- Canada

- /

- Metals and Mining

- /

- TSX:PAAS

TSX Companies Estimated To Trade Below Fair Value In November 2025

Reviewed by Simply Wall St

As November unfolds, the Canadian market is experiencing a slight pullback, largely influenced by global sentiment shifts around AI valuations and market concentration concerns. Amidst this volatility, identifying undervalued stocks on the TSX becomes crucial for investors seeking opportunities that align with strong corporate fundamentals and balanced portfolio strategies.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vitalhub (TSX:VHI) | CA$10.22 | CA$18.59 | 45% |

| Topicus.com (TSXV:TOI) | CA$128.76 | CA$226.23 | 43.1% |

| Savaria (TSX:SIS) | CA$21.75 | CA$35.12 | 38.1% |

| Haivision Systems (TSX:HAI) | CA$4.96 | CA$8.61 | 42.4% |

| GURU Organic Energy (TSX:GURU) | CA$4.51 | CA$8.91 | 49.4% |

| Green Thumb Industries (CNSX:GTII) | CA$9.82 | CA$19.36 | 49.3% |

| Decisive Dividend (TSXV:DE) | CA$7.40 | CA$14.67 | 49.5% |

| Aya Gold & Silver (TSX:AYA) | CA$14.28 | CA$22.57 | 36.7% |

| Artemis Gold (TSXV:ARTG) | CA$34.45 | CA$57.67 | 40.3% |

| Americas Gold and Silver (TSX:USA) | CA$5.49 | CA$8.73 | 37.1% |

Let's explore several standout options from the results in the screener.

Green Thumb Industries (CNSX:GTII)

Overview: Green Thumb Industries Inc. is involved in the manufacturing, distribution, marketing, and sale of cannabis products for medical and adult use in the United States, with a market cap of CA$2.28 billion.

Operations: Green Thumb Industries generates revenue through the production, distribution, and sale of cannabis products for both medical and adult-use markets in the United States.

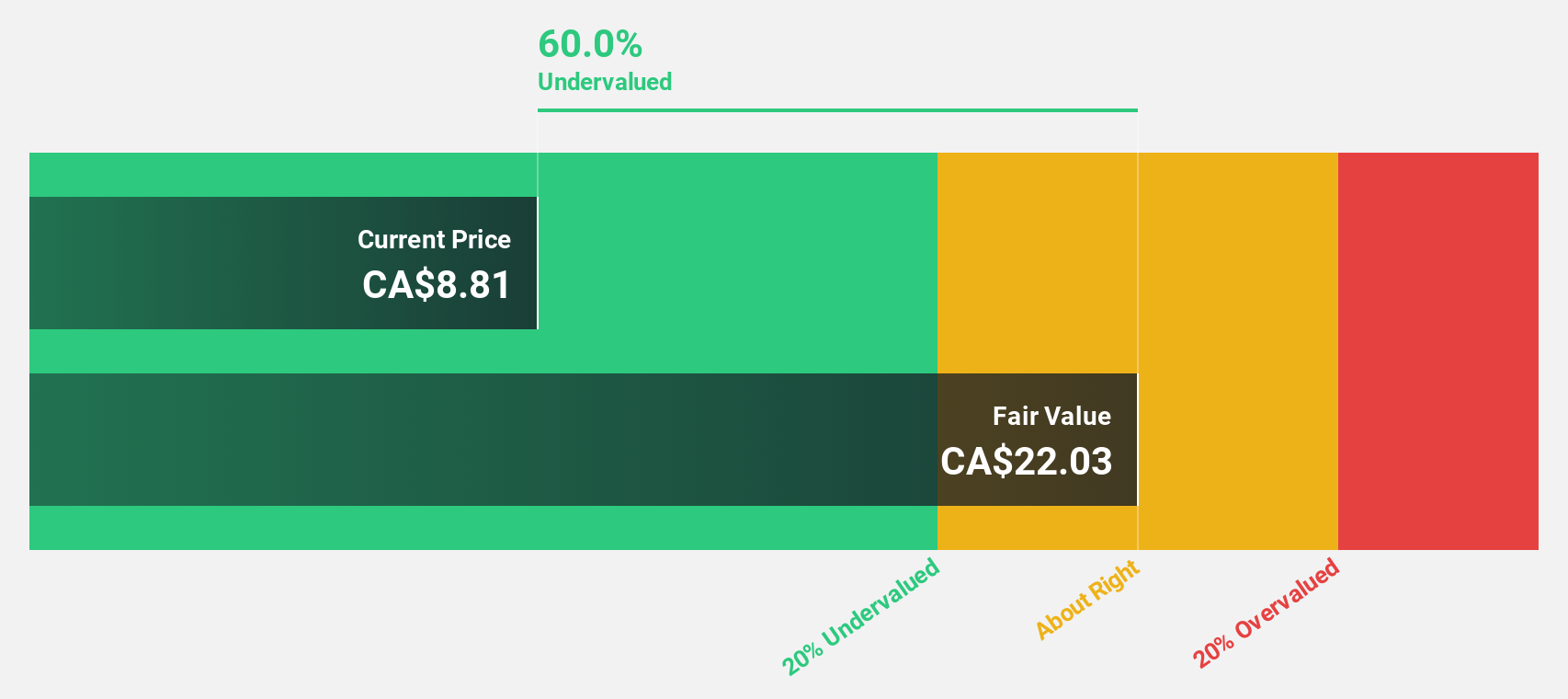

Estimated Discount To Fair Value: 49.3%

Green Thumb Industries appears undervalued, trading at CA$9.82, significantly below its estimated fair value of CA$19.36. Despite a forecasted revenue growth of 4.9% per year, which is slightly above the Canadian market average, earnings are expected to grow significantly at 30.7% annually—outpacing the market's 11.9%. Recent Q3 results show improved net income of US$23.29 million from US$8.62 million last year, highlighting potential for strong cash flow generation despite labor challenges and buyback activities underway.

- The analysis detailed in our Green Thumb Industries growth report hints at robust future financial performance.

- Take a closer look at Green Thumb Industries' balance sheet health here in our report.

Franco-Nevada (TSX:FNV)

Overview: Franco-Nevada Corporation is a royalty and stream company specializing in precious metals across various regions including the Americas, Australia, Europe, and globally, with a market cap of CA$51.95 billion.

Operations: The company's revenue segments consist of $1.27 billion from Precious Metals, $211.80 million from Energy, and $57.10 million from Other Mining.

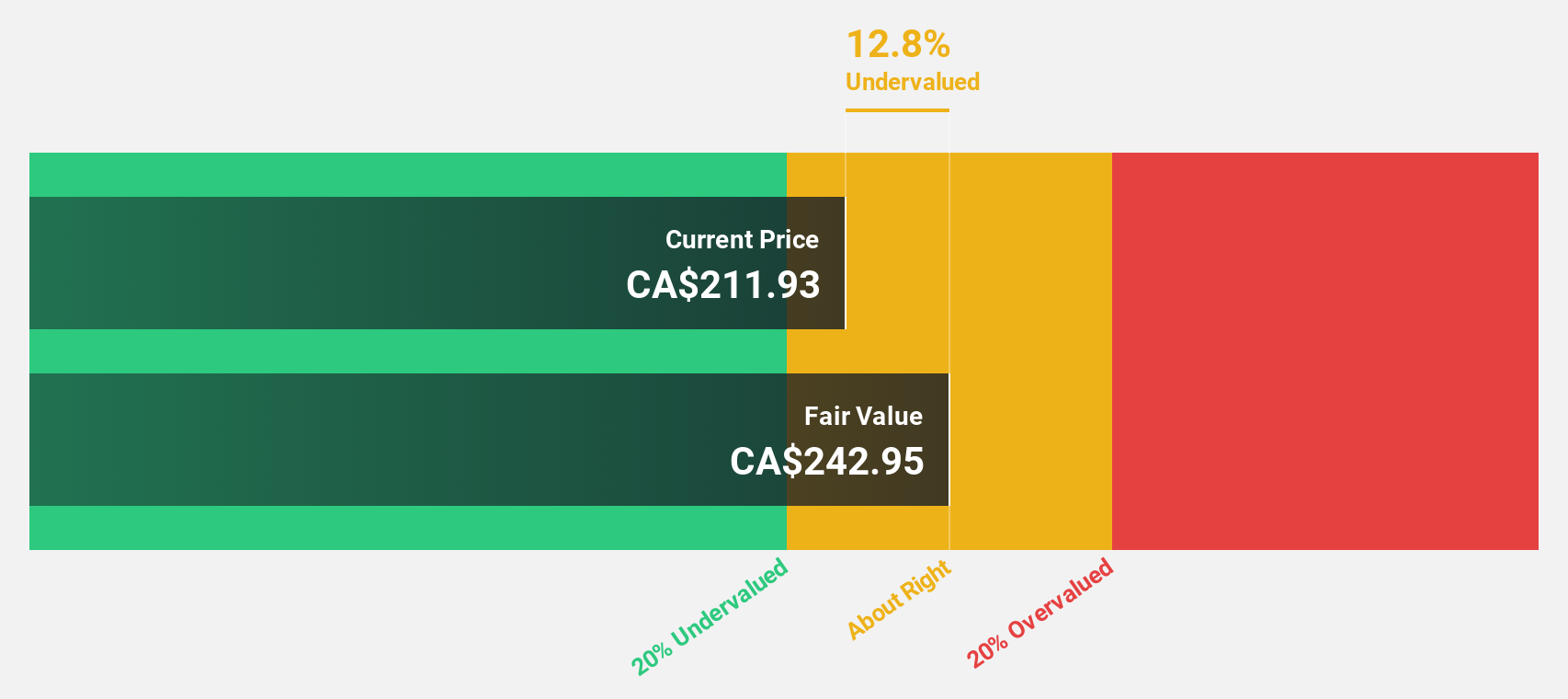

Estimated Discount To Fair Value: 18%

Franco-Nevada is currently trading at CA$269.47, below its estimated fair value of CA$328.66, suggesting it may be undervalued based on cash flows. The company reported a strong Q3 with net income rising to US$287.5 million from US$152.7 million last year, highlighting robust cash flow generation despite recent insider selling and executive changes. Earnings are forecasted to grow significantly at 21.9% annually, surpassing the Canadian market's growth rate of 11.9%.

- In light of our recent growth report, it seems possible that Franco-Nevada's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Franco-Nevada.

Pan American Silver (TSX:PAAS)

Overview: Pan American Silver Corp. is involved in the exploration, development, extraction, processing, refining, and reclamation of mines across Canada and several Latin American countries, with a market cap of CA$20.61 billion.

Operations: The company generates revenue from various mining operations, including CA$191.60 million from Huaron in Peru, CA$329.50 million from Timmins in Canada, CA$470.60 million from Elpeñon in Chile, CA$222.20 million from Dolores in Mexico, CA$391.20 million from Shahuindo in Peru, CA$560.90 million from Jacobina in Brazil, and additional contributions of CA$221.60 million from La Colorada in Mexico, CA$283.50 million from Cerromoro in Argentina, and CA$102.90 million from SAN Vicente in Bolivia.

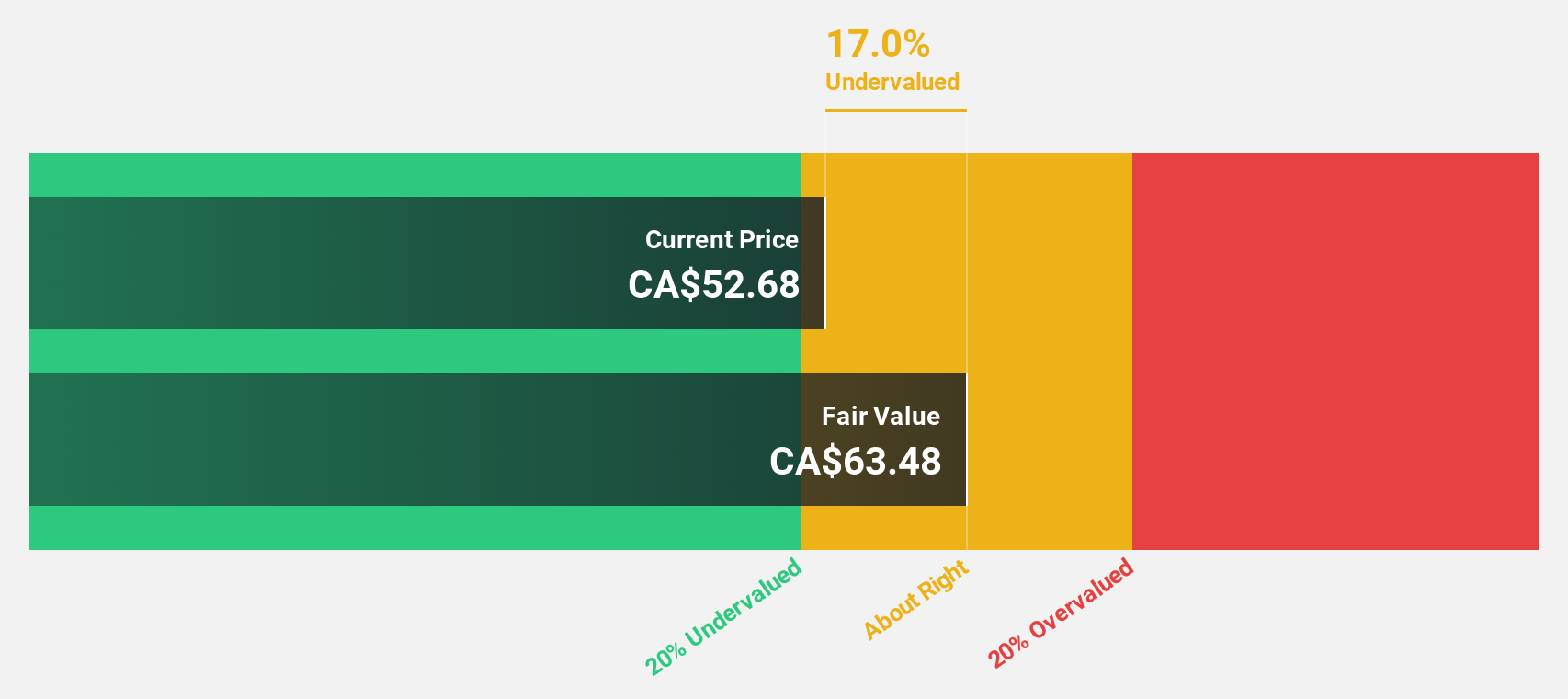

Estimated Discount To Fair Value: 23%

Pan American Silver, trading at CA$48.85, is valued below its estimated fair value of CA$63.45, indicating potential undervaluation based on cash flows. The company's earnings are expected to grow significantly at 29.7% annually, outpacing the Canadian market's growth rate of 11.9%. Despite recent insider selling and past shareholder dilution, Pan American has been added to the FTSE All-World Index and continues to expand its mineral resources with promising drill results at La Colorada mine.

- Insights from our recent growth report point to a promising forecast for Pan American Silver's business outlook.

- Unlock comprehensive insights into our analysis of Pan American Silver stock in this financial health report.

Taking Advantage

- Unlock more gems! Our Undervalued TSX Stocks Based On Cash Flows screener has unearthed 21 more companies for you to explore.Click here to unveil our expertly curated list of 24 Undervalued TSX Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PAAS

Pan American Silver

Engages in the exploration, mine development, extraction, processing, refining, and reclamation of mines in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives