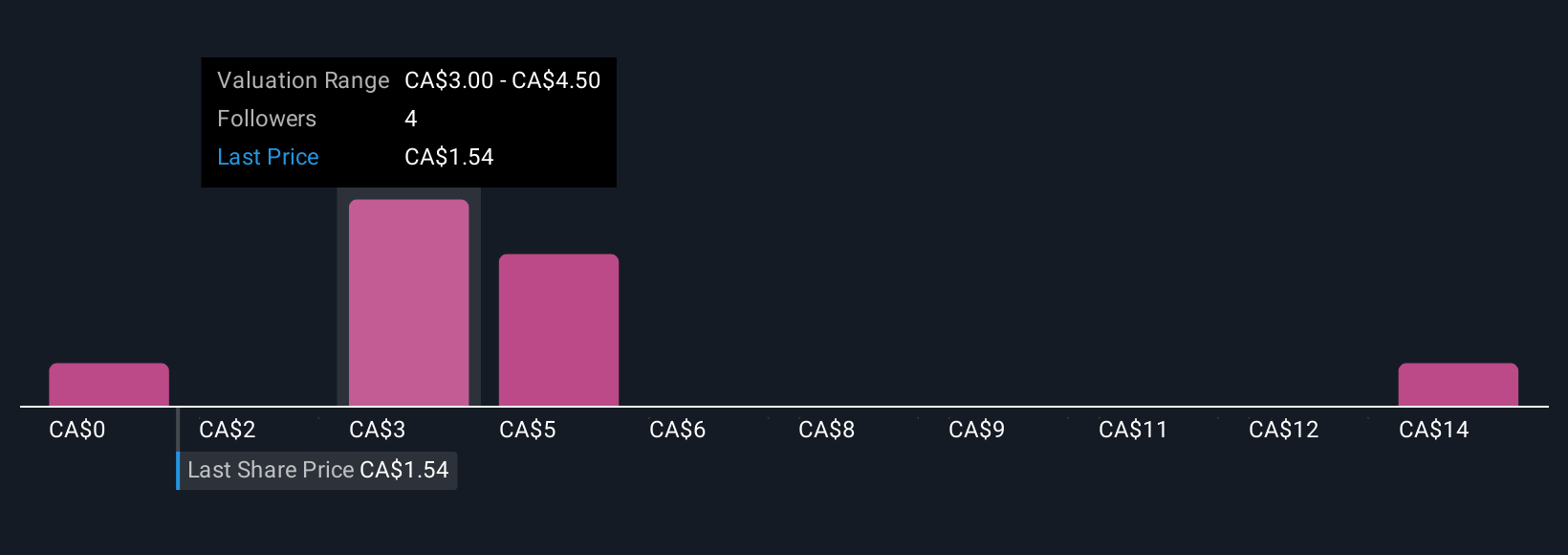

However, funding challenges in early-stage projects like this are not always obvious at first glance. Our valuation report here indicates Canada Nickel may be overvalued.Exploring Other Perspectives

Explore 4 other fair value estimates on Canada Nickel - why the stock might be a potential multi-bagger!

Build Your Own Canada Nickel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canada Nickel research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Canada Nickel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canada Nickel's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CNC

Canada Nickel

Engages in the exploration, discovery, and development of nickel sulphide assets for electric vehicle, green energy, and stainless steel markets in Canada.

Slight risk and slightly overvalued.

Market Insights

Community Narratives