- Canada

- /

- Metals and Mining

- /

- TSX:NGD

A Closer Look at New Gold (TSX:NGD) Valuation Following 1% Share Price Move

Reviewed by Simply Wall St

New Gold (TSX:NGD) shares edged up 1% today, drawing investor attention as the company’s year-to-date return stands at over 160%. This impressive run has some shareholders reevaluating expectations and strategy as they track performance.

See our latest analysis for New Gold.

New Gold’s year-to-date share price return of 160.58% makes its recent 1% pop more than just a blip. Strong 90-day gains have fueled growing optimism about the stock’s turnaround story. With a current share price of $9.85 and three-year total shareholder return exceeding 570%, momentum appears to be building as investors factor in both improved fundamentals and shifting sentiment.

If you’re looking for more opportunities like this, now’s the perfect time to explore fast growing stocks with high insider ownership.

With shares already soaring this year, investors must now decide whether New Gold is still trading at a discount or if the recent rally has priced in all the company’s future growth prospects. Is there still a buying opportunity here?

Most Popular Narrative: 20.2% Undervalued

With New Gold’s fair value pegged at CA$12.34 and a last close of CA$9.85, the primary narrative signals considerable upside, drawing on optimistic financial projections to support this case.

Consistent progress on cost-reduction and operational efficiency initiatives, evidenced by declining all-in sustaining costs and record free cash flow, are boosting overall operational margins and positioning the company to benefit disproportionately from persistent high gold prices due to heightened geopolitical tensions and inflationary pressures.

Want to see the bold math fueling this valuation gap? Discover how game-changing margin expansion and future earnings trajectories are factored into the narrative. The financial leap at the core of this story might surprise you.

Result: Fair Value of $12.34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should note that any project delays at core mines or a downturn in gold prices could quickly dampen the current optimism surrounding New Gold’s outlook.

Find out about the key risks to this New Gold narrative.

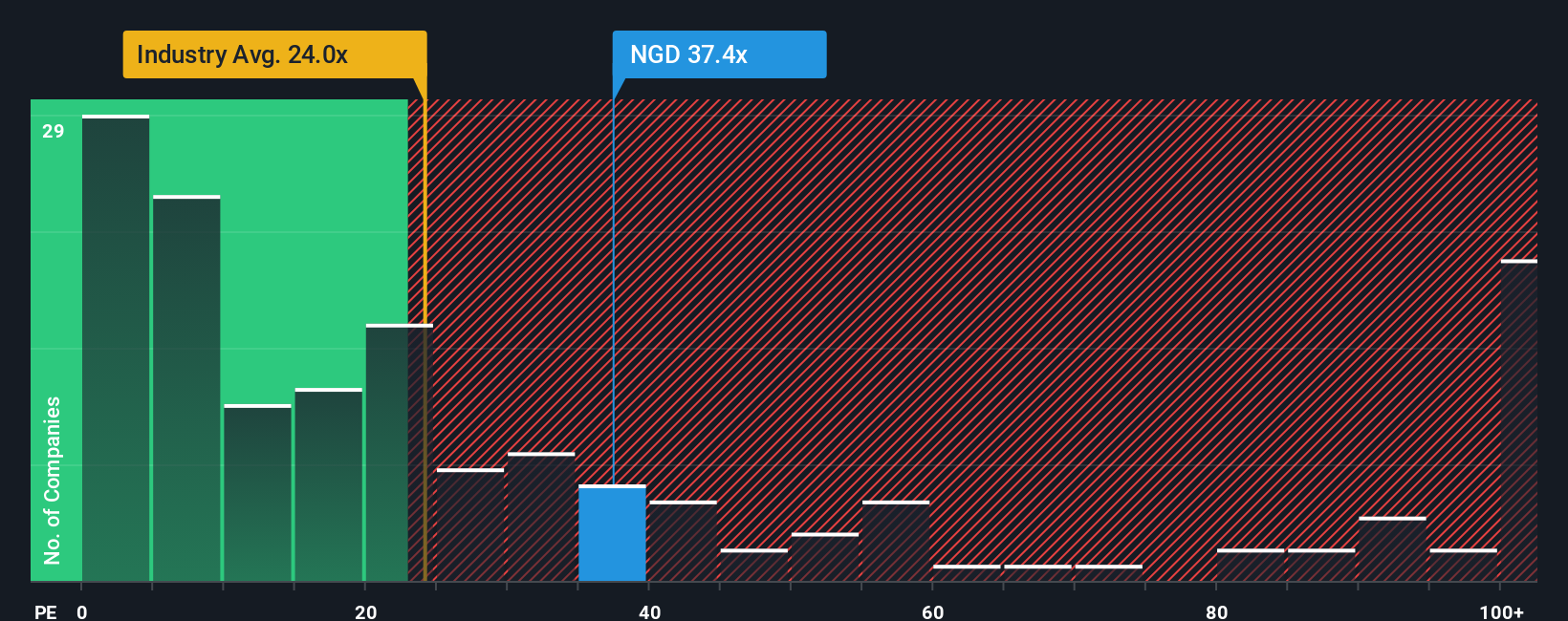

Another Perspective: Market Ratios Paint a Different Picture

Looking at how the market is pricing New Gold using the standard price-to-earnings ratio, some caution is warranted. At 22.3 times earnings, shares trade above the Canadian Metals and Mining industry average of 20.5x, but below both the peer average of 24.3x and the fair ratio of 27.4x. Market trends could move toward the fair ratio over time. This spread suggests the market sees value, yet also brings higher expectations. Does this indicate short-term optimism could be overextended, or is there further room for gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own New Gold Narrative

If you want a different take or enjoy digging into the numbers firsthand, you can put together your own story for New Gold in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding New Gold.

Looking for More Investment Ideas?

Don’t settle for the usual picks. If you want an edge in today’s market, seize your chance to see which stocks could set your portfolio apart.

- Tap into the momentum of digital currency by reviewing these 82 cryptocurrency and blockchain stocks, featuring innovative companies driving blockchain and secure payment advancements.

- Spot undervalued gems before the crowd does by checking out these 870 undervalued stocks based on cash flows. Here, promising cash-flow powerhouses await closer attention.

- Capitalize on future healthcare breakthroughs by exploring these 32 healthcare AI stocks. Artificial intelligence is reshaping how medicine evolves and delivers value for investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGD

New Gold

An intermediate gold mining company, engages in the development and operation of mineral properties in Canada.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives