A Look at 5N Plus (TSX:VNP)’s Valuation as Materials Science Demand Lifts Interest in Its Specialty Compounds

Reviewed by Simply Wall St

Growing interest in 5N Plus amid shifting materials science landscape

Rising attention on advanced materials has pushed 5N Plus (TSX:VNP) into the spotlight, as investors connect its ultra pure specialty compounds with broader demand for semiconductors, renewable energy technologies, and high performance industrial applications.

See our latest analysis for 5N Plus.

After a strong run that has lifted the share price to $19.66, 5N Plus has cooled slightly in the past month, but a robust 90 day share price return and standout 1 year total shareholder return suggest momentum is still very much on its side.

If the specialty materials story has you thinking bigger, this could be a good moment to explore fast growing stocks with high insider ownership as you search for the next potential outperformer.

With the shares having more than doubled over the past year, yet still trading at a meaningful discount to analyst targets and intrinsic value estimates, is this a late cycle chase or a genuine growth story that markets are underpricing?

Most Popular Narrative Narrative: 24.0% Undervalued

With 5N Plus last closing at CA$19.66 against a narrative fair value of CA$25.88, the story leans firmly toward underappreciated upside potential.

The expansion of the long term supply agreement with First Solar positions 5N Plus as a critical U.S. based supplier to the leading American solar panel manufacturer, aligning with accelerating clean energy adoption and North American supply chain security. This is set to drive sustained and step wise increases in semiconductor compound volumes (33% in 2025 26, with another 25% lift in 2027 28) and support multi year revenue and earnings growth, with minimal additional capital investment required.

Curious how multi year volume step ups, rising margins, and a premium future earnings multiple all tie together into that higher valuation signal? Read on.

Result: Fair Value of $25.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained outperformance hinges on policy and technology trends, with IRA support and thin film dominance both vulnerable to regulatory shifts and disruptive solar innovations.

Find out about the key risks to this 5N Plus narrative.

Another Lens on Valuation

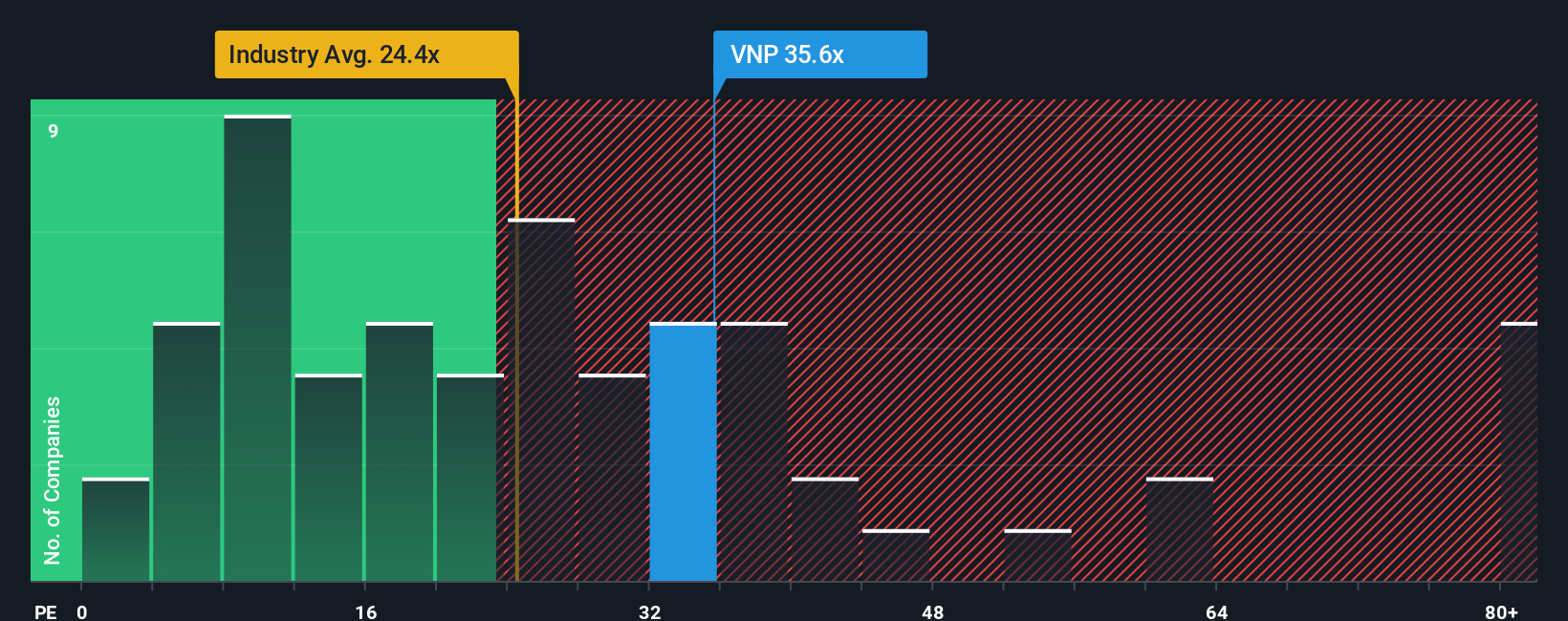

While the narrative fair value implies clear upside, a closer look at the earnings multiple tells a more cautious story. At 28.5 times earnings, 5N Plus trades above both peers at 26.6 times and the North American chemicals group at 22.5 times, and well ahead of its 16.3 times fair ratio. This suggests the market may already be baking in a lot of good news, leaving investors to weigh how much execution risk they are comfortable with from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 5N Plus Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a full narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding 5N Plus.

Looking for more investment ideas?

Before you move on, lock in your edge by scanning fresh opportunities on Simply Wall Street, where data driven shortlists help you act before the crowd catches on.

- Capture tomorrow's potential market leaders early by reviewing these 3575 penny stocks with strong financials with solid financial footing instead of speculative hype.

- Enhance your growth strategy by targeting these 26 AI penny stocks positioned at the forefront of real world artificial intelligence adoption.

- Secure a margin of safety by focusing on these 908 undervalued stocks based on cash flows where cash flows indicate potential value the market has yet to recognize.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VNP

5N Plus

Produces and sells specialty semiconductors and performance materials in the Americas, Europe, Asia, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026