- Canada

- /

- Metals and Mining

- /

- TSX:USA

A Look at Americas Gold and Silver (TSX:USA) Valuation Following Expansion Plans and Investor Optimism

Reviewed by Simply Wall St

Americas Gold and Silver (TSX:USA) just wrapped up its presentation at the 121 Dubai Mining Investment Conference, where its plans for expanded mining and new project development took center stage. Investors are watching closely as the company outlines its vision.

See our latest analysis for Americas Gold and Silver.

Momentum has clearly shifted for Americas Gold and Silver, with a 64.8% share price return over the last 90 days and an impressive 353.1% total shareholder return in the past year. The stock’s extraordinary upward move this year appears to be fueled by investor optimism about its expansion plans and new project pipeline. Recent news has only added to the positive sentiment, suggesting that growth potential is taking the spotlight over short-term challenges.

If this kind of turnaround story has you curious about the next big mover, now’s your chance to discover fast growing stocks with high insider ownership

With shares still trading at a noticeable discount to analyst price targets and the company delivering strong revenue growth, investors may wonder if there is still value left to unlock or if the market has already incorporated all future gains.

Most Popular Narrative: 49.3% Undervalued

At a fair value estimate of CA$12.29, Americas Gold and Silver stands nearly double its last close price, according to Agricola's widely followed narrative. This dramatic gap points to a bold set of long-term financial projections and a belief that operational growth is set to challenge market expectations.

“Cosalá Operations: EC120 project achieves commercial production by end of 2025, contributing significant silver and zinc output. San Rafael continues steady production. Galena Complex: Recapitalization (including shaft repairs) completed on schedule, increasing silver and lead production. Recent metallurgical tests show over 90% antimony recovery, potentially adding a new revenue stream.”

Interested in what really moves the needle on this sky-high fair value? The real story rests on ambitious production growth and game-changing revenue streams. What is the assumption underpinning this huge upside? Uncover the unexpected catalyst and see why this narrative is setting such a daring price target.

Result: Fair Value of $12.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in mine development or unexpected drops in silver prices could quickly challenge the optimism surrounding these ambitious forecasts.

Find out about the key risks to this Americas Gold and Silver narrative.

Another View: What Do Valuation Ratios Suggest?

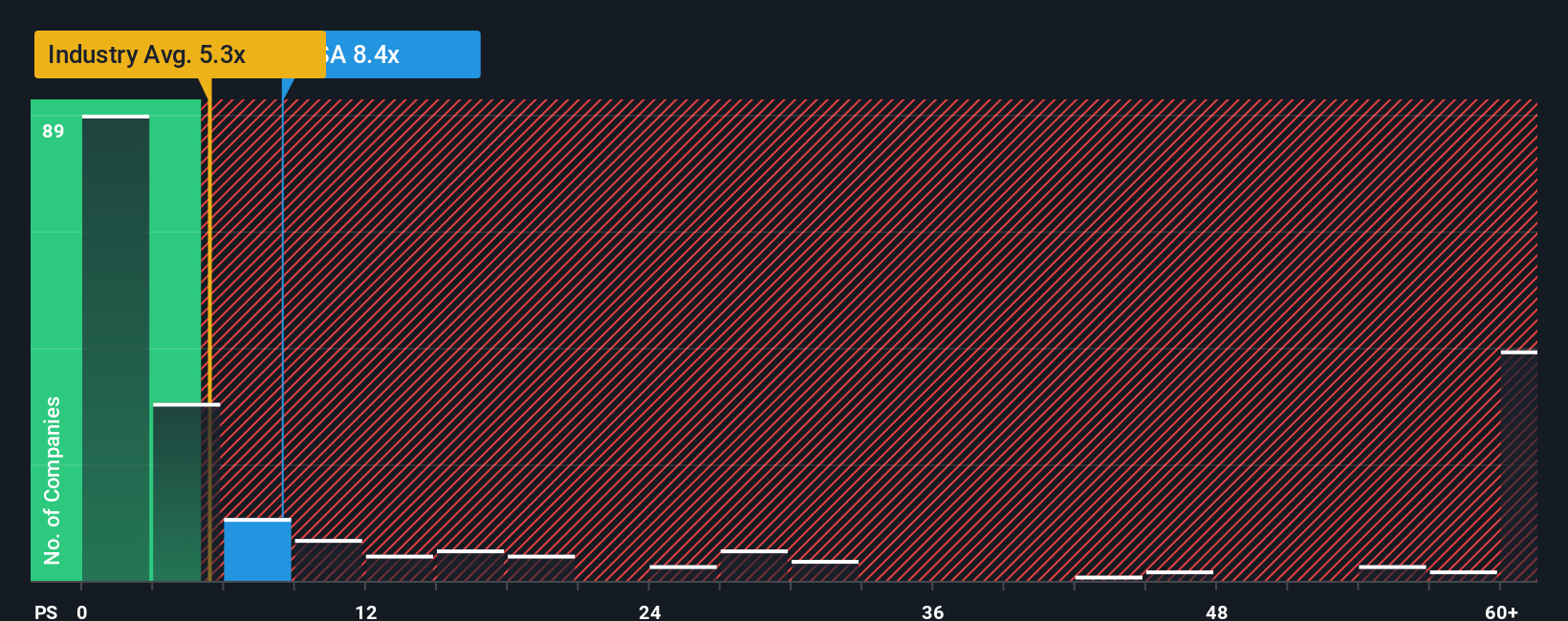

Looking at the company's price-to-sales ratio, Americas Gold and Silver stands at 11.6x. This is significantly higher than both the Canadian metals and mining industry average of 6.2x and the peer average of 10.9x. Compared to the fair ratio of 2.1x, this elevated metric raises questions about valuation risk, even with strong growth expectations. Is investor enthusiasm outpacing fundamentals, or could current optimism still prove justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Americas Gold and Silver Narrative

If you see things differently or are eager to dig deeper into the numbers yourself, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your Americas Gold and Silver research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one success story when there’s a world of opportunity waiting. Use the Simply Wall Street Screener to spark your next smart investment move.

- Unlock powerful returns by checking out these 919 undervalued stocks based on cash flows that have the financials to back long-term growth, not just hype.

- Tap into future-defining technologies by reviewing these 28 quantum computing stocks where advanced computing is already transforming industries.

- Boost your portfolio’s stability and income with these 15 dividend stocks with yields > 3% offering yields above 3%. These companies don't just grow, they reward you along the way.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:USA

Americas Gold and Silver

Engages in the exploration, development, and production of mineral properties in the Americas.

Exceptional growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026