- Canada

- /

- Metals and Mining

- /

- TSX:SVM

A Look at Silvercorp Metals (TSX:SVM) Valuation Following Q2 2026 Earnings and Analyst Buy Rating

Reviewed by Simply Wall St

Silvercorp Metals (TSX:SVM) is drawing renewed attention after its Q2 2026 earnings release showed revenue growth, attributed to stronger silver and gold prices. While results narrowly missed estimates, management remains committed to its 2026 production outlook.

See our latest analysis for Silvercorp Metals.

Silvercorp Metals has seen a surge in momentum lately, with a 141% year-to-date share price return and a one-year total shareholder return of nearly 145%. This follows its latest earnings announcement and ongoing optimism about rising precious metals prices. Both factors have sparked stronger investor interest in the stock’s long-term prospects.

If recent gains have you curious about where the next breakout might come from, it could be the perfect time to discover fast growing stocks with high insider ownership.

With shares not far from analyst targets but momentum building, the key question is whether Silvercorp Metals remains undervalued based on fundamentals, or if the market is already pricing in future growth opportunities.

Most Popular Narrative: 14.7% Undervalued

Silvercorp Metals is currently trading at CA$10.98, noticeably below the most widely followed narrative’s fair value estimate of CA$12.88. With an optimistic pricing gap in focus, the case for upside is built around further production growth and stronger profit margins.

*Record operating cash flow ($48.3 million in Q1) and a substantial cash position ($377 million), together with disciplined capital allocation and access to additional financing (such as the $175 million Wheaton stream), support higher earnings stability, potential dividend capacity, and the ability to invest in further growth projects.*

Want to know the growth blueprint behind this high valuation? The narrative’s bullish math hinges on sharp profit leaps and the kind of margin expansion not seen in every cycle. Intrigued about exactly which financial leaps analysts are banking on? Delve into the complete breakdown and see the numbers powering this fair value estimate.

Result: Fair Value of $12.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks around new mine ramp-ups and potential regulatory challenges in both China and Ecuador could quickly shift this narrative's outlook.

Find out about the key risks to this Silvercorp Metals narrative.

Another View: Multiples Raise Questions

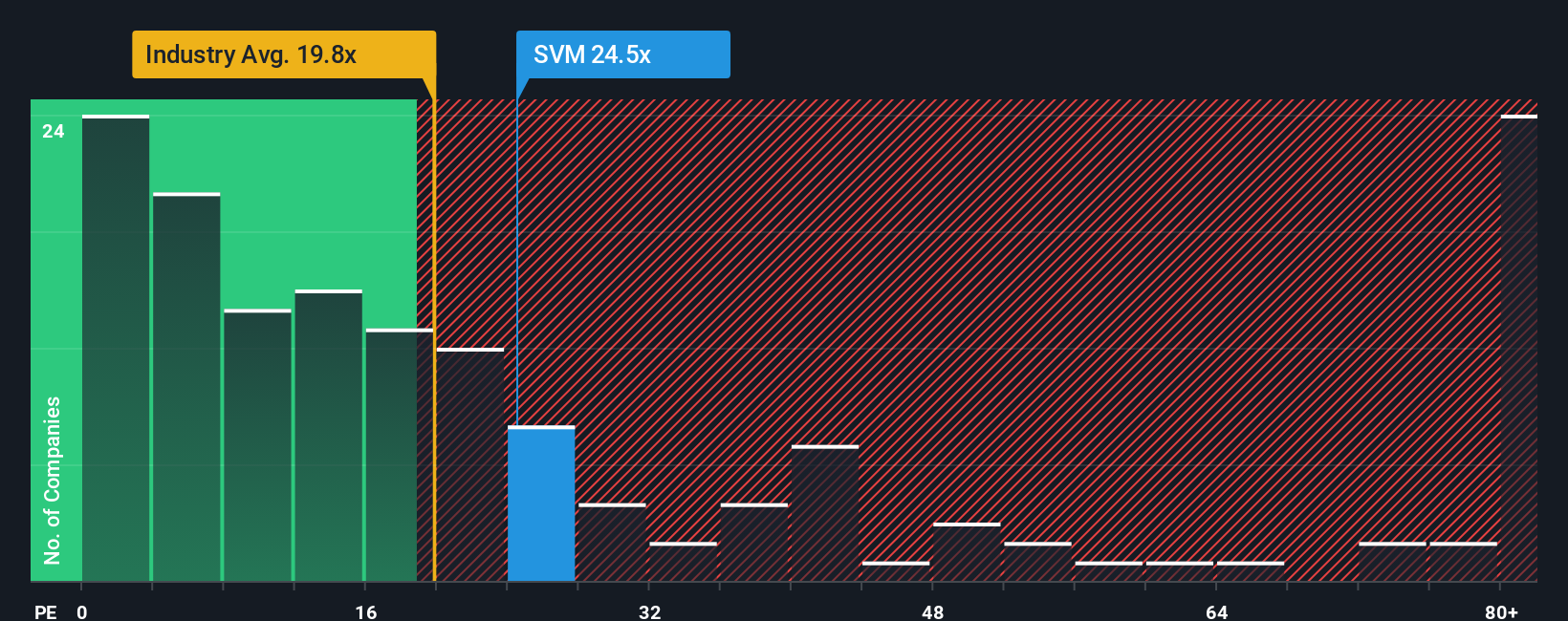

While the fair value estimate suggests Silvercorp Metals is undervalued, a look at valuation multiples paints a very different picture. Silvercorp’s price-to-earnings ratio is far higher than both its industry average and peer group, and well above the fair ratio the market could move towards. This could indicate the stock is priced for strong execution with little room for disappointment. Is the optimism already fully reflected in the current share price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Silvercorp Metals Narrative

If you think another angle tells the story better, or want to run your own numbers, you can craft a fresh perspective in just a few minutes. Do it your way.

A great starting point for your Silvercorp Metals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let fresh opportunities pass you by. Amp up your research and take action on some of this year's most promising trends using Simply Wall Street’s powerful tools.

- Jump on the surge in health-tech by spotting innovative companies shaping tomorrow's care through these 30 healthcare AI stocks.

- Secure reliable income streams for your portfolio and see which businesses stand out with these 15 dividend stocks with yields > 3% yielding above-average returns.

- Catch early-stage growth stories by getting the inside track on these 3556 penny stocks with strong financials with robust balance sheets and accelerating momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026