- Canada

- /

- Metals and Mining

- /

- TSX:LUG

Major Exploration Success at Fruta del Norte Could Be a Game Changer For Lundin Gold (TSX:LUG)

Reviewed by Sasha Jovanovic

- Lundin Gold Inc. recently announced strong results from its 2025 exploration drilling programs at the Fruta del Norte gold mine in Ecuador, confirming significant new high-grade gold mineralization and advancing toward an initial Mineral Reserve estimate in early 2026.

- The company’s expanded drilling campaign has identified wider mineralized zones and a new epithermal vein deposit at FDN East, indicating substantial growth potential and prompting acceleration of its largest exploration program to date.

- We'll look at how this major exploration success and resource expansion at Fruta del Norte may reshape Lundin Gold's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lundin Gold Investment Narrative Recap

To be a Lundin Gold shareholder, you need confidence in the company’s ability to continuously convert exploration success into long-term mine life, scaled-up production, and efficient operations. The recent drilling results at Fruta del Norte meaningfully strengthen the near-term catalyst, the potential for a Mineral Reserve expansion, but do not materially alter the key risk: the company’s concentrated reliance on its single Ecuadorian asset, and potential exposure to political or social instability in the country.

Of the latest announcements, Lundin Gold’s update on its share capital and voting rights is most relevant, as transparent governance and strong stakeholder engagement support the company’s position amid rapid operational and resource developments, underpinning its efforts to secure long-term value and ESG credentials as exploration advances remain in focus.

By contrast, while new gold zones can drive optimism, investors should be aware that any escalation in country risk, social tension, or policy shifts...

Read the full narrative on Lundin Gold (it's free!)

Lundin Gold's narrative projects $1.4 billion in revenue and $758.8 million in earnings by 2028. This implies a forecast earnings increase of $133.7 million from current earnings of $625.1 million.

Uncover how Lundin Gold's forecasts yield a CA$93.42 fair value, a 19% downside to its current price.

Exploring Other Perspectives

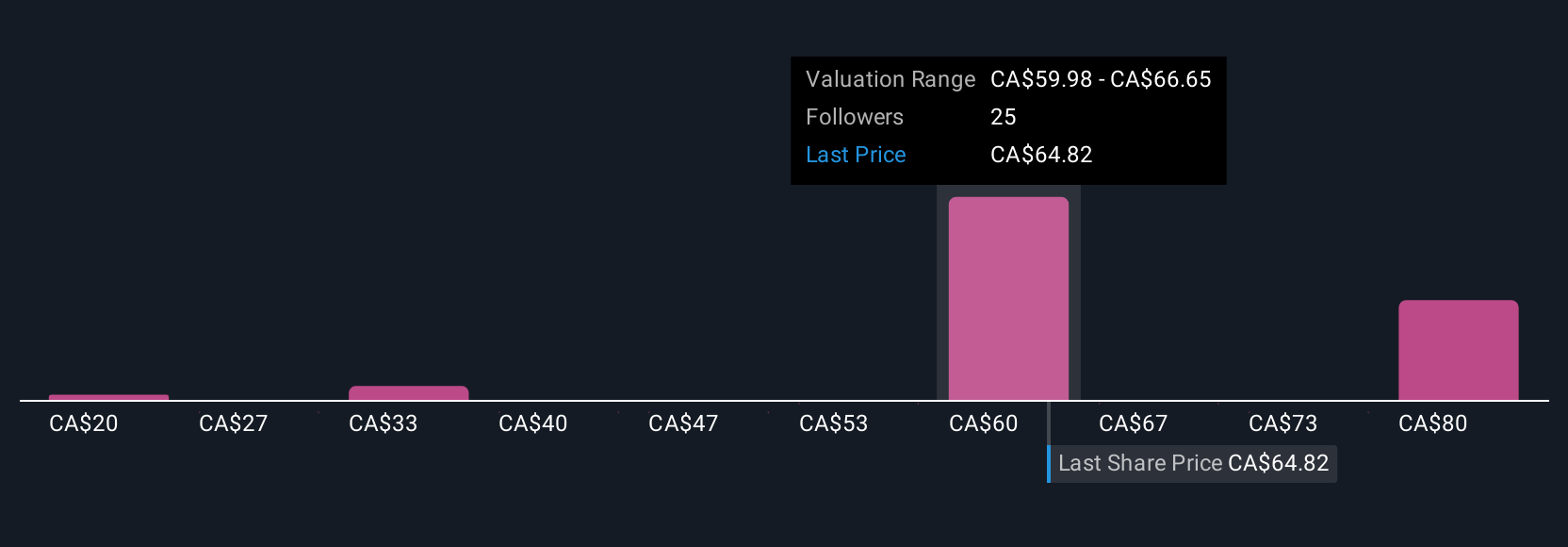

Nine Simply Wall St Community members estimate Lundin Gold’s fair value from CA$34.66 to CA$93.42 per share. With expectations for a seamless resource base expansion still prevailing, consider how concentrated asset risk could influence performance outcomes.

Explore 9 other fair value estimates on Lundin Gold - why the stock might be worth as much as CA$93.42!

Build Your Own Lundin Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lundin Gold research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lundin Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lundin Gold's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LUG

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026