Is Methanex Still an Opportunity After Rebounding 10% in May 2025?

Reviewed by Bailey Pemberton

Trying to decide what to do with Methanex stock? You are not alone. Whether you are holding, considering buying in, or thinking about trimming your position, Methanex has made itself a talking point for investors who care about both steady returns and real value. After a rocky start to the year with shares down almost 25% year-to-date, recent weeks have been more encouraging. The stock bounced back 10.5% over the past month. Despite giving back nearly 3% in the last week, Methanex has still managed to post long-term gains of over 60% in the past five years. These swings do not come from nowhere, and much of Methanex’s recent movement can be tied to shifting expectations around demand for methanol, global supply chain adjustments, and changes in energy markets.

But how do you know if Methanex is really a bargain at today’s prices? Analysts try to cut through the noise with valuation checks that compare essential financial and market data against industry peers. On that score, Methanex comes out looking pretty strong, with a valuation score of 4 out of a possible 6, meaning it is undervalued on four major checks. Next, we will break down what this score really means using popular valuation methods. Later, I will share an even more insightful way to assess whether Methanex is truly undervalued today.

Why Methanex is lagging behind its peers

Approach 1: Methanex Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and then discounting them to present value. For Methanex, this involves evaluating how much cash the company is expected to generate over the next decade and translating those future dollars into today’s terms.

Based on the most recent data, Methanex generated $759.94 million in Free Cash Flow over the last twelve months. Analyst forecasts suggest Free Cash Flow will fluctuate over the coming years, ultimately reaching about $345 million by 2035. Analyst coverage for these projections extends five years, and values beyond that period are extrapolated.

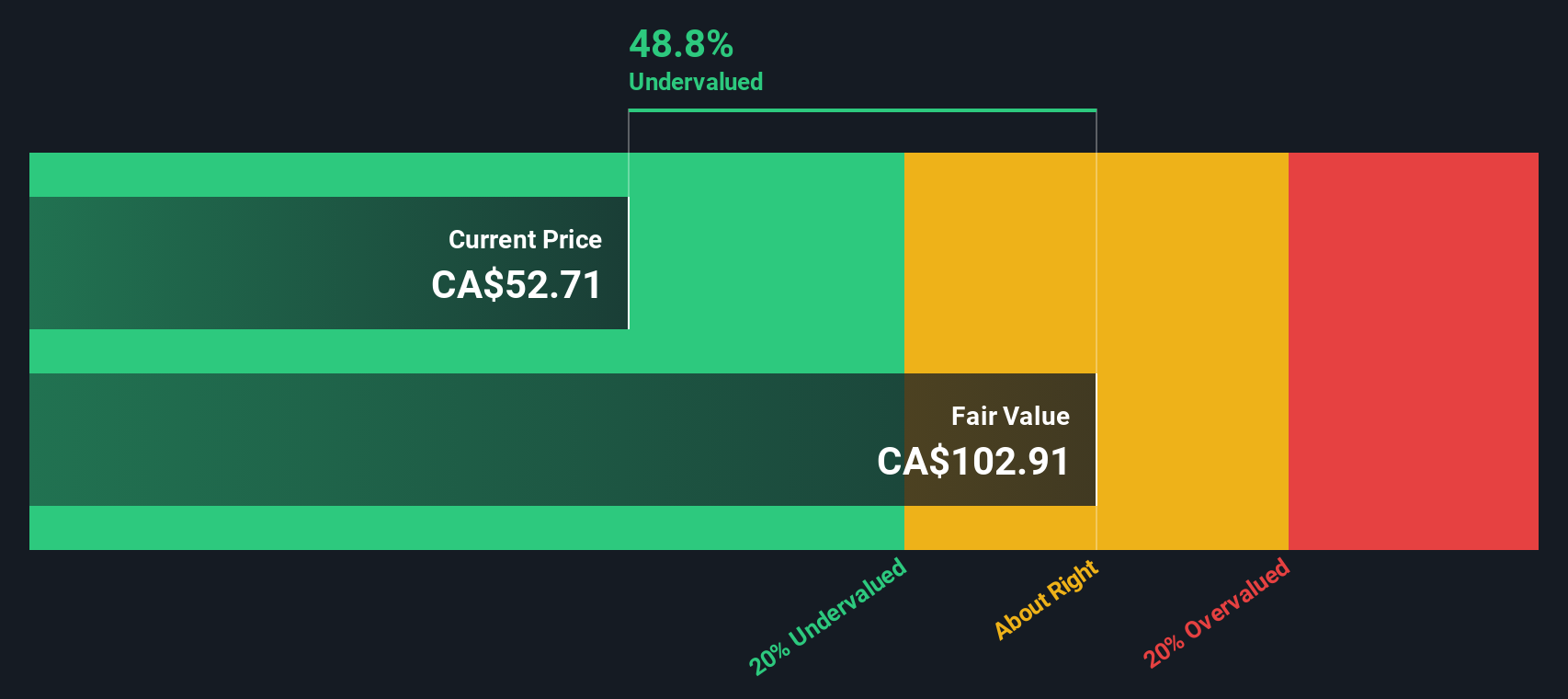

The DCF model used here assumes a 2 Stage Free Cash Flow to Equity approach. This model results in an estimated intrinsic value per share of $91.45. Since this intrinsic value represents a 41.1% discount compared to Methanex’s current market valuation, it suggests the stock is significantly undervalued.

If these cash flow and projection assumptions hold true, investors could be buying Methanex shares today for well below what the underlying business is actually worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Methanex is undervalued by 41.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Methanex Price vs Earnings

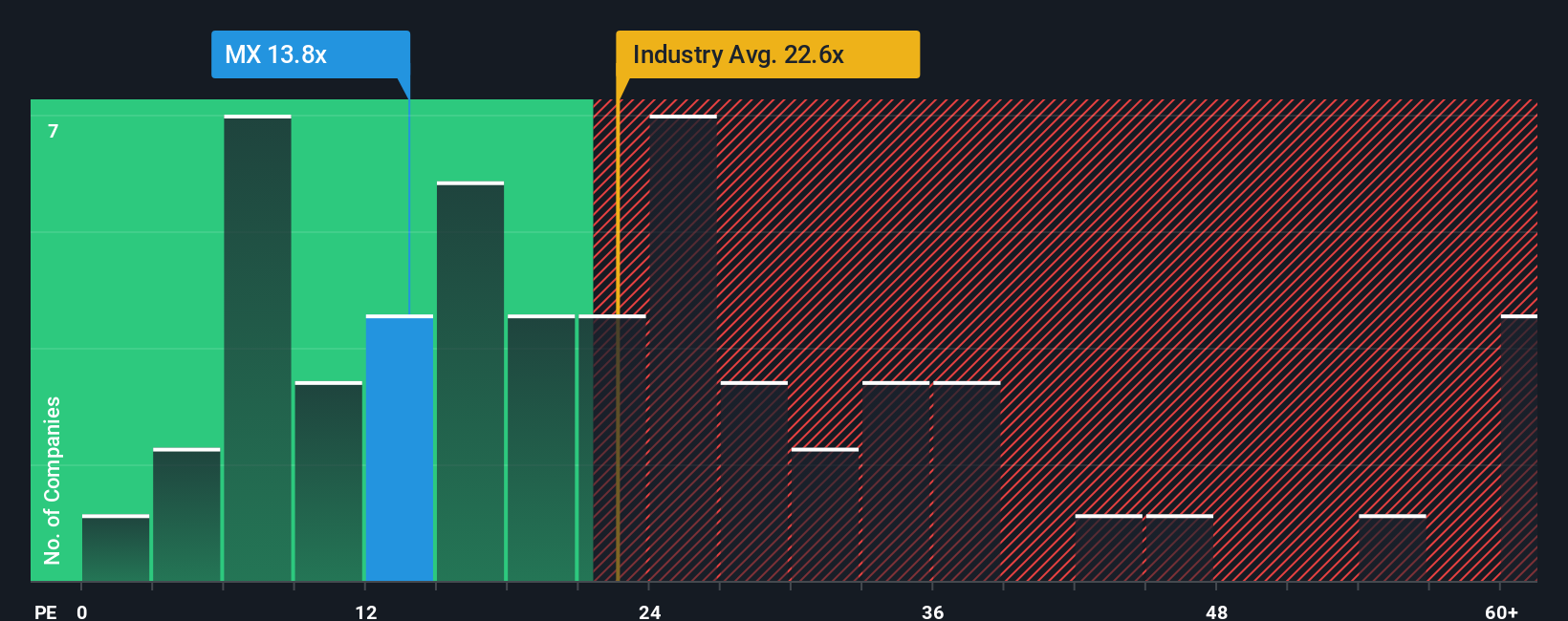

The Price-to-Earnings (PE) ratio is one of the most widely used tools for valuing profitable companies like Methanex because it measures how much investors are willing to pay for each dollar of earnings. It is especially helpful as it captures the relationship between a company’s current share price and its actual profitability.

Growth expectations and risk play major roles in deciding what a “normal” or “fair” PE ratio should be. Higher expected earnings growth or lower business risks usually warrant a higher PE. Slower growth or higher risk would result in a lower one. This means industry benchmarks and similar peers can provide useful reference points, but they do not capture the full picture for every company.

Currently, Methanex trades at a PE ratio of 11.85x. This is well below the Chemicals industry average of 22.59x and also considerably lower than the average for its peers. While this initially makes Methanex look undervalued on a simple comparison, it is important to dig deeper. The “Fair Ratio,” a proprietary metric from Simply Wall St, calculates Methanex’s ideal PE at 14.10x. This Fair Ratio is more insightful than peer or industry averages as it adjusts for Methanex's specific growth prospects, profit margins, company size, risks, and industry profile.

Since Methanex’s actual PE of 11.85x is noticeably lower than its Fair Ratio of 14.10x, the analysis suggests Methanex is undervalued at current prices based on earnings multiples.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Methanex Narrative

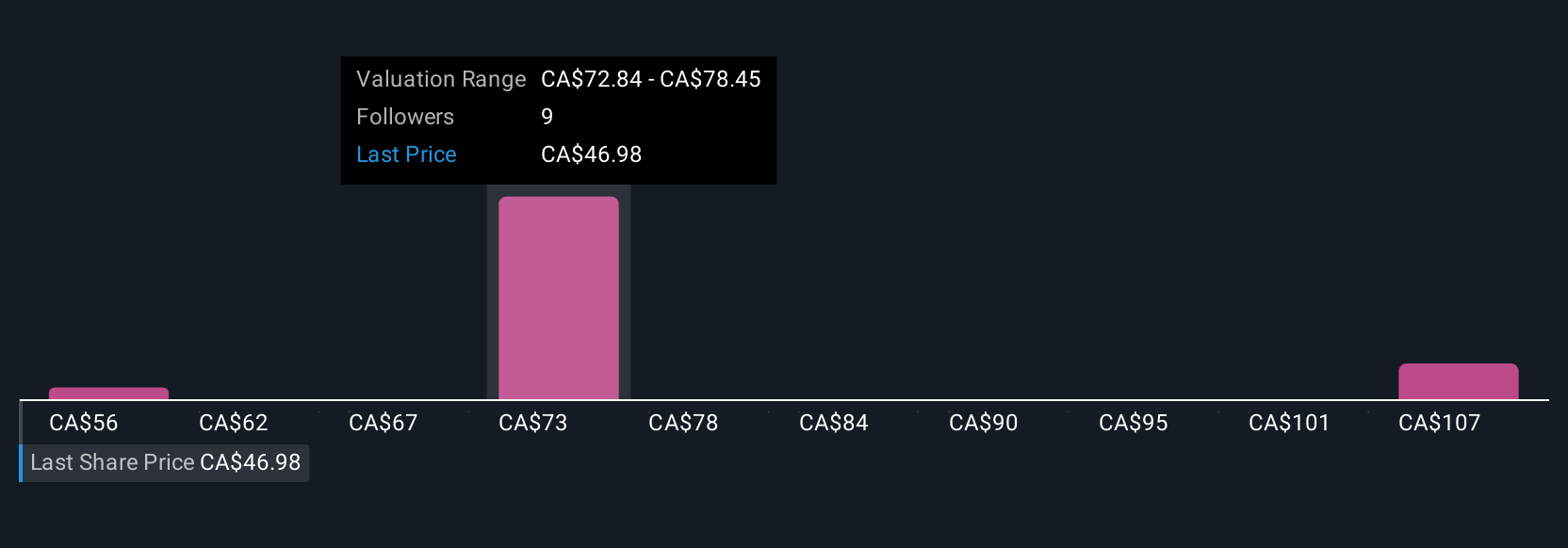

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple but powerful tool that lets you attach your outlook (the story you believe about a company’s future) to detailed financial forecasts like revenue, margins, and fair value.

Instead of just relying on numbers in isolation, Narratives help you connect Methanex’s recent events, strategic moves, or risks to a concrete set of assumptions and an estimated fair value for the stock. Narratives are easy to use and available right now within the Simply Wall St Community page, trusted by millions of investors.

By comparing your Narrative's fair value to today’s share price, you can make smarter buy or sell decisions according to what you think will happen next. Better yet, Narratives update automatically as news, analyst estimates, and earnings results come in, so your insights always stay relevant.

For example, one investor might believe demand growth and strategic acquisitions will push Methanex’s fair value as high as CA$76.82 per share. Another who worries about integration risks and gas supply challenges might see value closer to CA$44.00.

Do you think there's more to the story for Methanex? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MX

Methanex

Produces and supplies methanol in Asia Pacific, North America, Europe, and South America.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success