- Canada

- /

- Metals and Mining

- /

- TSX:TKO

Taseko Mines (TSX:TKO) Valuation in Focus Ahead of Q3 2025 Results Announcement

Reviewed by Simply Wall St

Taseko Mines (TSX:TKO) has announced it will publish its third quarter 2025 financial results after markets close on November 12, 2025. A management conference call is scheduled for the following day.

See our latest analysis for Taseko Mines.

Taseko Mines has generated strong momentum in 2025, with robust buying pushing the latest share price to $6.73 and a 132.87% share price return year to date. Over the past year, the total shareholder return has outpaced most peers at 136.97%, and those who stuck around longer are now seeing a whopping 534.91% total return over five years. As anticipation builds ahead of the upcoming financial results, investors appear increasingly confident about the company’s growth prospects and ability to execute.

If Taseko’s rapid climb has you curious about other high performers, consider expanding your search and discover fast growing stocks with high insider ownership

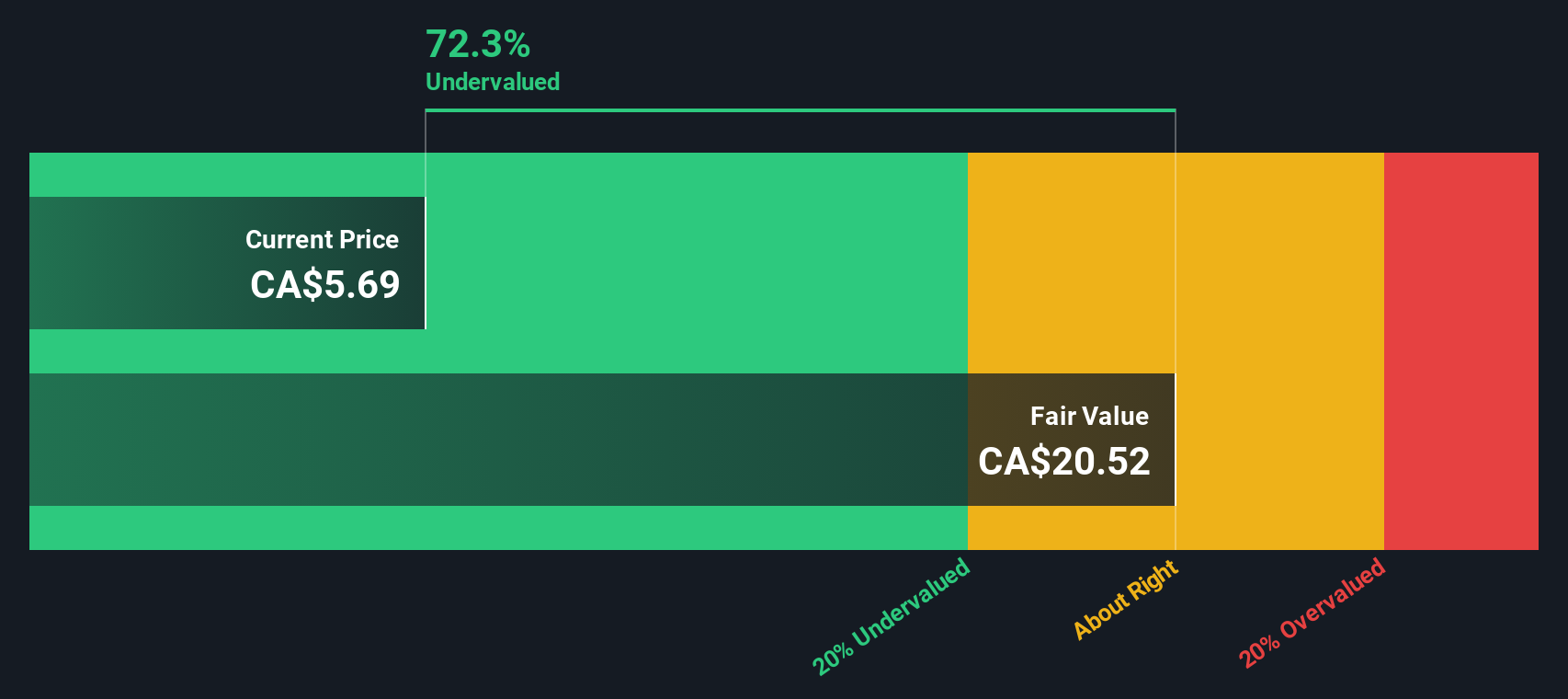

With shares soaring and anticipation building ahead of earnings, the key question now is whether Taseko Mines remains undervalued or if the market has already factored in its future growth. This presents investors with a potential buying opportunity or a fully priced stock.

Most Popular Narrative: 0% Overvalued

With Taseko Mines last closing at CA$6.73, the most widely followed narrative assigns a fair value of CA$6.71 and signals that the current price is right near consensus expectations. Investors are looking to upcoming events and project milestones as the next big catalysts that could shift future valuation.

Progress on large-scale growth assets enhances long-term value potential, with favorable market dynamics supporting revenue visibility and future returns.

What are analysts really expecting to fuel this projected value? There are bold financial forecasts and aggressive assumptions hidden beneath the surface. Want a peek at the rapid expansion blueprint, profit targets, and turnaround forecasts? The underlying narrative is stacking ambitious growth ahead of the pack, but what exactly are those key numbers? Dive in and see which assumptions could move the market next.

Result: Fair Value of $6.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory hurdles or a meaningful drop in copper prices could quickly challenge the positive outlook that investors currently hold for Taseko Mines.

Find out about the key risks to this Taseko Mines narrative.

Another View: Discounted Cash Flow Model Suggests Undervaluation

While the consensus price target pegs Taseko Mines as fully priced or even slightly overvalued, our SWS DCF model tells a different story. According to this method, shares are trading at a steep 61% discount to intrinsic value. This signals a notable gap between market expectations and long-term cash flow potential. Does this imply a hidden opportunity, or are DCF assumptions overlooking important risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Taseko Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Taseko Mines Narrative

If the consensus narrative or valuation models do not match your perspective, take a deeper dive into the data to construct your own viewpoint in just a few minutes. Do it your way

A great starting point for your Taseko Mines research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let potential winners slip past you. Use the Simply Wall Street Screener to spot exciting new opportunities and make your next smart move today.

- Uncover overlooked value plays by starting with these 863 undervalued stocks based on cash flows for compelling options trading below their intrinsic worth.

- Fuel your portfolio with future-focused innovation by screening these 25 AI penny stocks shaping the AI revolution right now.

- Maximize income potential and stability when you check out these 14 dividend stocks with yields > 3% offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taseko Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TKO

Taseko Mines

A mining company, acquires, develops, and operates mineral properties.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives